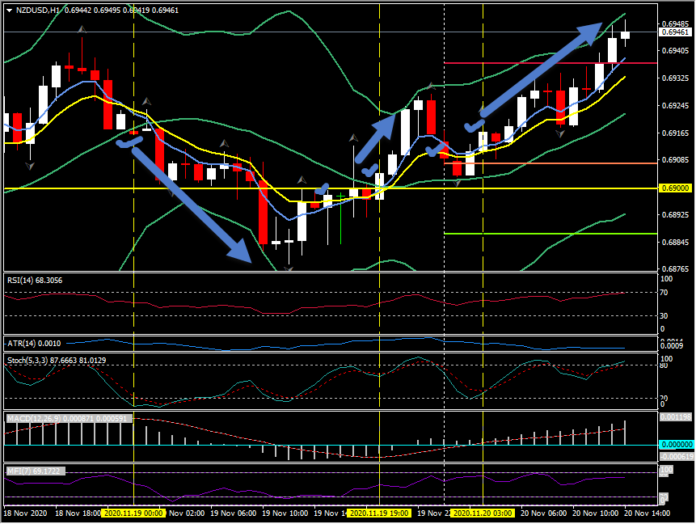

NZDUSD, H1

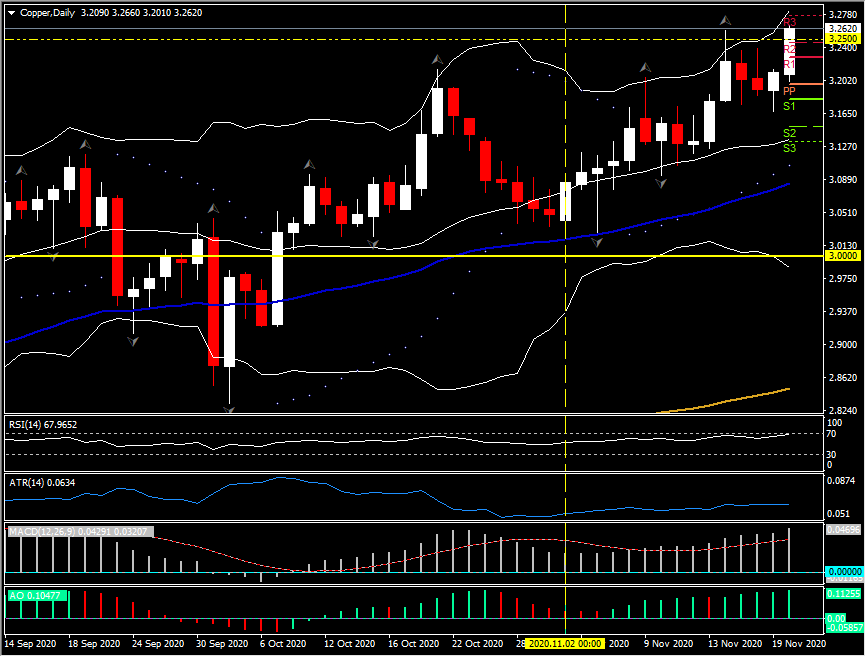

Currencies have largely remained within recent ranges. Risk appetite picked up during the European morning, which saw the Dollar bloc currencies lift. Asian stock markets lifted after starting out weak, with the main indices across the region finishing in a mix of modest losses and modest gains. Europe’s Stoxx 600 was up 0.6%, and S&P 500 E-mini futures had pared intraday declines and were near flat heading into the New York interbank open. Base metal prices remain perky, with copper lifting to two-and-a-half-year highs while aluminium prices posted a new two-year high. Bitcoin surged to a fresh three-year high.

In Europe, an EU official said that an agreement with the UK was near on most issues, which helped maintain an underpinning for the Pound, though neither side has been willing as yet to begin the concession phase on key sticking points. In Asia, the PBoC kept the Loan Prime Rate unchanged for a seventh straight month while draining a net CNY80 bln via monetary policy tools, suggesting that the bank is tapering its emergency support programs. Japan core inflation fell to -0.7% y/y, which will cause an unwanted tightening in real interest rates in Japan.

Among currencies, the USDIndex matched Wednesday’s 11-day low at 92.21 while EURUSD lifted to a two-day high at 1.1891. USDJPY plied a sub-20 pip range in the upper 103.00s, holding above the 11-day low that was seen earlier in the week at 103.64. Sterling traded modestly firmer against the dollar, euro and yen, among other currencies, though mostly held within recent ranges. Cable edged out a two-day high at 1.3291. The pair’s two-and-a-half month high, clocked on Wednesday, is at 1.3314. The largest mover of the main pairs at 13:00 GMT is the NZDUSD up +0.88% and testing the 0.6950 zone.

Later we have the CAD Retail Sales data and expectations are for a 0.6% October retail sales gain with a 0.7% ex-autos increase, after respective September gains of 1.9% and 1.5%. Chain store sales improved in October, but remained depressed. Consumer confidence remained firm despite pullbacks in some measures. Construction employment continued to improve, bolstering the outlook for building material sales. However, vehicle sales slowed and the gasoline component of CPI fell -0.5% in October.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.