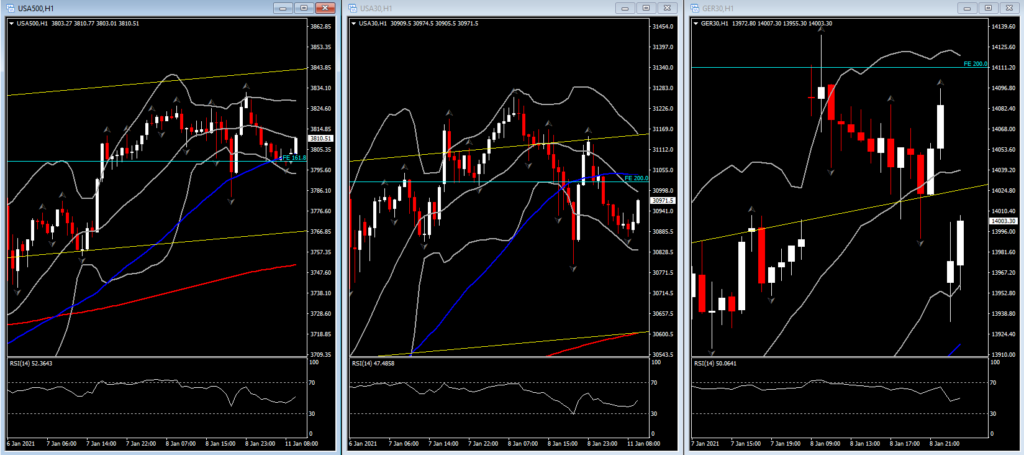

Wall Street reversed lower after all major indices posted fresh new peaks. Reports that Democratic Senator Manchin will oppose further direct aid payments of $2000 weighed on investor sentiment temporarily. Comments from president-elect Biden ahead of the closing bell that there would be “trillions” of dollars in stimulus spending, saw stocks rally initially.

So far today, Stock market futures are broadly lower, with GER30 and UK100 down -0.3% and -0.2% respectively and US futures underperforming and posting losses of -0.5 to -0.7% as political developments in Washington remain in focus. Additionally, the US Dollar and Stock markets appear to be getting some support from Speaker Pelosi’s plans to impeach President Trump, if the cabinet doesn’t act to remove him.

In Europe there is no sign that the virus situation is under control and officials are debating a further tightening of restrictions, especially in Westminster. Against that background the risk of a double dip recession is rising and comments from BoE’s Tenreyro and ECB President Lagarde this afternoon will be watched carefully.

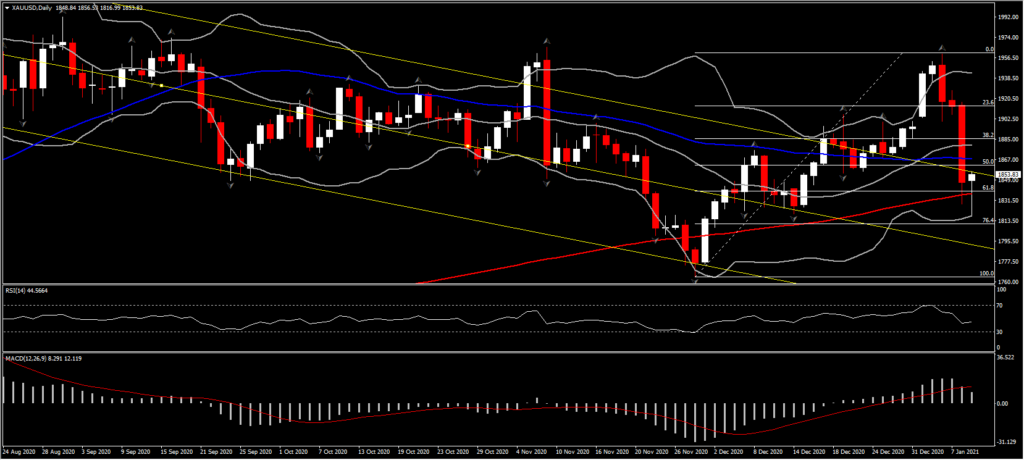

Meanwhile in the metal market, Gold had bottomed at 1,816 early in the session, extending the 3-day drift since rallying to 1,959 highs. The USD bounce and rising yields have weighed on the gold price. The precious metal is retesting 200-day SMA something that could attract some short term buyers, as it coincides with December’s 61.8% Fib. retracement level. The recent decline in gold look to has corresponded with the rise in real yields. The cheapening in Treasury yields accelerated on technical pressures after key levels were broken and following the jump in earnings in the jobs report. Those added fuel to the selloff that’s been in place so far this year amid reflation trades, inflation bets, and upcoming supply. The break of 1.10% on the 10-year saw the wi note test 1.13%. Also, the 30-year was up over 3 bps to 1.895%. The Treasury is auctioning $120 bln in coupons this week.

