Market participants made a quick retreat from risk-off positioning so far. We have seen a retreat from short positions in assets and high beta currencies. Even stock markets in locked-down Europe rallied strongly, with many national bellwether indices showing gains of over 2% while the broad pan-Europe Stoxx 600 of about 1.5%.

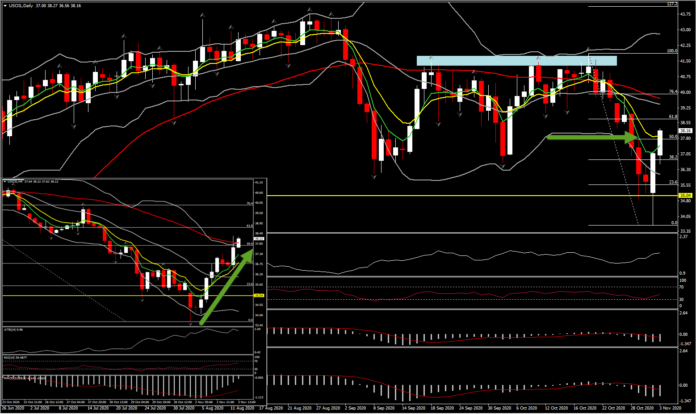

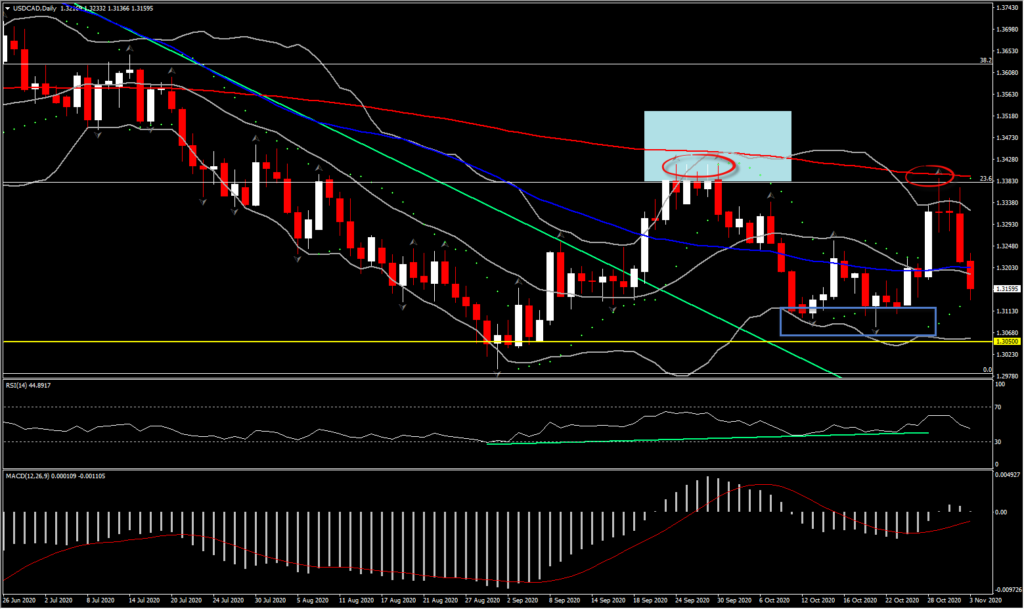

Many commodity prices showed solid gains, rebounding from recent weakness. Oil prices have surged by nearly 14% from yesterday’s five-month low. On USOIL surge, the USDCAD has extended a sharp retreat from the 1-month high at 1.3370. The pair has posted a 6-day low at 1.3136 — a near 2% loss from the high, which is a pretty large move by the standards of the prevailing era.

A sharp recovery in oil prices drove the move, which evidently wrong footed speculative accounts with Canadian Dollar short exposures, which had accumulated both in USDCAD and CADJPY. USOIL prices have surged which in turn drove the Canadian Dollar and other oil-correlating currencies higher in a classic short-squeeze dynamic.

The idling of oil facilities in the Gulf of Mexico by Hurricane Eta catalysed a rebound in the crude market. Strong economic data out of China (the October Caixin PMI showed the biggest improvement in business conditions since January 2011) added fuel to the rebound. For perspective, USOIL prices still remain down by nearly 10% from the highs seen just a couple of weeks ago, before European nations started ramping up Covid-19 related restrictions, which have culminated with Germany, France and the UK implementing national lockdowns. Much of Asia and other parts of the world, including the US to a degree, have remained open for business at levels that are much greater than Europe currently, while it has also been recognized that the lockdowns in Europe are nowhere near as restrictive as they were the first time around. This was the background to the upward adjustment in crude prices.

Meanwhile, USOIL also supported by Bloomberg reports that OPEC+ may delay easing of output cuts by three months. There had been hints of a delay for a while against the background of new lockdowns across Europe and with developments in the US also adding to concerns that the recovery in demand will falter. Oil prices plunged 10% last week but news from Moscow on a possible delay after discussions between Russian oil companies and Energy Minister Novak helped markets to stabilise. Officials have also been discussing the potential deepening of current curbs, but that is currently not the main scenario, with the initial step a possible delay of the easing of curbs. The front end WTI future is currently trading at $38.27 per barrel.

Nevertheless, in currencies, the commodity correlating ones, alongside many currencies of newly developed and developing world economies, are rallying (the Indian rupee and Turkish lira are notable exceptions), while the haven currencies are down, principally the Dollar and Yen.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.