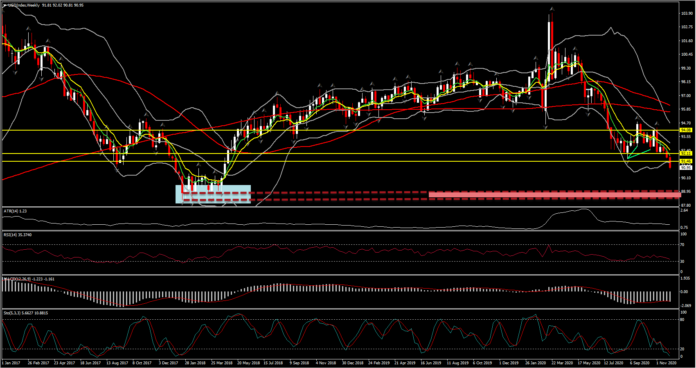

The USDIndex posted a fresh 32-month year low at 90.93. The index is amid its third consecutive down week, and the Dollar has declined in four of the last five weeks.

Global asset markets have come off the boil, and many market narratives are talking about the good news on Covid vaccines and the clearing political picture in the US having been “priced in.” December has a reputation for being a down month (although not so much in recent years), while the most recent BoA global fund managers’ survey found that cash holdings at fund managers are now down to pre-pandemic levels.

Investor sentiment hasn’t turned negative (which in the event would support the Dollar), and the big-picture view remains a potently bullish one, despite the challenging realities of the now and over upcoming depths the northern hemisphere winter. The mix of global fiscal and monetary stimulus, low interest rates, potential for a significant consumer spending boom in a vaccine-assisted return to normalcy in 2021 (households saving has increased over the pandemic) should maintain a positive sentiment overall.

This, in turn, is a negative backdrop for the Dollar, especially with the shift in FAANG stocks from massive outperformers to underperformers likely to sustain. The ingredients for an asset bubble are there, which may end in an eventual bust. One particular downward driver of the Dollar came into sharp focus in EURUSD’s upside break on Monday and Wednesday, when the initial estimate of November Eurozone inflation data showed CPI at -0.3% y/y, which contrasts the relatively high inflation rate in the US (albeit at only 1.3% y/y in October). The implication is that inflation is imparting a loosening impact on real interest rates in the US, and a tightening impact on real interest rates in the Eurozone, which translates to higher nominal EURUSD levels. Amid the currency pairings today, EURUSD lifted to a new 32-month peak at 1.2138.

In the US meanwhile, bearish momentum in bonds amid positive vaccine news and a tentative reflation trade are weighing. Also, treasury yields continued to move higher, hitting multi-week peaks, on increased optimism on a recovery. And those odds have improved increasingly not solely due to the positive vaccine developments but also with news that the Democrat leadership was supportive of the $908 bln bipartisan deal. The Leader McConnell indicated there could be a deal by the weekend, and that President Trump would sign.

However, the bearish tone in bonds may continue as the 30- and 10-year yields test multi-week highs. The 30-year tested 1.71% while the 10-year hit 0.957%. But there is one big obstacle in the way for bond bears, the Fed. Policymakers have assured they will act to limit an unwanted rise in rates, and they may be particularly sensitive to the recent climb as it comes alongside a jump in virus cases and renewed lockdowns that threaten the economic recovery. Chair Powell reiterated that stance again in this week’s testimony. Other Fed speakers have indicated their willingness to keep rates low as well. And there is about a 50-50 risk the FOMC could decide to act at the upcoming December 15-16 meeting by extending QE duration.

So action could be choppy in the near term as while bulls will look for Fed intervention with more accommodation to try to push rates back down.

Hence, negative US real interest rates, along with the Fed’s lower for longer stance, and perhaps more asset buying in the cards, do not bode well for the USD for now, and while we look ahead to 2021, widespread vaccine distribution should open up economies, and keep equity markets on the rise, another USD negative.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.