Stock markets moved broadly higher after a positive close on Wall Street yesterday. Concern over volatility in retail trading has started to recede and stimulus hopes and vaccine progress are keeping sentiment underpinned. Tech stocks outperformed ahead of earnings from the likes of Amazon and Alphabet today. GER30 and UK100 futures are currently up 0.4% and 0.6% respectively. US futures are also higher, with the tech-heavy USA100 outperforming. The JPN225 closed with a gain of 0.97%. The 10-year Treasury yield is up 0.3 bp at 1.08%, while Australian 10-year rates climbed 0.5 bp even as the RBA announced an extension of asset purchases worth an additional AUD 100 bln. The Dollar was on bid overall on Monday, with a new month reportedly seeing USD inflows, despite the general risk-on conditions seen, which typically weigh on the USD.

Headlines:

- For Europe it is clear that vaccination programs won’t bring a quick reopening of economies, even in the UK.

- US records deadliest month of the pandemic.

- RBA left key rates unchanged, as expected, with the target of 10 basis points for the cash rate on the yield on the 3-year Australian Government bond maintained.

- US-China: China calls for its relationship with the US to be put back on a predictable and constructive track.

- Biden had a “substantive and productive discussion” with Republican senators on Covid relief.

- South Korea is preparing a fourth round of coronavirus cash handouts.

- CME futures exchange has raised its margin on silver futures by 18%.

- Robinhood, the online broker at the centre of the boom in day trading, has raised $2.4bn in its second capital infusion in a week to shore up finances strained by turbulent trading.

- Japanese government saying it would extend Covid related lockdowns and restrictions in various areas of the country for an additional month, to March 7, appeared to have weighed on the Yen as well.

- Traders continue to price out any hope of additional rate cuts from BoE and ECB and data releases today are likely to be bond negative, with preliminary GDP numbers for the Eurozone and French HICP inflation likely to come in higher than originally anticipated

Forex Market

EUR – is trading at 1.2071, bellow PP and a breath above 2-month Support at 1.2000.

GBP – dollar safe haven strength drifted Pound to 1.3600 territory. Currently close to PP at 1.3690.

JPY – Resistance is at the psychological 105.00 level, with buy-stops noted above the level. A break higher will see the 200-day moving average at 105. 63 as the next upside target. The pairing last traded above the 200-DMA in June of 2020. Currently below R3 at 104.97.

AUD – ranging between the PP and S1, (0.7600-0.7665).

CAD – at 1.28 from 1.2860 highs.

Silver – in retreat, fell by 4% back below $28 – CME has raised its margin on silver futures which is arguably a significant factor in driving prices lower today.

USOil – surged to 54.35.

Today: Focus mainly on GDP reading for the Eurozone, and the Labor data for New Zealand . OPEC meeting on tap as well.

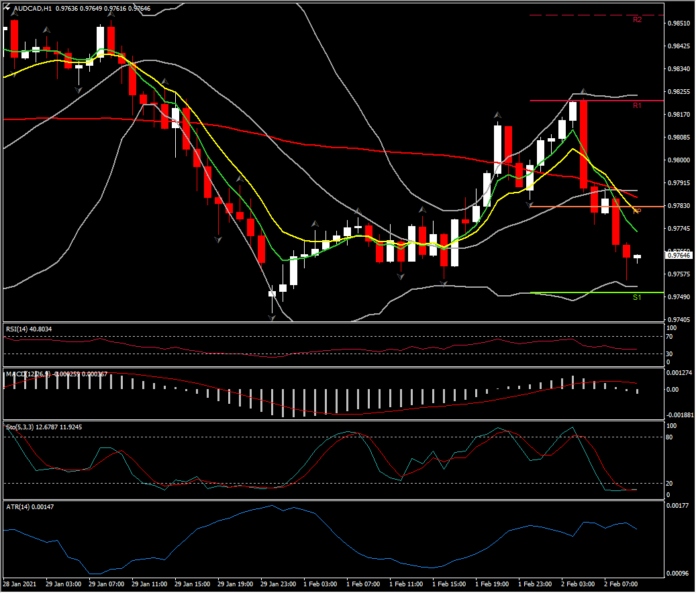

Biggest Mover AUDCAD (+0.32% as of 08:00 GMT) – The Australian Dollar ebbed after the RBA left interest rates unchanged but extended its QE program following its February board meeting. Governor Lowe also noted in the central bank’s statement that the exchange rate “has appreciated and is in the upper range of the recent year.” AUDUSD edged out a five-day low at 0.7603.

RBA left key rates unchanged, as expected, with the target of 10 basis points for the cash rate on the yield on the 3-year Australian Government bond maintained. The parameters of the Term Funding Facility were also confirmed, but the RBA decided to purchase an additional AUD 100 bln of bonds issued by the government, states and territories “when the current bond purchase program is completed in mid April. These additional purchases will be at the current rate of AUD 5 bln a week”. The statement said the outlook for the global economy has improved over recent months thanks to vaccine developments. It warned, however, that the expected recovery is likely to “remain bumpy and uneven” and “remains dependent on the health situation and on significant fiscal and monetary support”. The central scenario is for the Australian economy to expand 3 1/2 percent this year as well as expected to “return to its end-2019 level by the middle of this year”. Spare capacity is likely to stay for some time. Inflation and wages growth are expected to pick up from weak levels, but to remain “below 2% over the next couple of years”.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.