Narrow ranges have been ensuing, with a theme of yen firmness amid a backdrop of softening stock markets. Stock markets remained under pressure during the Asian part of the session and GER30 and UK100 futures are currently down -0.3% and -0.9% respectively. US futures have pared earlier losses, however, and are moving higher, with USA100 futures the leading way as stocks that benefit from stay-home-orders are back in favor against the background of rising virus infection numbers.

Market narratives are loaded with the ‘fading Covid-19 vaccine rally’ phraseology due the rollout logistics and time frame. The rollout of the vaccination will take many months, and in the meantime, the Northern Hemisphere winter could keep the virus burning, causing further lockdowns and mitigation, resulting in a further reduction in oil demand.

The IEA said that a Covid vaccine won’t likely boost the oil market until late 2021, for instance. Pfizer’s production of a workable vaccine, with a high efficacy rate, has given investors the ability to see across the valley of restrictions and lockdowns in major economies, but the valley appears to be a wide one. Any successful candidate vaccine at this stage will also come with several known unknowns, including long-term efficacy and population-wise safety.

To take a different angle, it’s worth highlighting that the all-cause excess mortality rate in Europe is remaining in-line with seasonal norms, contrasting the picture being thrown up by the Covid-specific mortality rate. The explanation is that Covid is replacing other causes of death, rather than increasing excess deaths (as it did earlier in the year), with other causes showing a marked decrease in expected mortality rates.

There also appears to be greater awareness about the false positive risk in Covid testing, and there is speculation that a recent sharp drop in positive cases in Ireland, for instance, may be due to the implementation of a stricter testing regime, including follow-up testing of individuals with initial positive test results. The scientific school of thought that argues that Covid is already endemic in the population, at least in Europe and North America, also argues that Covid’s impact, as measured by ICU admissions and mortality, will be much less than before. This is hardly the consensus view at this time, but worth being aware of.

