Visa Inc. will deliver Q4 2020 fiscal earnings on January 28, 2021 via conference call, after the market close. The Zacks Consensus Estimate is for total payment transactions to be pegged at $51.7 billion, which implies a 4.8% increase from the figure reported in last year’s quarter. In the Q4 2020 report, non-GAAP company earnings were $1.12/share. The Zacks Consensus Estimate for fiscal Q121 earnings of $1.27/share implies a 13.01% decline from the reported amount for the prior year period. Likewise, the consensus forecast for sales of $5.52 billion shows an 8.81% decline from the figure reported for the last quarter.

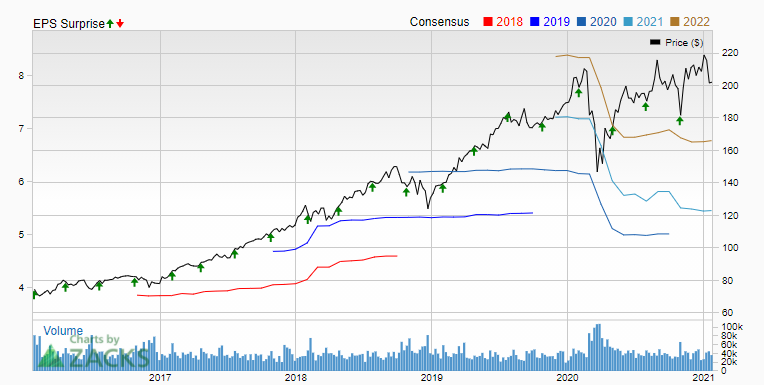

The company boasts record-exceeding earnings surprises in each of the past three quarters, beating estimates by an average of 2.41% as shown in the chart above.

Meanwhile, Marketbeat and Wedbush also issued their forecasts for Visa’s Q221 earnings at $1.37 EPS, Q321 at $1.41 EPS, Q421 at $1.51 EPS and FY2021 earnings at $5.58 EPS. As for the quarterly report due out today, Wedbush expects a profit of $1.29 per share, down from a previous estimate of $1.32 by giving it a “Buy” rating at a target of $220. Morgan Stanley, a Visa shareholder, raised Visa’s target share price from $218.00 to $233.00 with the company rating “Overweight”, similar to the rating given by KeyCorp which raised Visa’s target share price from $210.00 to $225.00. In general, Visa has a consensus rating of “Buy” with a target price of $221.28.

Visa Inc. is one of the largest digital payment companies in the world, serving individual consumers, merchants, governments and financial institutions in more than 200 countries. Visa generates income by selling its services as an intermediary between merchants and financial institutions. In early January 2021, Visa’s trailing-12-month (TTM) revenue was $21.9 billion and TTM net income was $10.9 billion. The company has a market capitalization of $473.0 billion.

The domestic and global business rebound in late 2020 that saw easing of restrictions, gradual recovery in consumer spending resulting in increased payment volumes, cross-border volumes, digital payments in face-to-face transactions and significant increases in online shopping are likely to have also increased CNP transactions, and are expected to be the main driver of the earnings report which will be released later.

In addition, there are many large institutions that are major shareholders of Visa, including the ETF management company Vanguard Group, which owns 145.2 million Visa shares, and BlackRock, which owns 127.4 million Visa shares, as well as investment management company T. Rowe Price, which offers portfolio management alongside equity, fixed income, asset allocation and financial advisory services, which owns 75.9 million shares of Visa. Behind these 3 large institutions, there are still a line of other well-known institutions that hold a large number of shares such as State Street Corp with 75.5 million shares; FMR LLC with 72.7 million shares; Morgan Stanley with 34 million shares and more, according to the company’s 13F filings as of September 29, 2020.

Apart from large institutions, sizable individual shareholders include: Alfred F. Kelly, who owns 165,087 Visa shares, representing 0.01% of all outstanding shares. Kelly has been Visa’s CEO since December 2016 and has been the chairman of the company’s board of directors since April 2019. Rajat Taneja owns 250,856 shares of Visa, representing 0.01% of all outstanding shares. Taneja is the president of Technology for Visa who joined in 2013. Vasant M. Prabhu owns 73,633 shares of Visa, representing less than 0.01% of all outstanding shares. Prabhu is Visa’s chief financial officer, a position he has held since February 2015.

The Annual Shareholders Meeting was held on January 26, 2021. Class A common stockholders at the business close of November 27, 2020 were entitled to vote on all proposals.

Visa is very dominant in the payment processing business and this would be reason enough to have this name on the list of preferred investment companies. With the volume of transactions likely to continue to increase rapidly over time, long-term profitability growth can be forecast for a very long time.

Visa shares opened at $197.44 on Wednesday (27/01) and fell to near Monday’s low that was above the low price of $193.09 in September last year. Prices are temporarily holding onto the 61.8% retracement level of FR from last year’s $179.20 measurement low and December’s new high of $220.36..

The stock is still moving below the 100-day moving average (blue line) and holding on to the 200-day EMA (red line). Further declines will target a psychological level of $190.00 and a low of $179.00. On the upside, the 100-day EMA will be the hurdle calculated near the price of $204.40. The oscillation indicator provides information on the condition of stock prices that are still in negative sentiment.

Please note that sometimes the period before the release of an income statement can create high price volatility because the income statement is identical to the distribution of dividends. This opportunity is sometimes used by institutional and individual shareholders to buy back shares or sell ownership, if the company’s performance has decreased. Besides that, it is also used by retailers and speculators to get cheaper purchase prices.

Click here to access the HotForex Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.