Joe Biden made a number of promises during his presidential campaign that will require enormous financing, meaning that the deficit will not only remain large, but also grow, alongside the US debt which will also increase and develop. Of course this will be detrimental to the US Dollar, because the Dollar will be diluted and the hard assets will be the beneficiaries such as land, property, gold, silver, etc.

In addition, it is still a pandemic era. Vaccines that have the hope of stopping the spread of the new virus will begin to be widely available in the second quarter. However, there are significant costs involved in research, regulatory approval, production, distribution and application. This is one of the greatest logistics exercises ever undertaken. The amount of money needed for such an extraordinary task will be borrowed, and this will affect the economic and political scene as it will result in more and more fiat currencies for financing needs.

Hard assets such as gold, silver, platinum, palladium or copper may become more valuable in the future.

Platinum and palladium saw renewed growth in interest in November after Democratic candidate Joe Biden bolstered his presidential win. Economists predict that the Biden administration will produce stricter environmental legislation and a new focus on developing green energy technologies.

Regardless of the ability of the new administration to pass climate-friendly laws from next year, along with the Paris agreement, this will be a clear signal of seriousness and likely to be followed by steps to improve vehicle fuel efficiency and regulate other pollutants and promote green energy. This may generally benefit PGM in emissions control, at a time when the auto industry is in a recovery phase and as the entire United States is following in the footsteps of California in tackling regulated pollutants and reducing CO2 emissions in vehicles. Therefore, platinum and palladium could become more expensive going forward as resources are stepped up.

Palladium is expected to experience its 10th annual supply deficit next year. So with these considerations, it is possible that the price will be pushed to $3000/ounce. Although global light vehicle production will return to 2019 levels in 2022, the palladium autocatalyst offtake could hit new all-time highs in 2021. This reflects the dominance of metals in the petrol segment and the trend towards higher metal loads in response to tightening emission standards.

Palladium is expected to experience its 10th annual supply deficit next year. So with these considerations, it is possible that the price will be pushed to $3000/ounce. Although global light vehicle production will return to 2019 levels in 2022, the palladium autocatalyst offtake could hit new all-time highs in 2021. This reflects the dominance of metals in the petrol segment and the trend towards higher metal loads in response to tightening emission standards.

Meanwhile, for many governments, fighting climate change has become a top priority, but there are still few funds available to make major changes. The development of hydrogen as an alternative fuel source is one of the most cost-effective options available today.

Green hydrogen provides short term cost effectiveness and long term alternative energy solutions. Platinum is a critical metal used in the process that separates water into hydrogen and oxygen. As a result, many companies are looking for hydrogen fuel cells to fill important gaps, which in turn is raising demand for platinum. Therefore, many economists expect a surge in demand for electric vehicles in the coming years, as battery technology is not sufficient for heavy duty vehicles.

Speculative demand for platinum is not benefiting from a surge in demand for gold and silver, but will likely benefit from speculative interest in the expected reflexive hurdle for next year, as the spread of vaccines aids global recovery.

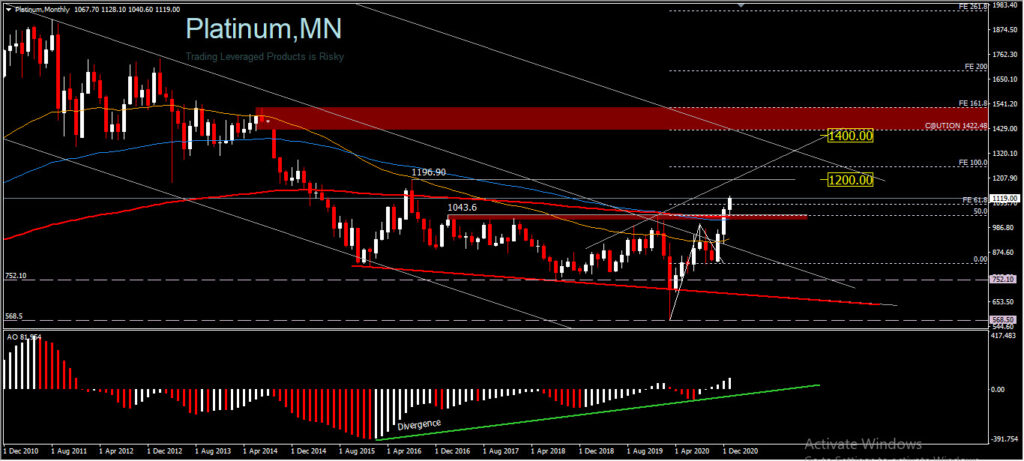

While the aftermath of the pandemic is likely to generate a primary market surplus for platinum, driven mainly by a strong recovery in South African production, forecasts for investment demand for the metal will balance the market as conditions improve. The price of platinum, which has crossed the peak price mark of $1,043.6 formed in February 2017, is likely to continue its short-term forecast to $1,200 an ounce in the first and second quarters of this year, or about 7% more than the current price of $1,118.80. Long-term projections do not rule out a $1,400 price per ounce if world health conditions improve and manufacturing returns to normal operation.

Hence, one of the factors that could have a significant impact on PGM (Platinum Group Metal) metals and encourage higher demand for platinum is the development of green hydrogen technology. Not only will new demand from a growing sector increase interest in platinum, but other metals could attract investors in 2021 as investors seek more value in the precious metals space.

Click here to access the HotForex Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.