GBPUSD, Weekly & H1

The Pound, while softer today, has moderately outperformed this week. Various analyst notes from both the currency and equity realms have been reporting long-term investor interest in UK assets, which have been left undervalued by the impact of both the long Brexit process and Covid lockdowns (the UK economy having underperformed G20 peers during lockdowns last year). Cazenove Capital estimated, for instance, that UK equities were trading as low as a 30% discount to global peers, a near 30-year low by this comparative metric to last year. Sectors that have been hard hit by Covid lockdowns include the energy and banking stocks, which are sectors that the UK market is rich in. A survey conducted by the Association of Investment Companies recently highlighted that some UK equity fund managers have been heralding Brexit as an inflection point for UK stocks. There are also expectations that pent up business investment is being unleashed, with Brexit uncertainty having finally cleared.

The Pound has also been underpinned by a favourable shift in yield differentials after BoE Governor Bailey and Deputy Governor Broadbent downplayed negative interest rates this week. The rapidly proceeding Covid vaccination program in the UK, which is leading the way globally and is on track to have nearly 25% of the population vaccinated including nearly all of the at-risk groups by mid February, is another sterling positive. The Covid vaccination rollout is enabling investors to look across the valley of prevailing lockdown realities, with UK nations last week going into a ‘tier 5’ lockdown, the most restrictive level since the full ‘mother lockdown’ of spring last year.

This morning, UK GDP for November fell by -2.6%, better than expected but still a painful record. A double-dip recession by some¹ is now predicted as the UK enters the full extent of life outside the single market.

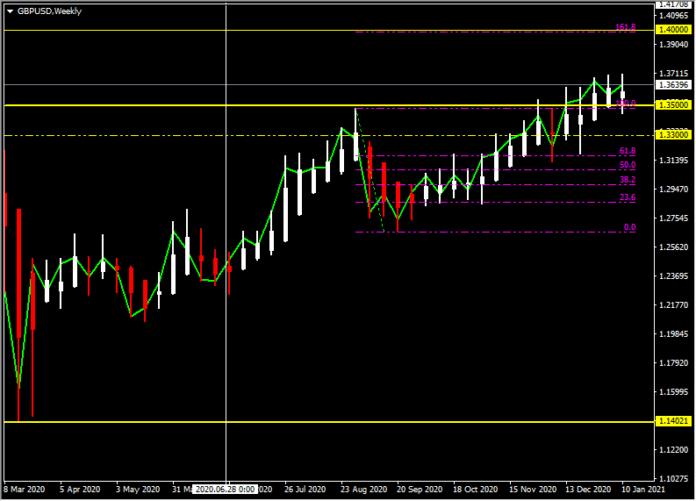

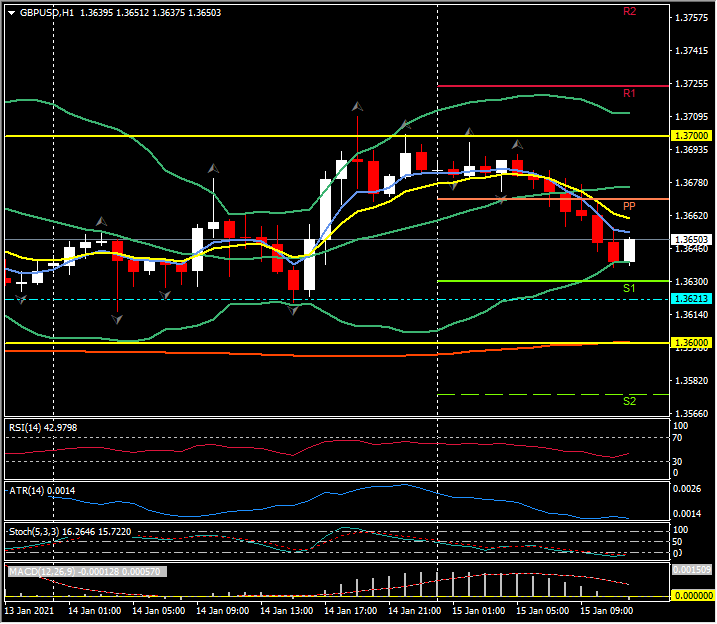

Technically GBPUSD remains bid on the Weekly chart, with the 161.8 Fibonacci extension from the September 2020 low sitting around 1.4000. Today, yesterday’s rejection of 1.3700 continues as the Dollar gains some support and Cable trades under 1.3650. S1 sits at 1.3630 and S2 below 1.3600 at 1.3575. First resistance is today’s Pivot Point at 1.3675, with R1 beyond 1.3700 at 1.3720.

¹https://www.cityam.com/uk-set-for-double-dip-recession-as-gdp-plummets-2-6-per-cent/

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.