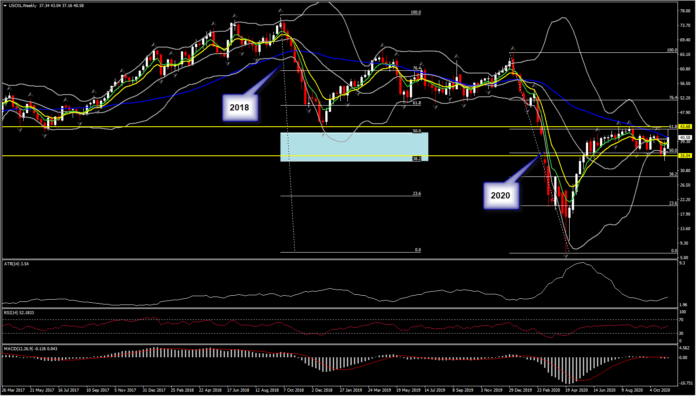

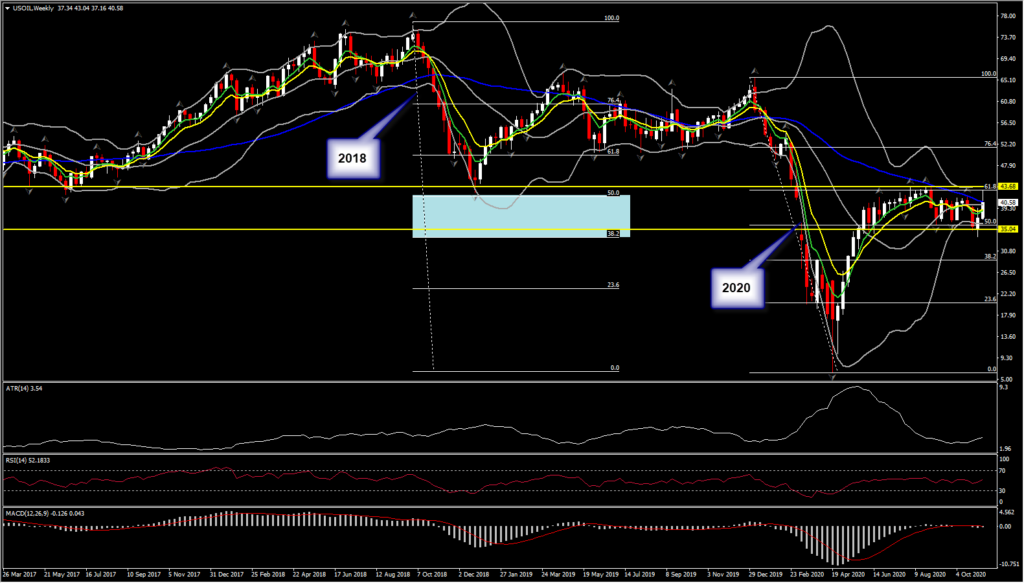

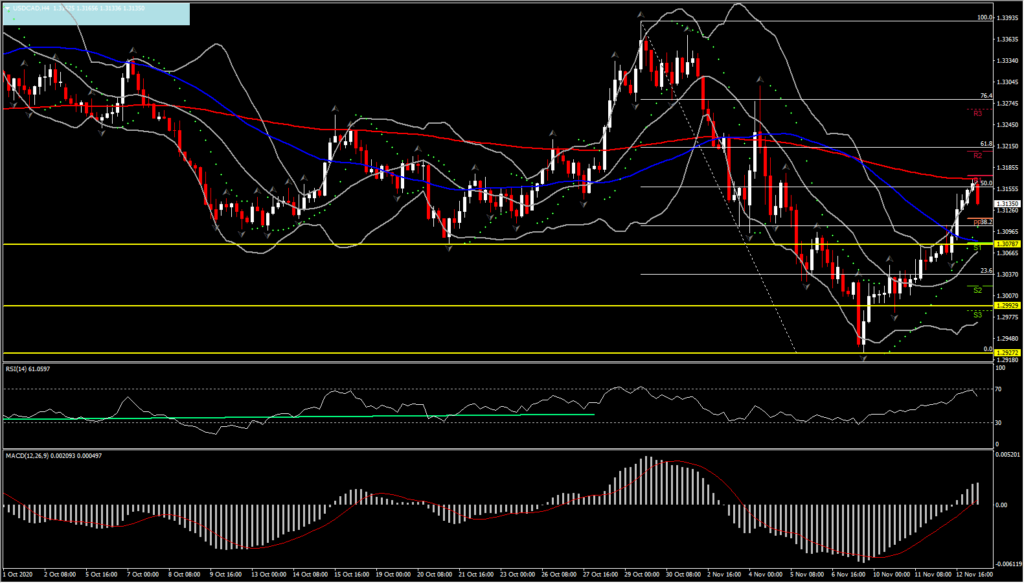

Among currencies, USDCAD lifted for a 4th consecutive day, posting an 8-day high at 1.3170. USOIL prices fell by over another 1.5%, and by over 6% from the high seen earlier in the week, which weighed on the oil correlating currencies. The IEA said that oil demand will fall more than it previously envisioned, and that a Covid vaccine won’t likely boost the oil market until late 2021. Currently the asset has stalled within the $35-$44 area which coincides with the 50%-61.8% Fib retracement from the 2020 plunge. This area also coincides with the huge plummet that we have seen in the Oil market since 2018, from $77 to $6. In the near term, something that has been positive for prices have been reports that OPEC+ may extend its current production cuts beyond year-end, though increasing production in Libya and oil rigs coming back online in the US, indicating increased output, may well offset that. The $40 level remains key.

Meanwhile, despite the overall negative outlook for Oil markets, in the short term USDCAD is expected to drift further to the downside, given the level of stimulus in the works around the world, increased ability to live with and work around the Covid virus (the lockdowns in Europe being much less restrictive than before, and the second dip in the expected double dip recession is likely to be much shallower than the first time around). The all-cause excess death rate is also remaining within seasonal norms in Europe, which markedly contrasts the picture when Covid-19 first struck.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.