The Final Brexit deadline keeps being pushed out. There was no breakthrough in Brexit talks last night and EU leaders will now have a chance to discuss the state of play at the summit that starts today with the deadline for talks now extended until Sunday. An EU diplomat source cited by Euronews, however, says that talks could continue through to the end of next week (December 18th), and that the pledge by UK PM Johnson and EU’s von der Leyen for a “firm decision” by Sunday meant a firm decision about the future of the talks. This follows UK foreign secretary, Dominic Raab, saying that negotiations could still be extended beyond Sunday. That said, nothing can be taken for certain.

The European Commission, meanwhile, has published targeted no-deal contingency measures to maintain basic air connectivity, aviation safety, basic road connectivity, and continued reciprocal access to fisheries. The European summit is also expected to unlock the EUR 750 bln pandemic stimulus package on top of what the ECB is expected to add to PEPP and TLTRO programs, that should help to get the economy through the winter and support the recovery once vaccination programs have started to have a real impact.

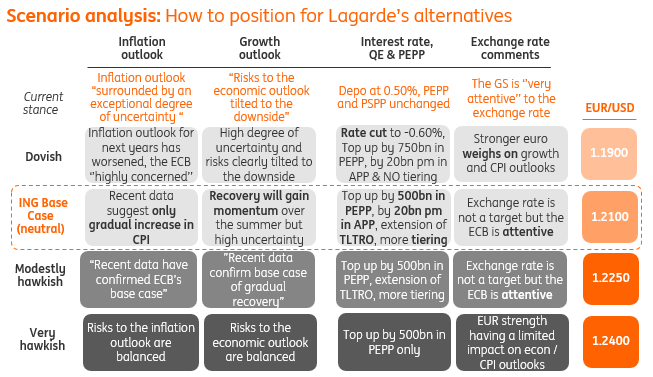

There is also a good chance that ECB’s Lagarde will attempt to talk down the Euro at today’s policy press conference, having form on this issue when the Euro was some 2% cheaper than prevailing levels.

Hence so far today on this Brexit craziness, after the announcement that “very large gaps remain between the two sides”, Pound lost ground, extending a volatile run for the currency, while the UK100 is outperforming with a 0.5% gain helped by a weaker Pound. Cable moved below 1.3300, while EURUSD has turned lower as well amid a pause in the bull trend that left a 32-month peak at 1.2177 last Friday. The markets might become more risk-cautious into the year-end period, which may see both the bull trend in global asset markets and the Dollar’s downtrend lose steam.

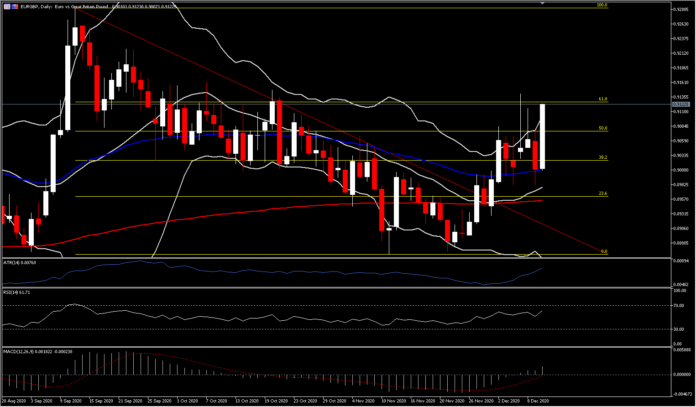

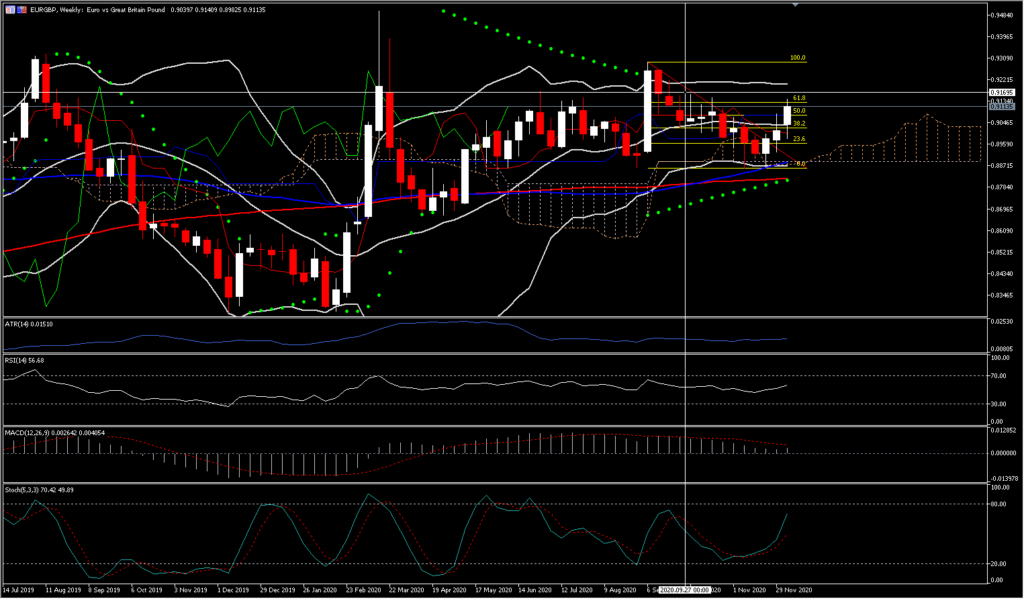

EURGBP on the other side is pushing up against the near 52-day high of 0.9160 as buyers look to extending the uptrend seen in December. The asset spiked by nearly 115 pips just today, retesting again the 61.8% retracement level on 2020’s plummet. Positive momentum is growing in the technical indicators and the rising simple moving averages (SMAs) are preserving the prevailing bullish picture. The MACD has turned in, however signal line remains neutral suggesting resistance, while the RSI is at 60 pointing north. Moreover, advances in price are being endorsed by the stochastic %K line, which is ready to cross above its %D line, having already posted 3 consecutive higher lows since the beginning of November. The short-term oscillators also display improving positive momentum.

If bullish bias sustains, breaking out the key 0.9140 Resistance, it could reach the upper weekly Bollinger band at the round 0.9200 barrier. Clearly climbing over there, the price may propel towards the September highs at the 0.9290 level. If sellers gain the control back the price could find a floor at the confluence of 20- and 200-DMA at 0.8980. A deeper pullback from here may encounter the reinforced support region of 0.8860, which encapsulates the 8-month Support and the lower weekly Bollinger band.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.