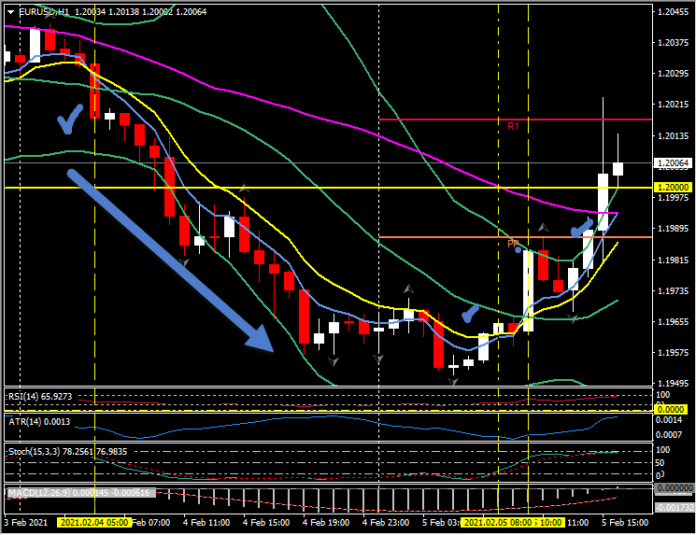

EURUSD, H1

US nonfarm payrolls bounced 49,000 in January, recovering slightly from the -227,000 (was -140,000) drop in December, which was the first decline since April. While the headline was a little disappointing, some of the other components weren’t too bad. The unemployment rate dropped to 6.3% from 6.7%. Average hourly earnings edged up 0.2% following the 1.0% (was 0.8%) jump. On a 12-month basis, earnings are up 5.4% y/y from 5.1% y/y. The average work week climbed to 35.0 from 34.7. The labor force dropped -406,000 versus the prior 31,000 rebound, and household employment rose 201,000 versus 21,000 previously. The labor force participation rate dipped to 61.4% from 61.5%. Total private payrolls were up only 6,000 following the -204,000 (was -95,000) drop. The service sector added 10,000 jobs, barely recovering from the -280,000 (was -188,000) plunge in December. Leisure and hospitality jobs declined another -61,000 versus -536,000 (was -498,000). Employment in the goods producing sector dipped -4,000. Construction jobs were down -3,000 from 51,000 (was 51,000). Manufacturing lost -10,000. Government jobs bounced 43,000 from -23,000 (was -45,000).

The US trade deficit narrowed -3.5% to -$66.6 bln in December following the 8.2% surge to -$69.0 bln (was -$68.1 bln) in November which was a record high. The Dollar fell following the data, which saw January non-farm payrolls rise a bit less than consensus, but it was the sharply lower December revision that did the damage. The unemployment rate unexpectedly fell to 6.3% from 6.7%. The December trade deficit narrowed less than forecasts, with the November deficit revised higher. USDJPY fell from trend highs of 105.77 to 105.45, while EURUSD rallied from 1.1985 to 1.2023 and GBPUSD spiked to 1.3718.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.