Exchange Traded Funds – (ETF)

A few months ago we launched a new suite of products available to trade – Exchange Traded Funds, or ETF’s – and many of you have asked for an explanation.

An Exchange-Traded Fund (ETF) is a collection of investments – stocks, bonds, commodities and more, put together to permit traders to trade in a few markets simultaneously. Due to their continuous pricing, ETFs can be bought and sold on a stock market exchange during market hours just like stocks.

ETFs are traded as a basket of related assets. The baskets are usually combined together based on a common characteristic or underlying connection such as industry, theme, geography etc. ETFs also make it possible to invest in certain industry sectors. In this way, traders can gain broad exposure to the overall sector within an industry at a much lower cost in just a single transaction.

ETFs are an increasingly popular investment and a fast-growing innovative market since they offer great portfolio diversification. They can be ideal for traders and investors getting started in the market as you can get diversified exposure to a market, a sector or an asset class with only a small amount of capital. Traders and investors can have a fully diversified stock portfolio with only a small collection of ETFs.

We offer a range of sector-based ETFs, including mining, energy, technology, health care, real estate and more providing the advantage of diverse, flexible, low-cost ETF trading.

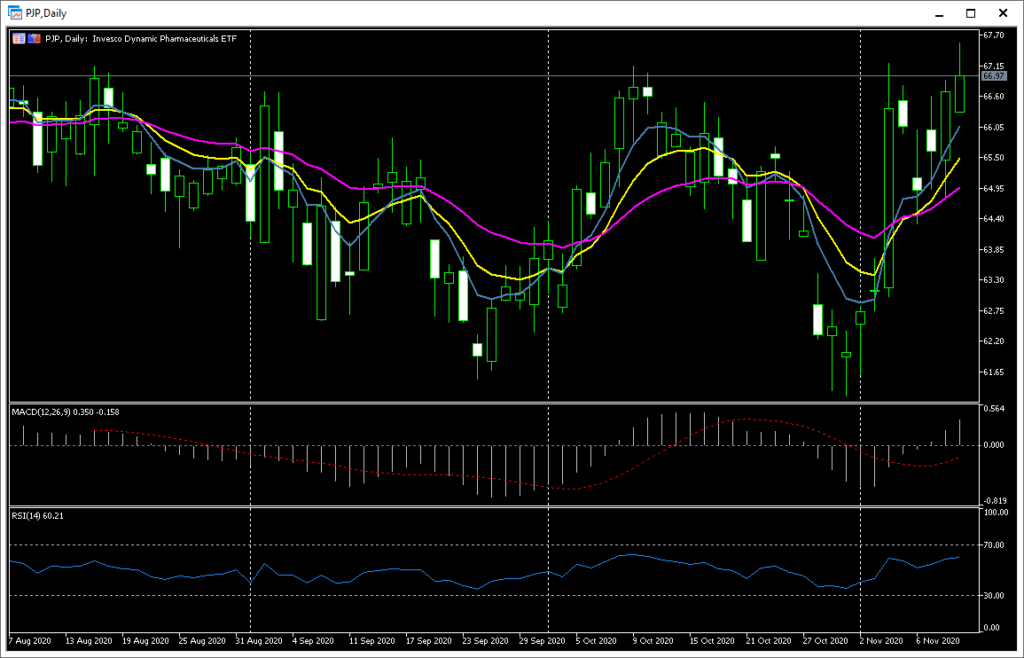

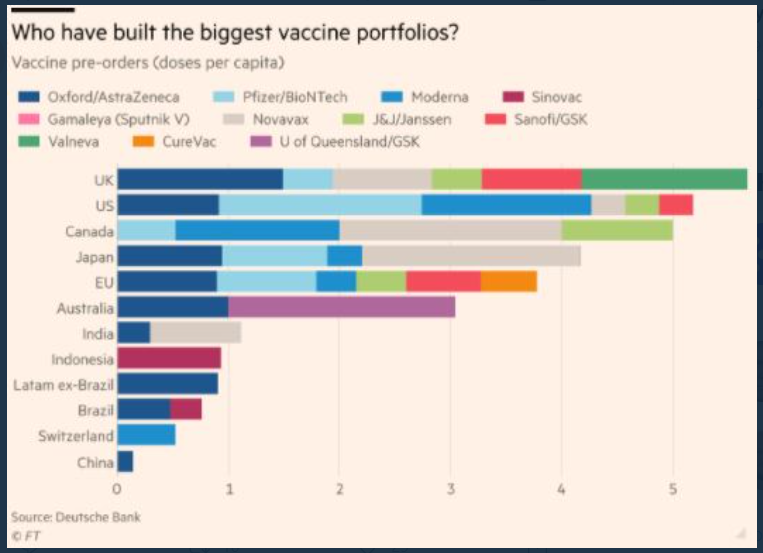

As we enter the final 50 days of the year, which is typically a good time for investors and stock markets, a simple way to diversify your risk is to consider ETF investments. As the rally on Monday showed, positive news surrounding the progress of a vaccine for COVID-19 can have a dramatic impact on a company’s stock price. Both Pfizer and BioNTech saw their share price rise over 7% on Monday alone. However, vaccine research and development is an expensive, highly complex procedure and not all runners in the race, even some of the biggest names in the pharmaceutical world, will be successful. The table below shows the key participants currently developing COVID-19 vaccines. A way to invest could be via the Invesco Dynamic Pharmaceuticals ETF #PJP which uses a quant-driven methodology to select and weight US pharmaceutical companies based on fundamental and risk factors. Other ETFs that are closely correlated to the response to the pandemic would be the Healthcare sector via either the iShares Global HealthCare ETF #IXJ or the Health Care Select Sector SPDR Fund #XLV.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.