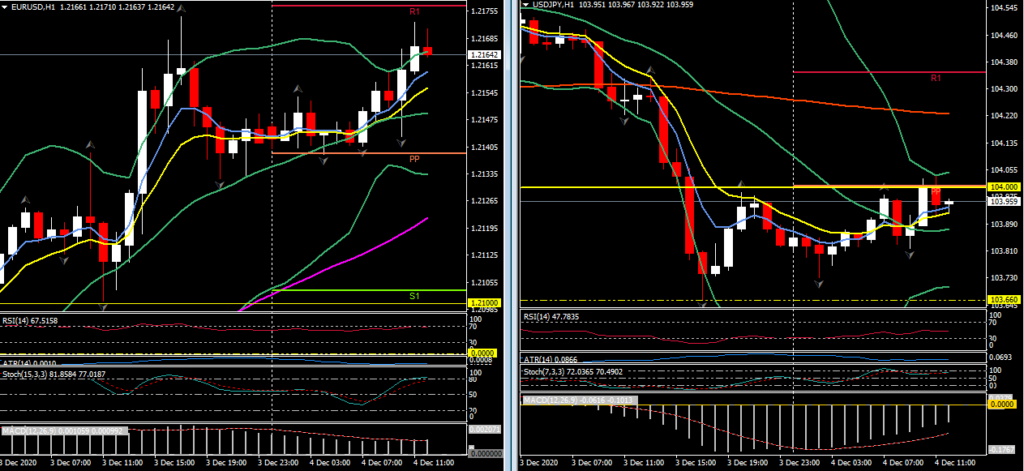

EURUSD, H1

Currencies have settled in relatively narrow ranges so far today, with the Dollar and Yen consolidating recent sharp declines. Global asset markets have remained buoyed, though mixed. The main US equity indices hit fresh highs yesterday and copper prices posted new near-seven-year highs today in Asia trading. South Korea’s KOPSI pegged a new record peak, though the main equity indices in China, Japan and Australia remained off recent highs. US equity futures also showed moderate gains. JP Morgan analysts said emerging market stocks are “under owned”, forecasting a 20% rally, while Paul Tudor Jones forecast an “absolute, supersonic boom” in the US economy in Q2 and Q3 next year due to unprecedented fiscal stimulus and a release of pent up consumer demand, on the proviso that the Covid vaccine program proves effective. European markets have started on the front foot with better than expected German manufacturing orders jumping 2.9% m/m in October, much more than anticipated. At the same time, the September reading was revised up to 1.1% from 0.5%, which means the annual rate lifted to 1.8% y/y from -1.1% y/y in the previous month. Also, German (45.6 vs 45.2) and UK (54.7 vs 52.0) Construction PMI data were both better than expected. GER30 trades up from yesterday’s low (13,180) at 13,300, and the UK100 also opened higher and trades at 6540.

Today’s release of US November payroll, meanwhile, is expected to remind us of the grimmer realities of the now, with job growth expected to be the slowest in six months due to tightening Covid-related restrictions and the extended delay in another fiscal relief package.

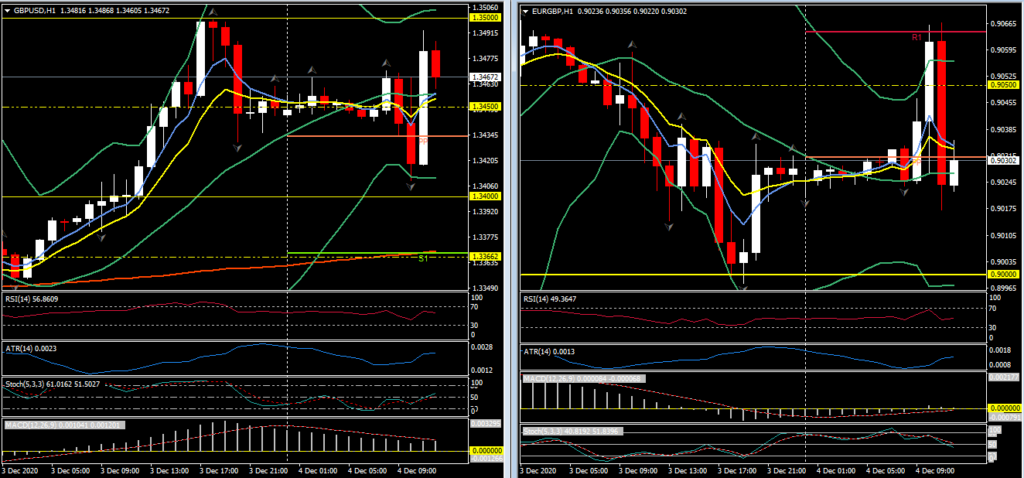

In Europe, the major focus remains on Brexit. Tensions are scaling up in EU-UK negotiations, which if nothing else is a sure sign than they’re very close to deadline, which is reportedly tomorrow. The EU Chief negotiator, Barnier, and his team remain in London. France, according to sources cited by media reports, has at the 11th hour increased demands on state aid rules, although an EU source cited by the BBC refuted this. It is also understood that Brussels has so far not accepted the UK’s offer for EU fishing boats to keep 40% of the catch in UK seas. Sources on the UK negotiating team have also been cited in media saying that talks are near to collapse. Despite this, the Pound, which is the principal conduit of investor expression on all things Brexit, has remained steady. Market participants are refusing to be drawn in, having witnessed down-to-the-wire dramatics in previous Brexit negotiations, and waiting instead on concrete developments. We continue to expect a deal, though France is continuing to threaten it may veto a deal, which in the event would trigger a no-deal outcome. France’s Clement Beaune said, “we would veto any Brexit deal that is deemed unsatisfactory”.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.