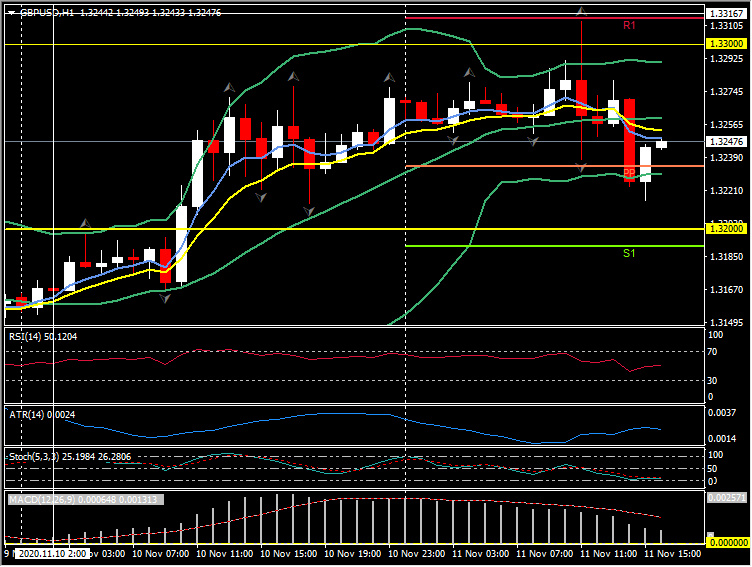

The Dollar has firmed against the Euro and other European currencies outside the case versus the Pound, with the UK currency posting two-month highs against both the Dollar and Yen, while holding steady-to-lower against the dollar bloc before rotating lower as the news broke that the mid-Nov trade deal deadline looks to be extended from November 15 into next week.

The risk-on mood has continued. Europe’s Stoxx 600 equity index rallied to its best levels in eight months, and S&P 500 E-mini futures were showing a gain of nearly 0.8% as of the early afternoon in London. The 10-year US T-note yield rose 1.5 bp to a new eight-month high at 0.979%. Commodities were mixed, however, though oil prices gained more than 3%.

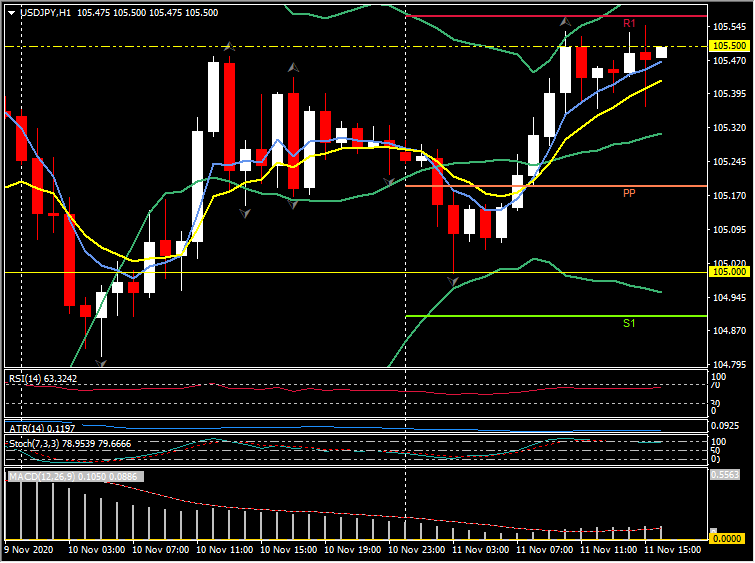

In forex markets, Yen weakness and outperformance in commodity currencies and those of export oriented economies have been prevailing. USDJPY lifted back above 105.50, though remained shy of the highs seen on Monday, while AUDJPY and NZDJPY posted new two- and 10-month highs, respectively.

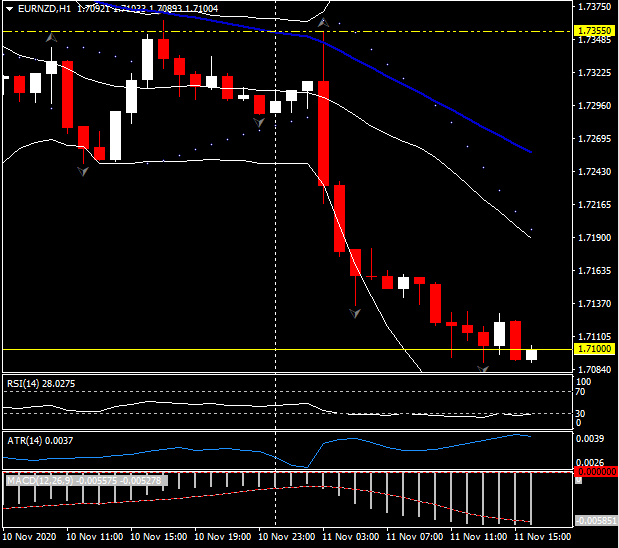

A pricing out of negative interest rate expectations in New Zealand following the RBNZ policy review today, which saw policymakers signal that the need for more monetary stimulus has reduced, boosted the Kiwi Dollar, which gained about 1% on the US Dollar and by more against the Yen. But biggest mover today, so far is EURNZD down some 1.5% from early day trades at 1.7350 to 1.7090 lows now.

The Japanese currency’s pronounced underperformance on Monday and continued softness marks a return to form with an inverse correlation of risk appetite in global markets. The success of Pfizer’s candidate vaccine for Covid in trials has been greeted as a game changer by investors. Bank shares, which hit record valuation lows this year, and so-called social-close stocks along with energy shares have rallied strongly, revealing that investors are looking across the valley of the prevailing predicament of Covid-related restrictions and economic weakness, and beyond to a return to normality in 2021. There is naturally some caution (known unknowns include long-term vaccine efficacy and population-wide safety), which has seen asset price gains lose momentum, though the massive fiscal and monetary stimulus that is in the works across the world, and the lower-for-longer monetary policy rubric at the Fed and other central banks (which enhances the value of corporate earnings), is a powerful tonic for higher valuations in cyclical assets. There are also a multitude of other credible Covid-19 vaccine candidates, aside from Pfizer’s, many of which have been reporting encouraging signs in advanced-stage testing.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.