USDJPY, H4

US Nonfarm payrolls increased 638,000 in October following the 672,000 (was 661,000) rise in September and the 1.493 million (was 1.489 million) gain in August for a net 15,000 upward revision.

Job gains were broadbased with the only weakness coming from the government, and this is a solid report across the board. The unemployment rate fell to 6.9% versus 7.9%, and is down from the record 14.7% in April. Earnings rose 0.1% versus 0.1% (was 0.1%) previously, for a 4.5% y/y clip compared to 4.6% y/y (was 4.7% y/y). Hours worked were steady at 34.8.

Household employment surged 2.243 million from the prior 275,000 gain, and the labour force bounced 724,000 from -695,000. The labour force participation rate edged up to 61.7% from 61.4%. The private service sector added 783,000 jobs versus 795,000 (was 784,000) previously, with goods producing employment at 123,000 compared to 97,000 (was 93,000) previously. Government jobs dropped -268,000 after the prior -220,000 (was -216,000 drop), with a -138,000 slide on the Federal side.

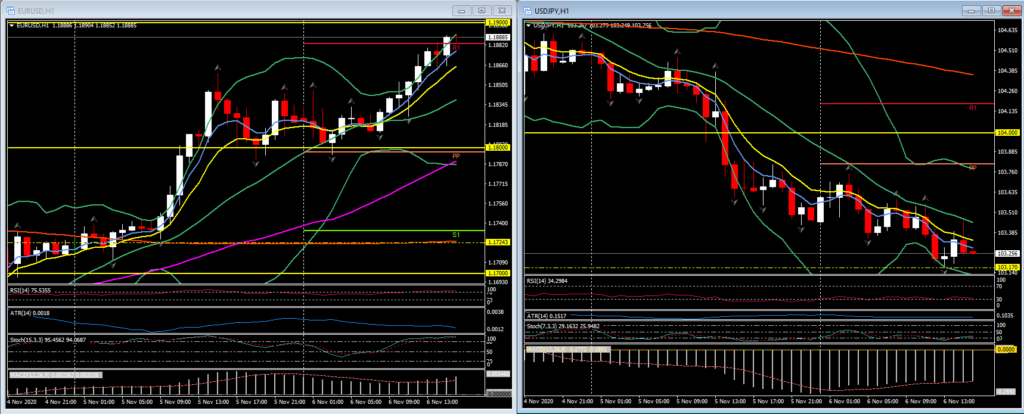

The Dollar, initially headed a bit higher after the jobs report, but then quickly reversed. USDJPY rallied to 103.48 from 103.35, before slipping again to 104.30 but remained above current trend lows at 103.17, set earlier today. EURUSD dipped toward 1.1865 from 1.1880, before moving back to test 1.1890. Equity futures remain in the red, though off earlier lows, while yields ticked slightly higher before pulling back.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.