Joe Biden was inaugurated as the 46th President of the United States overnight in a peaceful ceremony. Wall Street rallied to new record highs to begin the new administration, with ongoing support from the prospects for massive additional stimulus.

GER30 and UK100 futures are up 0.3% and 0.4% respectively, alongside broad gains in US futures. The tech heavy USA100 continues to outperform after already rallying yesterday. Meanwhile, helping the yields market recover from the 2021 selloff has been the Fed’s commitment to low rates, with the long end supported by expectations the FOMC will adjust QE purchases to cap rates, while foreign demand and dip buyers are also expected to limit selloffs.

Asian markets mostly moved higher and risk appetite generally improved, although Treasury and JGB yields still dropped back slightly overnight and Bund futures are also slightly higher. Inflation data headlined with the final Eurozone HICP for December confirmed at -0.3% y/y. UK CPI was higher than anticipated at 0.6% y/y and German PPI inflation turned positive in December. Inflation will likely start to move higher later this year as economies rebound and governments implement recovery programs against the background of still generous financing conditions. Elsewhere, Canada’s CPI slowed to a 0.7% growth rate in December (y/y, nsa) from the 1.0% pace in November, undershooting expectations for little change in the annual pace. The slowing in total and core CPI growth supports the BoC’s view that current accommodations will remain in place until 2023, which is why yesterday BoC maintained the low for long policy pledge, reiterating that the economy will “continue to require extraordinary monetary policy support.”. They will continue the QE program but will adjust the pace of net GoC bond purchases as required as they gain confidence in the strength of the recovery.

The BoJ on the other hand, this morning left main policy settings unchanged as widely expected. Interest and asset buying frameworks were confirmed and deadlines for some funding programs extended as the BoJ took a grimmer view on the current state of the economy, but also upped its growth forecast for the expected recovery in the next fiscal year, also thanks to the government stimulus package announced last month. Governor Kuroda said uncertainty remains high for now and the risks for the economy and inflation are to the downside. Against that background he stressed that the BoJ won’t hesitate to add easing if needed, but also stressed that the BoJ will need to consider the cumulative effects of the policy measures, including side effects.

Forex Market

- EUR – lifted to 1.2130 but remains flat in the daily timeframe.

- GBP– struggling to break the 1.3720 level (33-month high which has retested 4 times within December and January).

- JPY – down to 103.35 (S1) – S2 at 103.15 and PP at 103.63

- AUD – 3rd day higher – Currently at 0.7760 with R1 at 0.7773

- CAD – retesting the 1.2610 Support for the 4th time in January

- GOLD – spiked yesterday on risk on flows however fails so far to break the 20-DMA at 1874.

- USOil –Currently at 53.20 (PP and 20-hour SMA) – Crude has pulled back slightly from 4-session highs of $53.82. Stimulus and vaccine hopes, along with Saudi Arabia’s voluntary production cuts in February and March continue to underpin prices, while the upside has been hampered by continued and increasing Covid lockdowns, which have dented the demand side of the equation. As a result, the recent $52-$54 range is likely to hold up for now.

- Bitcoin – turns lower to 33.2-34.7K

Today: All eyes will be on the ECB at 12:45 and 13:30 GMT. The data calendar meanwhile focuses on US Jobless claims and New Zealand and Japan inflation data.

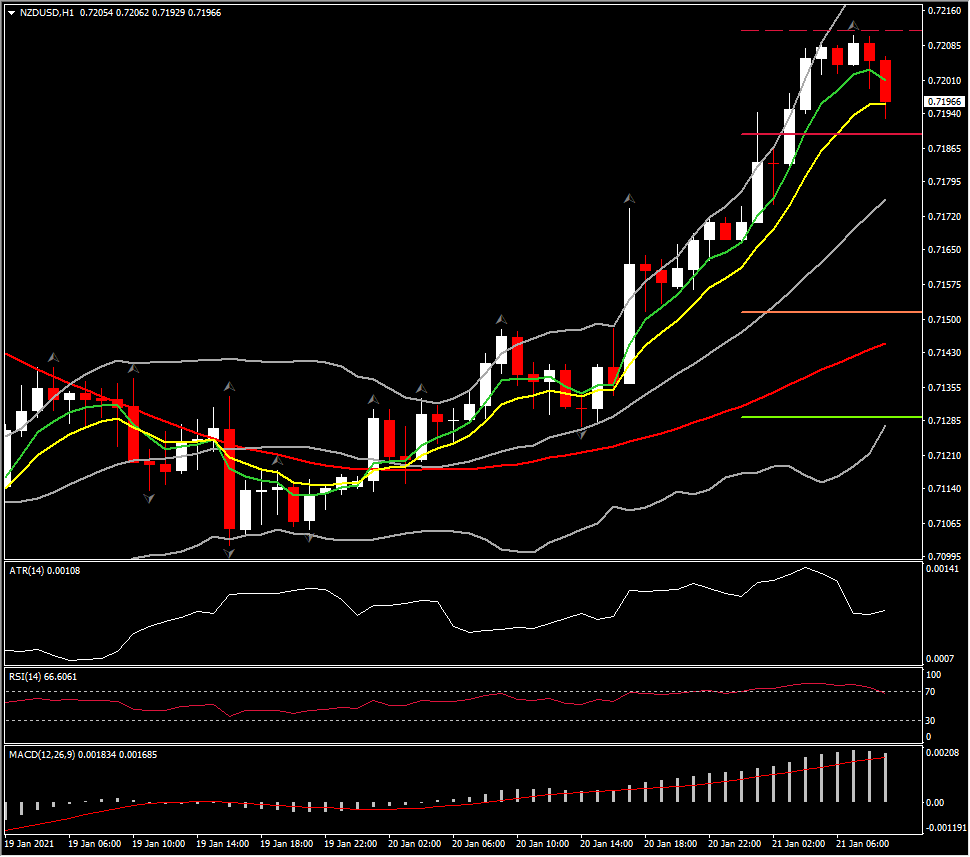

Biggest (FX) Mover – NZDUSD ( +0.40% as of 07:58 GMT) – The asset broke 20-DMA, regaining nearly 50% of losses seen since December 2020. Intraday and Daily momentum indicators are positively configured, however a pullback has been seen the past 3 hours with the asset turning back below the 0.7200 area. Fast MAs haven’t bearishly crossed yet in order to confirm the pullback. ATR H1 – 0.00103 & ATR Daily – 0.00725

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.