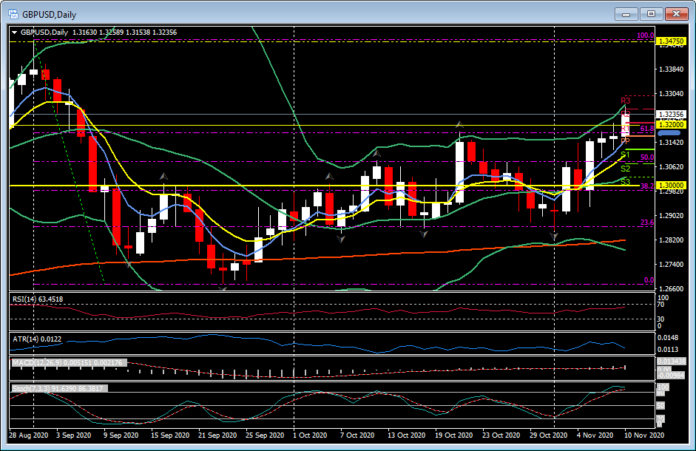

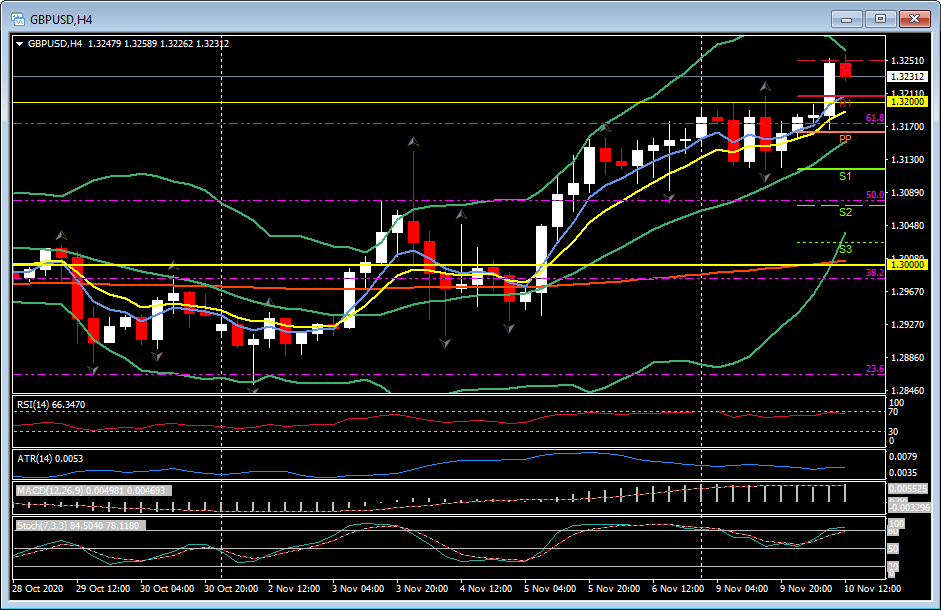

GBPUSD, Daily & H4

The main currencies have settled in comparatively narrow ranges after yesterday’s outsized rally in dollar bloc and other commodity-correlating currencies against the Yen. The Dollar has also settled after rising by over 2% versus the Yen and, to a much more moderate extent, against the Euro and other European currencies, which collectively found themselves in the underperforming lane due to the relatively tight Covid restrictions across the region.

USDJPY is trading near the 105.00 level after storming higher yesterday from levels in the lower 103.00s. AUDJPY, NZDJPY and CADJPY are moderately lower after surging over 2.5% yesterday. EURUSD has come to rest in the lower 1.1800s after dropping back from two-month highs above 1.1900.

Global stock markets remain buoyant after surging yesterday. A rotation out of big tech stocks and into banking, energy stocks and shares in so-called social-close industries, along with the outperformance in European markets (being more sensitive to the positive vaccine news from Pfizer), have been telling, along with a sharp steepening in yield curves (which was a fundamental driver in supporting banking shares). Markets are looking to a future of massive stimulus in global economies while anticipating that an effective Covid vaccine will arrive within months. Incoming data have also showed the US economy to be in firmer shape than recent prevailing expectations, while China’s economy has also been showing robust performance. There is potential for the stock market rally to continue to much higher levels, though this hinges on Covid being contained, and the direction of travel on this front is going the wrong way in both Europe and North America. The risk, too, that the reported mutation in the coronavirus in Denmark will compromise a vaccine.

Elsewhere, the Pound is firmer with Cable pushing over R2 to 1.3256 and a 45-day high in the wake of above-forecast earnings data and a better claimant count but a rise in Unemployment out of the UK, which followed a good BRC retail sales figure. Sterling also got a positive spin from Deutsche Bank as they suggested that the currency should benefit from the Pfizer vaccine, more than most, as the UK has had more problems dealing with the virus than other G10 economies, as they put it – “struggled the most with managing the pandemic without a vaccine” – and the UK also has “good exposure to Pfizer in its broad and deep vaccine portfolio”.

The anticipated breakthrough in EU and UK trade discussions has yet to materialize, though the forex market remains sanguine, as November 15 looms later this week.

Technically for Cable, a break and hold of the 61.8 Fibonacci level 1.3175 and the 1.3200 level on the Daily timeframe is likely to attract more buyers and could see the September high at 1.3475 targeted. The recent high The H4 chart has struggled to breach this key level, so far this week following a very positive week last week. Key support is the 50.0 Fibonacci level and todays S2 at 1.3090.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.