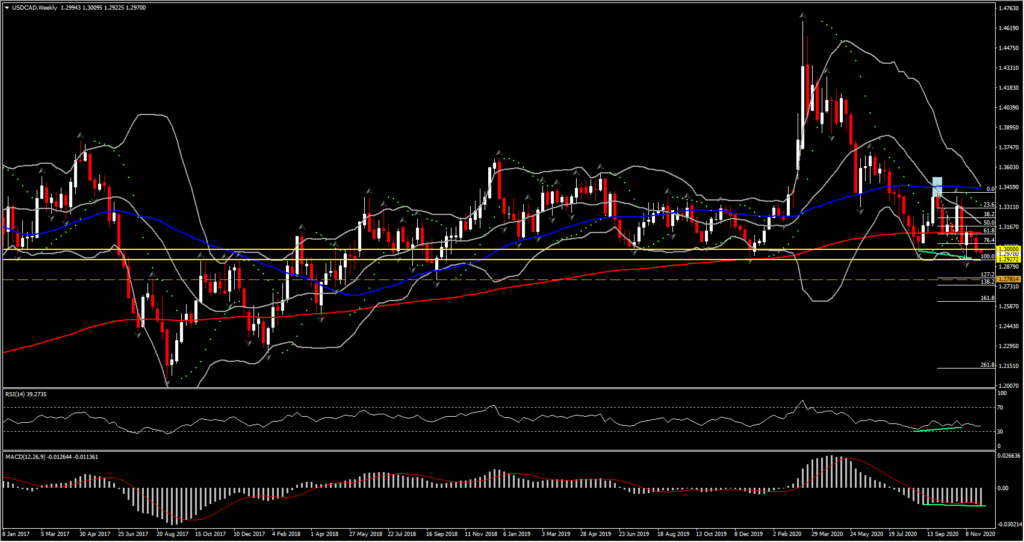

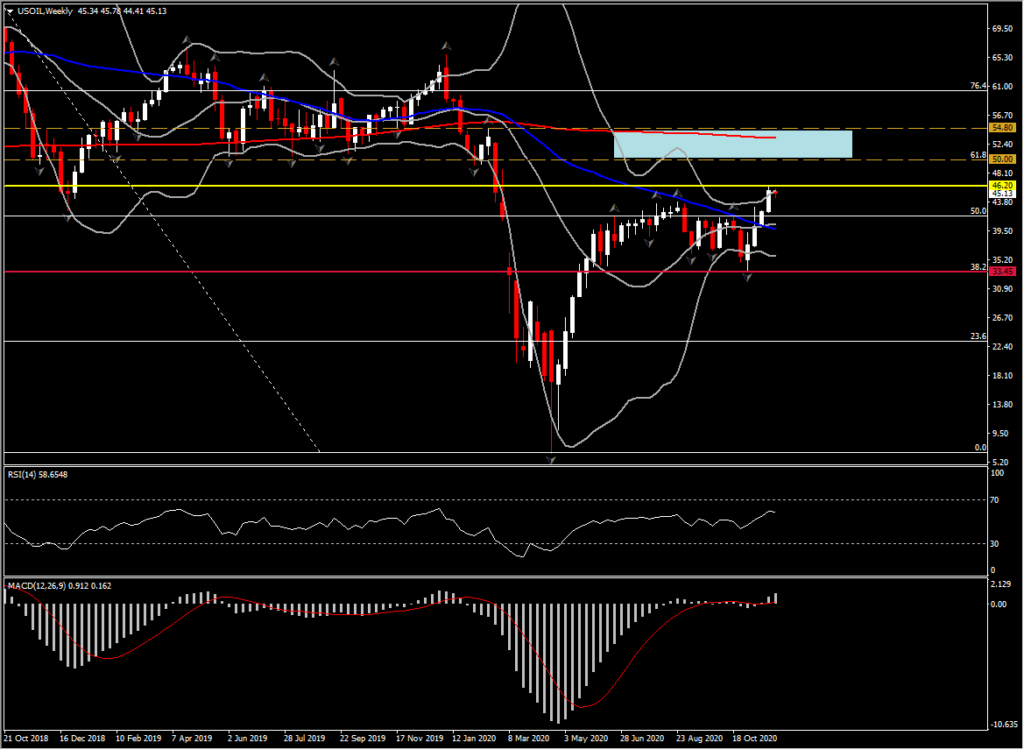

USDCAD has dropped back under 1.2980, pulling lower from yesterday’s rebound high at 1.3010, which was seen after the pair posted a 26-month low at 1.2922. The oil market will remain the dominant driver of USDCAD. Oil prices are steady to the upside holding Support at $44 this week after ebbing moderately over the previous few days.