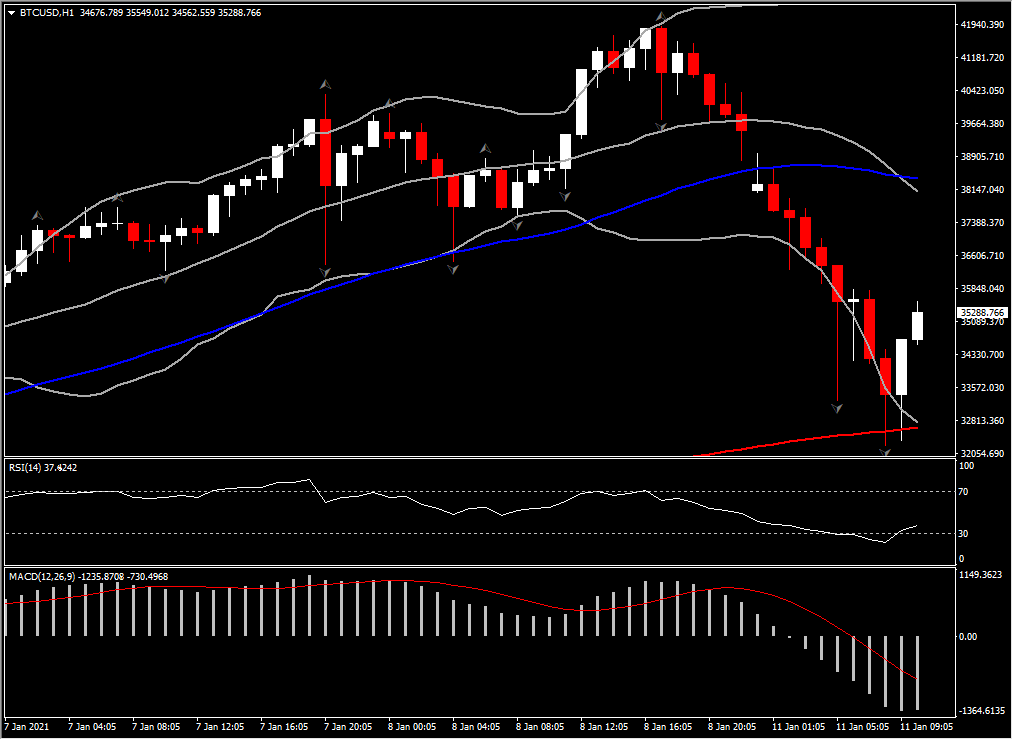

Rising US yields were also the possible suspect for Bitcoin’s plummet. BTCUSD and BTCEUR saw a decline by more than 15% and 20% respectively. However the cryptomarkets’ losses came on a variety of news that could have been the drivers of both Gold and Cryptos. One of the most important headlines that could have been a catalyst for the BTC drift is the Bitstamp exchange. Cryptocurrency exchange Bitstamp said it was halting XRP trading and deposits for all US customers on Jan. 8, 2021, because of the US Securities and Exchange Commission’s recent filing against Ripple Labs, alleging XRP is a security.

Additionally, US House leader Pelosi’s plans to impeach Trump for a 2nd time, the news that the US military is opening domestic terrorist cases on members involved in the assault on the Capitol last week, along with the removal of US self-imposed restrictions on its relationship with Taiwan which worsens the China-US trade war are factors that supported US Dollar today, suggesting that the Greenback is still being viewed as a safe haven by market participants while Bitcoin could correspond as a sentiment indicator. That said, the USD’s gain today has come despite a dip in Treasury yields, which in turn has been seen amid a pull back in most global equity markets and commodities.

Nevertheless, the new agenda expected out of Washington with more fiscal spending will likely continue to support a robust reflation trade, which should keep risk-on conditions intact for now. In the US, the economic docket is empty to start the week, but there’s a heavy Fedspeak slate that includes Chair Powell and VC Clarida. On tap today are Atlanta Fed’s Bostic, an FOMC voter, who will discuss the 2021 economic outlook. Dallas Fed’s Kaplan will speak on monetary policy and the economy. Data picks up later in the week and will include CPI, PPI, retail sales, industrial production and the Empire State index. In Japan, markets will be closed on Monday for Coming of Age Day.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.