Equities are roaring and bond yields are surging on very promising vaccine news by Pfizer and BioNTech. The firms reported that their vaccine was better than expected at protecting people from COVID-19 in a crucial study (WSJ paywall).

Also, Biden’s victory, announced over the weekend, is also providing support. In pre-market futures trading, the USA30 has soared 4.5%. The USA500 is up 3.4%. The USA100 has improved 1.2%. European bourses are similarly rallying with a 5.9% pop on the CAC 40, a 4.9% gain on the UK100, and a 5.1% increase in GER30.

However the markets remain focused on the US, with the control of the Senate still up in the air. The expected surge of support for the Democrats did not materialize, however, leaving a likely divided government that was cheered by equities. However, uncertainty over the composition of the Senate crept in last Friday, and the possibility that Senate control will not be decided until January could make for nervous markets this week.

The US election chaos remains allconsuming as the results will have major consequences for policy and the markets. While votes are still being tallied, the election appears to have resulted in a change to the US government that was less radical than feared, with equities initially finding a lot to like in the probable gridlock in Congress. Wall Street had its best week since April, led by the USA100 9.0% surge, with the USA500 up 7.3%, and the USA30 6.87% higher. The indexes rallied on the likelihood of moderate stimulus but with fiscal restraint, no onerous tax increase, or draconian regulatory measures that were feared amid a “blue wave.”

FAANG stocks reigned supreme on the sharp reduction in likelihood that Congress will start an antitrust investigation into top technology firms. However, renewed uncertainty has crept in since Friday as the contest for control of the Senate remained undecided, while profit taking also featured. Hence other than the usual traditional FAANG shares another interesting asset is the Technology Select Sector Index (XLK) ETF which provides an effective representation of the technology sector of the USA500 Index and hence the majority of the tech Giants.

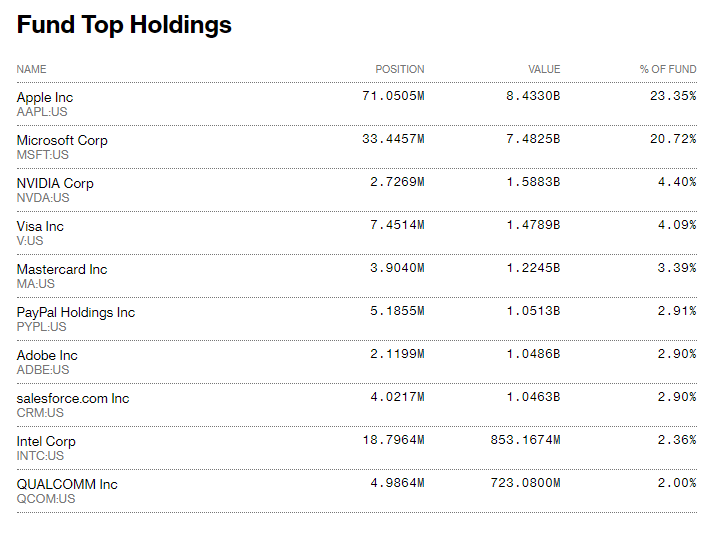

Top 10 Holdings of XLK ETF

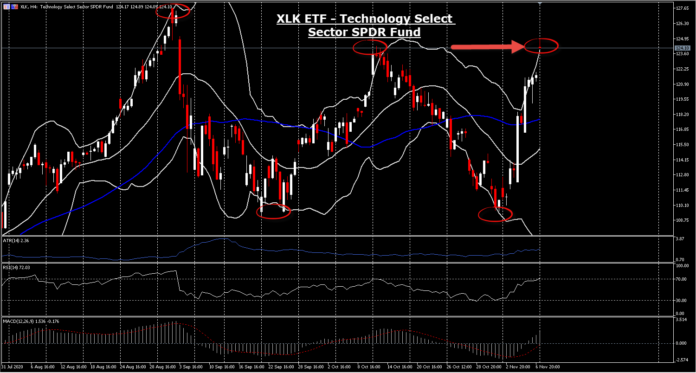

The XLK ETF is designed to provide broad exposure to the Technology – Broad segment of the equity market, with low transaction costs. Even though market participants focus on tech giants stocks, the particular asset is up by nearly 8.9% this month so far, which has been the largest gain by all the sectors. This is due to the fact that even with Biden in the House the hope that regulatory burdens might be stalled by a Republican-controlled Senate is boosting the technology sector. The XLK, after posting a double bottom similar to the USA500, currently opened with an upper gap at 124.17 high, posting a higher high since September.

The technical picture of the XLK ETF is positive with Daily and 4-hour momentum indicators turning positive. In the 4-hour chart, the MACD has flipped higher however the signal line remains below zero suggesting that the asset is OB so a correction is needed, while RSI just crossed 70 suggesting that there is still some space higher. The daily timeframe meanwhile remains unclear as despite the positive momentum bias, the Asset remains shy of upper Daily BB and the August Peak. Hence only a decisive break of 127.77 (all-time record high) could suggest a renewed rally higher. Immediate Support could be seen at Fridays close at 121.97, while a rejection of it could drift the asset to 50-DMA.

Nonetheless, from a fundamental perspective, the uncertainty over the Senate race centers on whether Republicans can retain the majority — it is looking like that will not be known until special elections in Georgia are held on January 5. Meanwhile, the Presidential election votes continue to be tallied, with lawsuits possibly dragging it out for many more days and weeks. Control of the House looks to be just barely maintained by the Democrats. Hence, the markets may be stuck in election limbo for the foreseeable future, with choppy, uncommitted trading.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.