Strong Chinese and Japanese manufacturing data boosted oil and other resource commodities. The Markit/Caixin Manufacturing PMI for China hit a decade high and Japan’s reading was the highest since August last year, which together with the recent upward revisions to both Eurozone and UK manufacturing PMIs helped to boost recovery hopes. The Canadian Dollar was recently boosted by Canada’s GDP which rebounded 40.5% in Q3, undershooting expectations following the -38.7% plunge in Q2.

A stronger GDP rebound was anticipated, with estimates for a 48% jump. However, the Q3 surge was the strongest quarterly GDP gain on record going back to 1961, even though Q3 GDP was 5.3% below the level from Q4 of 2019. The story is well known by now — the emergence from lockdowns spurred sizable pick-ups in household spending on durable goods and a huge gain in housing investment. Business investment also advanced while export and import volumes recovered as trade flows resumed. Meanwhile, the separate September GDP measures improved 0.8% (m/m, sa) after the 0.9% gain in August, marking a fifth consecutive monthly increase. But total economic activity in September was 5% below the pre-pandemic level seen in February, reports Statistics Canada.

Overall, the Q3 and September GDP reports track the well anticipated rebound in Q3 as the economy reopened. Of course, this is rather stale data, with the focus on the sustainability of the recovery amid increasing restrictions as virus cases have been on the rise since October. Meanwhile, the abundance of good news on the vaccine front has boosted optimism that we will return to normal next year.

In the meantime however, the USOIL future is stuck around the $44-$45 per barrel mark. Prices have moderated some since Monday, when OPEC+ deferred on a decision to extend production cuts through Q1 of next year. The Cartel again today delayed a decision until Thursday, reportedly as Saudi and the UAE remain at odds. The Emirates have been hoping to ramp up production after making large investments to increase production capacity. While the oil market hasn’t panicked just yet, a lack of production agreement later this week could see oil prices back under the $40 mark in a hurry.

The consensus expectation is for the group to refrain from rising output quotas for at least another three months from January, while a 6-month extension is also being considered, which by its own analysis would likely swing the oil market back into a supply deficit. Global stockpiles are high and demand for oil is set to be well below normal through the northern hemisphere winter due to Covid countermeasures, which are already tight in Europe and becoming more restrictive across North America and in the more northerly Asian countries.

At the same time OPEC output has increased, with Libyan production having fully returned to pre-blockade levels. There is also a view that after the Covid pandemic has gone, oil will have a more elastic characteristic, with many developed nations likely to see a higher prevalence of working from home than before, reducing demand for fuel and enabling consumers of gasoline to reduce commuting days during times of oil high prices. These are motivating reasons for oil producing nations to keep supply restrained.

Assuming quota discipline is maintained, the outlook is bullish for USOIL and the Canadian Dollar on the back of the increased optimism for a vaccine-assisted route out of the prevailing Covid situation. Consumers have built up savings and there is potential for a significant acceleration in global economic activity by mid next year. USOIL for now is in a steady consolidating mode, as it struggles to overcome the 46.20 barrier. However the bulls are holding the major control with momentum indicators presenting a steady positive picture and 50- and 200-day EMA confirming a bullish cross yesterday. The daily MACD lines are rising higher but RSI has flattened at 65 suggesting a sideways move for the next few days. For the long term only a pullback below $41.50-42.00 could switch the outlook into a negative one as this a key Support area which coincides the 50% retracement level from the 2-year downleg, and the 38.2% retracement level on November’s rebound. To the upside if the asset manage to overcome the key $46.20 high, the next Resistance levels to be watched will be $50 (61.8% Fib. level) and also $54.80 (swing high on February).

Nevertheless, as this week the Canadian calendar is busy, eyes will be on Employment (Friday) which is projected to rise 40k in November following the 83.6k gain in October. The unemployment rate is seen at 8.8 from 8.9%. The trade deficit (Friday) is anticipated to narrow to -C$3.0 bln in October from the -C$3.3 bln shortfall in September. While the relative deluge of data is of interest, we suspect it will not materially change the outlook for moderation in Q4 growth due to the fresh restrictions that have come as virus cases pickup, followed by a return to “normal” next year as the vaccine takes hold.

Notably, there have been whispers that the economy could be setting up for a surge in inflation if demand returns quickly next year — something the BoC is likely to monitor closely.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.