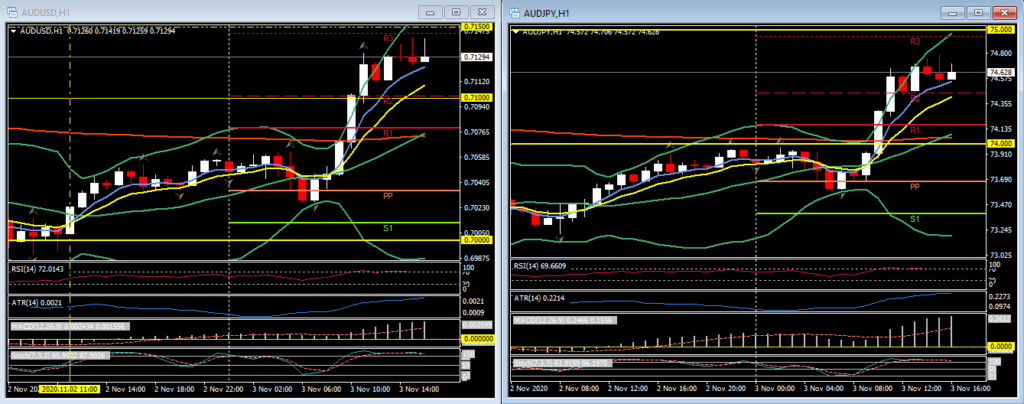

The correction in the Dollar and Yen intensified as market participants made a quick retreat from risk-off positioning. The risk-sensitive AUDUSD and AUDJPY have been the biggest gainers out of the most traded currencies, with both showing gains of comfortably over 1% at their highs. Wrong-footed speculative accounts beat a retreat from short positions in assets and high beta currencies. Even stock markets in locked-down Europe rallied strongly, with many national bellwether indices showing gains of over 2% while the broad pan-Europe Stoxx 600 rose by about 1.5%.

US Equity markets have opened higher, just like yesterday, after last week’s more than 5% losses. The industrial USA30 leads the way up over 1% from last nights close. All three major indices remain below their key 20, and 50-day moving averages, everything could change tonight – or nothing could change. The FOMC, NFP, the BOE, ADP and plenty more PMi’s still to come in potentially the week-to-end-all-weeks.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.