GBPUSD, H1

The Dollar has posted fresh trend lows, continuing last week’s weakening theme. It’s notable that the Dollar has continued to decline despite Friday’s unambiguously solid US jobs report and that it has remained heavy in the new week, which is revelatory of where sentiment is with regard to the US currency. The ongoing dollar weakness has hinged on ongoing risk-on positioning in global markets, which has been lifting stock markets and most commodity prices.

Markets are discounting a Biden presidency with a split congress, and most seem to be anticipating that Trump’s litigation efforts will come to naught. The Democrats’ failure to dominate the election has evidently been a relief for markets, given the implication for tax policy and regulation. Incoming economic data, meanwhile, have continued to help bolster investor spirits. Not least is the strong trade data out of China, which showed exports rising 11.4% y/y and imports rising 4.7% y/y in October. Both readings were above consensus forecasts, and China’s trade surplus is now 50% bigger than when Trump took office in 2017.

At the same time Trump waged his trade war with China, Beijing worked on reaching an agreement with ASEAN countries, along with Japan and South Korea, in joining the Regional Comprehensive Economic Program. The positive benefits of this to China have offset the negative impacts of the trade war with the US. Japan’s Tankan survey of business sentiment for November showed improvement with both the manufacturing and non-manufacturing headlines rising to 1 and -13 readings, up from -26 and -16, respectively, from October headlines.

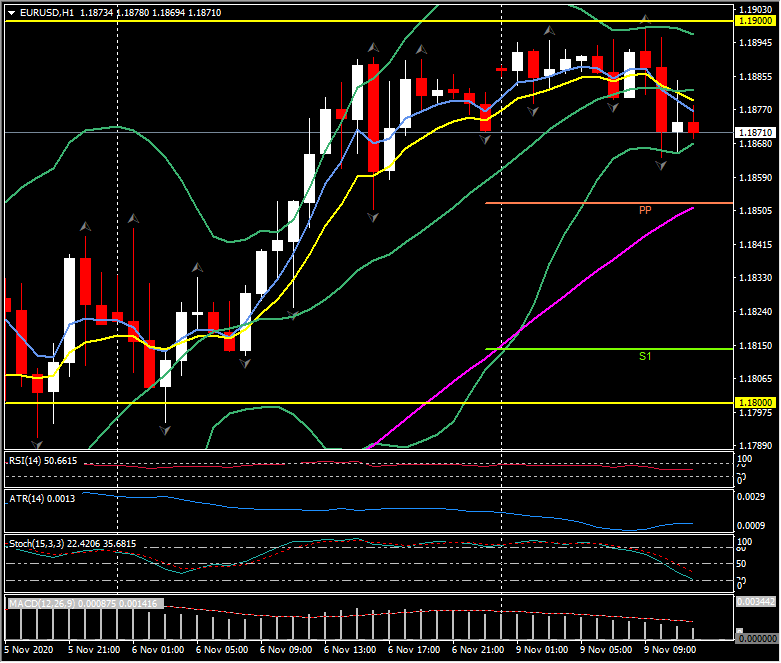

In currencies, the USDIndex index printed a two-month low at 92.13. EURUSD posted an eight-week high at 1.1899. USDJPY, in contrast, managed to lift moderately, back above 103.50, leaving last week’s eight-month low at 103.17 unchallenged. The Japanese finance minister said that policymakers there are watching forex markets with a sense of “urgency.” China’s Yuan lifted in what is now its sixth consecutive week of gain, posting its highest level against the Dollar since June 2018, and making fundamental sense given the strength of China’s balance of payments position. AUDUSD lifted above 0.7300 for the first time in seven weeks, and NZDUSD 0.6800 breached. USDCAD posted a two-month low testing the 1.3000 zone.

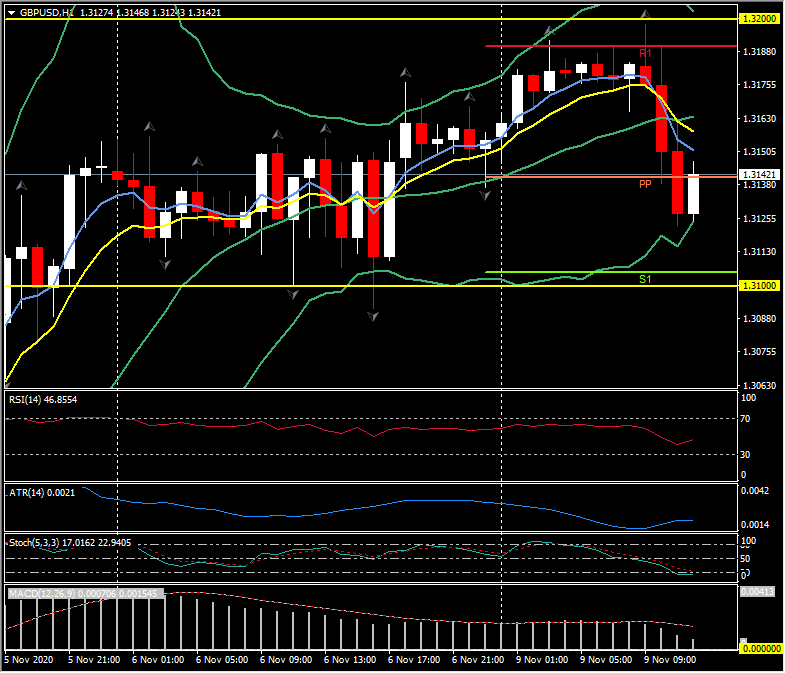

Meanwhile it’s a huge week for UK-EU trade talks as the endgame arrives. Sterling has remained directionally mixed, rallying against the broadly soft Dollar, while holding steady against the Euro and weakening against the dollar bloc currencies. Cable, peaked at 1.3198 earlier before settling athe daily pivot point around 1.3140.

Brexit remains in sharp focus, with this week in theory being the last week for the EU and UK to reach an accord on trade. Brussels has stated that an agreement needs to be in place by November 15 (5 trading days) for there to be sufficient time for ratification before the UK exits the common market and customs union on January 1. The House of Lords in London is this week set to vote in favour of removing the parts of the government’s controversial internal markets bill that would give the UK power to unilaterally overwrite parts of the EU withdrawal agreement. Expectations are that Boris Johnson’s government will accept this, seeing the bill as being a negotiating ploy. Reports have continued to highlight that the two principal sticking points remain fishing rights and state aid rules. Given the win-win and lose-lose choice that confronts both sides, the incentive to reach a deal is there (while a narrow free trade deal may leave both sides with worse terms of trade compared to the prevailing arrangement, a no deal would still be much worse than a narrow deal). There have been signs that a compromise is possible in the case of fisheries, and a doable walk around in the case of level playing field rules, but the problem so far is that neither side has been willing to be the first mover in the concession game, presumably for fear of showing weakness. The bearing down of a final deadline should break the stand-off. The Pound would likely rally on news of a breakthrough, although not by much unless the deal is broader than the narrow agreement that most anticipate. The UK’s National Audit Office last week warned of “significant” border disruption in January, even in the event that a deal has been made.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.