USOIL printed fresh 13-month highs of $57.67 in London morning trade, after bottoming at $57.02 at the Asian open overnight. Brent crude meanwhile, traded over the $60 mark for the first time since February of 2020. OPEC’s resolve in capping production, along with fiscal stimulus, and hopes for a faster economic recovery now that vaccines are on the rise, have combined to support oil prices since November.

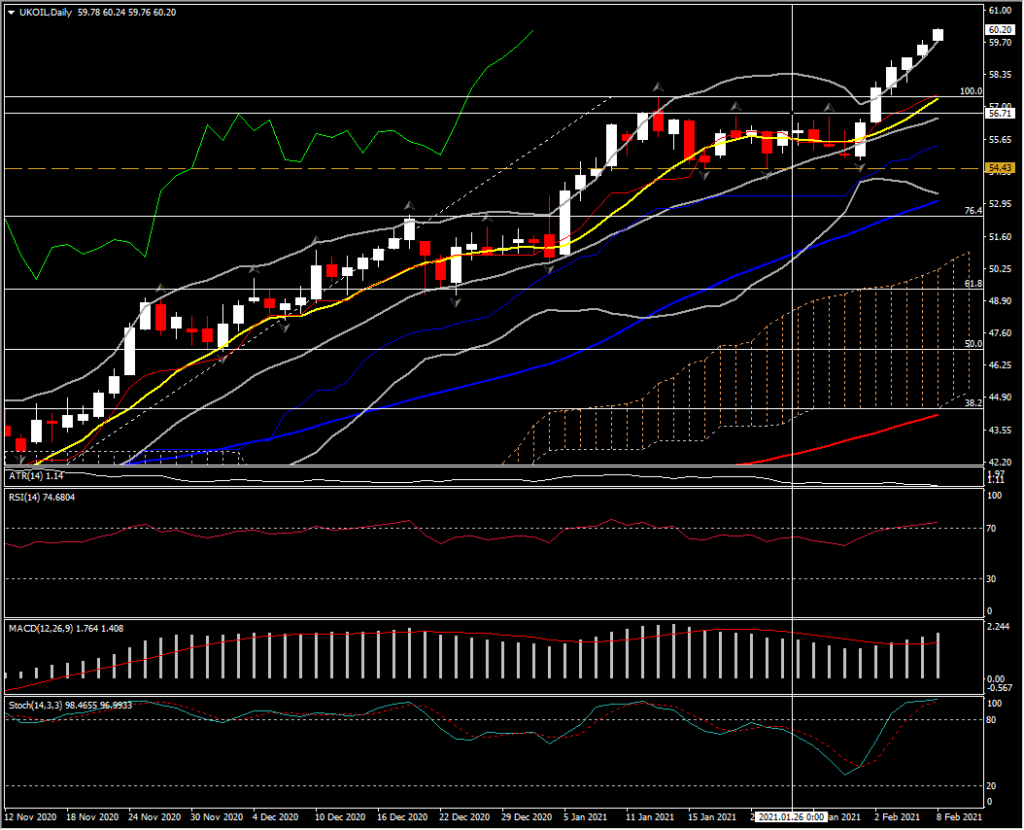

UKOIL has been holding in a bullish sloping channel over the last 3 months, developing beneath the simple moving averages (200-week DMA since Friday) and the Ichimoku cloud in the weekly timeframe since December.

From a technical perspective, the daily stochastic oscillator posted a bullish crossover within the %K and %D lines in the oversold zone, while the RSI is pointing up in the positive territory, crossing above 70, indicating an upside retracement in the medium term. The MACD lines in the meantime, extend northwards supporting the positive overall outlook.

However, the asset in the near term is overbought as the daily candles remain outside the upper Bollinger band area for a fifth day in a row. Hence a correction or consolidation might follow. Meanwhile, key near Resistance is at 63.00 (127.2% Fib. extension) hence if the price fails to jump above this level, this could pull the price back towards the 57.50-58.00 Support area which is set at the 200-week SMA and last 4-week resistance area which is now converted into a key Support. Steeper decreases could open the door for the 48-50 zone (20-week SMA), increasing the selling interest. Alternatively, a successful attempt above 63.00 could drive the market to the 2019 highs within the 72-73.50 zone.

In conclusion, the black gold is creating higher highs and higher lows in the long-term timeframe and only a fall below 46.00 may change this positive outlook.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.