FX News Today

USD weaker again – Positive sentiment lifts Equities (US500 new ATH, DOW over 30k first time ever, Nikkei closed off highs +0.5%), Oil (USOil over $45) and Bitcoin (poked over 19K) all up. Gold down to test $1800, JPY & Commodity currencies cool. Overnight weaker than expected AUD & JPY data. Biden presented top foreign policy and security team “America is back and ready to lead the world, not retreat from it”. Outreach from WH has been “sincere”. Last full day of trading this week. Tesla +6.43%.

Today – US Durable Goods, GDP (2nd Reading), Core PCE (Prelim), University of Michigan Survey, ECB Financial Stability Review, UK Chancellor Sunak November Update, FOMC Minutes.

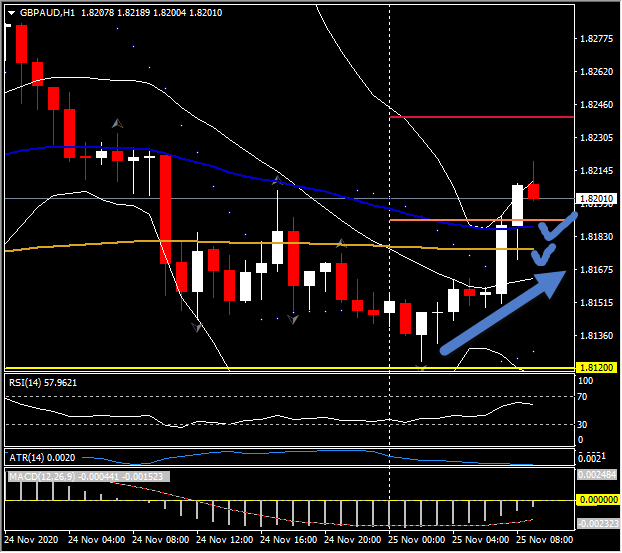

Biggest (FX) Mover @ (07:30 GMT) GBPAUD (+0.47%) – Broke downtrend as floor at 1.8120 held, 20 & 50 MA break at 1.8185. Fast MAs aligned and trending higher, RSI 57 and rising, MACD histogram & signal line aligned higher, but remain below 0-line, Stochs. rising but not yet OB. H1 ATR 0.0020, Daily ATR 0.126.

The Dollar retained a softening bias while the dollar bloc and other commodity and cyclical currencies retained a firming bias, although momentum flagged somewhat during the course of trading, into the open of European interbank markets.

While the MSCI World Index yesterday clocked a fresh record high, the mood in Asian stock markets has been more mixed, with Japan’s Nikkei hitting a new 29-month high while the main Chinese indices declined amid rising corporate debt defaults in China, which pulled the MSCI Asia-Pacific index lower, albeit modestly so.

U.S. equity index futures are showing modest gains. The Dow Jones bellwether index closed above the 30,000 level for the first time ever. Shares in the energy sector have been a notable outperformer of late, having rising by 34% so far this month. USOil benchmark oil prices rose today to the highest level since early March, gaining on the combo of risk-on sentiment and discipline from OPEC+ nations in maintaining output quotas. Base metals remain bid. Copper prices today rallied to the highest levels since February 2014.

Investor sentiment is likely to remain buoyant, overall, on the optimism for a vaccine-assisted route back to normalcy in 2021, along with the formal start of the Biden transition process (reassuring proof that the U.S. constitution and institutions retain respect), the expected nomination of former Fed chair Yellen as Treasury Secretary, confidence that the EU and UK will reach a trade deal, massive liquidity from the world’s central banks, prospects of more fiscal stimulus, and benign inflationary pressures. The ingredients for a bubble era in asset markets are in place, which may entail an eventual crash.

Among currencies today, the USDIndex posted a two-day low at 92.06, which is 4 pips shy of the 12-week low that was seen on Monday. EURUSD lifted to a 16-day high at 1.1914, which is 7 pips shy of making it into 12-week high terrain. USDJPY plied a sub-20-pip range near 104.50. The yen posted fresh lows against some other currencies, including a two-week low against both the euro and Australian dollar, before rebounding. AUD-USD pegged a 12-week peak at 0.7373 before retreating back under 0.7350. The Kiwi dollar saw a similar up-then-down price action, though the high was below the 29-month peak that was seen yesterday against the U.S. dollar. USDCAD clocked a 15-day low at 1.2988.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.