If there is one thing markets (all markets) hate, it’s uncertainty, and that’s what we have at the moment in both the Presidential and Senate races. As things stand at 08:30 GMT the morning after the USA Election 2020, there are 87 Electoral votes still available. Trump, with 213, needs 57, and Biden, on 238, needs 32, to reach the key 270 votes required to become President of the USA. States yet to declare results are:-

- Pennsylvania 20

- Michigan 16

- Georgia 16

- North Carolina 15

- Wisconsin 10

- Nevada 6

- Alaska 3

- Maine 1

The Senate (with 100 votes) stands at 47 each for the Republicans and Democrats with 6 decisions awaited.

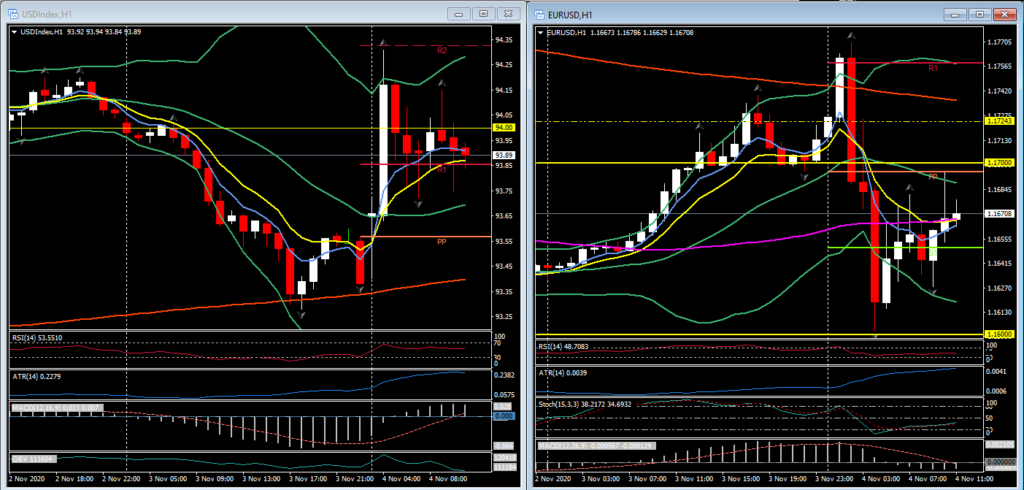

So it’s very much risk aversion on a closer than expected US election, and Trump agitating the process with claims that his rivals are attempting to manipulate the results has driven the dollar higher on a safe haven bid, while US Treasuries have surged, driving the 10-year T-note yield down by 12 bp. The DXY dollar index rose by over 0.7% in making a high at 94.30. The S&P 500 E-mini has also racked up a 1% decline, reversing over half of the gain that the cash version of the index saw on Wall Street yesterday.

There is potential for the US to be in limbo for days as the closeness of the race means a drawn-out process of vote counting. Political pundits warned ahead of the election that if Biden won a close contest, the risk of Trump formally contesting the outcome would rise. This backdrop should keep the risk-off positioning theme in play, unless there is any clear-cut outcome. The Democrats are looking set to retain their dominance in the House, though it’s looking less certain that they will flip the Senate.

Elsewhere among currencies, EURUSD has seen volatile price action, dropping sharply from levels in the mid 1.1700s to a 1.1602 low before recouping to the mid 1.1600s. The pair still remains down by around 0.5% on the day. The biggest currency losers include the Australian Dollar, which is down by over 1%, and the likes of Mexican Peso, which is showing a 3% loss, and the South African Rand, which is nearly 2% lower versus the US Dollar. The Yen has been mixed, losing ground to the Dollar while holding steady versus the Euro and gaining on the more risk-sensitive, higher beta currencies. Amid all this, the Pound has been underperforming peer currencies, that is the Euro, Dollar, Yen, and others. Cable dropped over 1% to a 1.2915 low while EURGBP rallied out of two-month lows and back above the 0.9000 level. We have been earmarking Sterling as being a currency at particular risk given the upcoming drop in the UK’s terms of trade when the country exits the single market and customs union, the impact of which will be compounded by Covid lockdowns in the UK and across Europe.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.