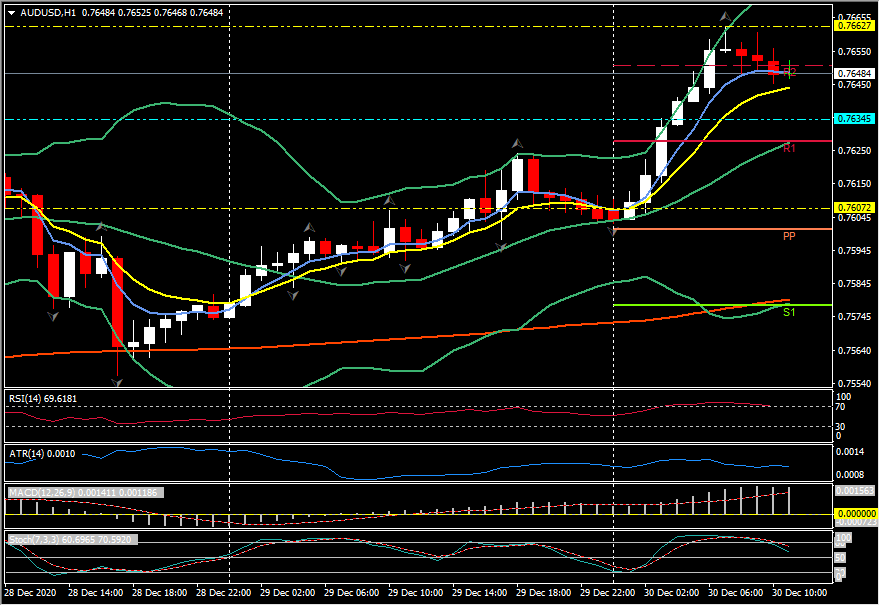

AUDUSD, H1

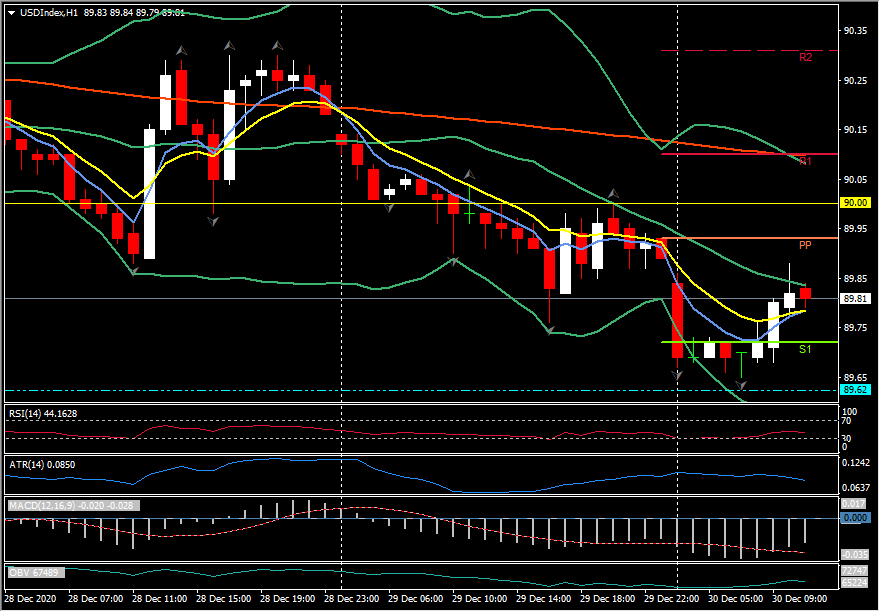

The USDIndex posted down to 89.65 earlier, close to the 32-month low from December 17 at 89.62, before recovering to 89.80 in low volume trading. EURUSD concurrently printed a 32-month high at 1.2295 before turning back to 1.2255, and USDJPY saw a nine-day low, at 103.26, and remains below 103.30. The pair’s near-10-month low, seen on December 17th, is at 102.88. The Australian and New Zealand Dollars posted respective 30- and 32-month highs against their US peer. AUDJPY and NZDJPY also saw new trend highs. The Canadian Dollar also traded firmer, but remains comfortably below recent trend highs. Oil prices remain in a consolidation, below recent near-nine-month highs. Base metal prices also remain off recent trend highs. The Pound recouped some of the declines seen over the last couple of days, with Cable lifting to a two-day high at 1.3357. The pair’s 31-month high, which was seen before Christmas, is at 1.3626. EURGBP concurrently ebbed to a two-day low at 0.9055.

Intra-day the AUD is the strongest and the USD and CHF are the weakest. AUDUSD holds at 0.7650 around R2, up some 0.56%, and AUDCHF trades up over 0.69% at 0.6768 from last night’s close at 0.6718.

Later today there are US pending Home Sales which are projected unchanged in November at 128.9, after falling -1.1% in October from 130.3 in September. The only other key data point is the Chicago PMI index which is expected to slip further to 57.0 in December after dropping -2.9 points to 58.2 in November. This would be a third straight monthly drop. Most of the regional PMIs have declined on the month amid the surge in virus cases and increasingly stringent lockdowns. The index was at 48.2 a year ago.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.