Japanese, South Korean and Chinese markets were closed today, with the latter commencing the week-long Lunar New Year holiday. Singapore will be off tomorrow, and the Lunar New Year holiday will start tomorrow in Hong Kong. Despite these absentees, global stock markets have remained overall buoyant in record high areas, if lacking directional ambition.

The stock rally however has paused since Tuesday on the lack of any eventful news, the short holiday week for Asia but also against the background of tame CPI readings in the US. Meanwhile with stocks holding around their record highs, US President Biden spoke of concern about China’s “coercive and unfair economic practices” as well as human rights and markets will be watching for signs of how the relationship between the two countries will change under Biden.

US Equity futures are modestly firmer in cautious trading. While earnings remain upbeat, there has been little in the way of news flow today. The Dollar cross currencies correspondingly have been firm even after the jobless claims outcome while remaining below their respective Wednesday highs. The initial claims report was taken in stride, with still elevated claims levels consistent with a very difficult labour market that in turn underpins expectations for steady Fed policy and the passage of the $1.9 tln stimulus package. Hence as the initial claims report under-performed and after Fed Chair Powell’s rather glum outlook on the labor market in yesterday’s comments, as well as the ongoing commitment to a lower for as long as it takes rate stance, the bias remains for richer yields.

The initial claims report under-performed, with disappointing declines after upward revisions for both initial and continuing claims. Despite the disappoint however, claims are still trending downward from elevated holiday levels that likely reflect this year’s difficulties with seasonal adjustment, and we also saw big holiday layoffs for the leisure and hospitality sector that are likely reversing course now even if claims remain elevated. Initial claims are entering February below recent averages of 850k in January, 828k in December, and 749k in November. Next week’s BLS survey week reading will follow prior survey week readings of 875k in January, 892k in December, and 748k in November. Continuing claims are poised to fall -625k between the January and February BLS survey weeks, after prior drops of -537k in January, -767k in December, -1,734k in November, -4,924k in October, -1,745k in September, -2,459k in August, -2,280k in July, and -1,610k in June. The February nonfarm payroll estimate remains at 400k.

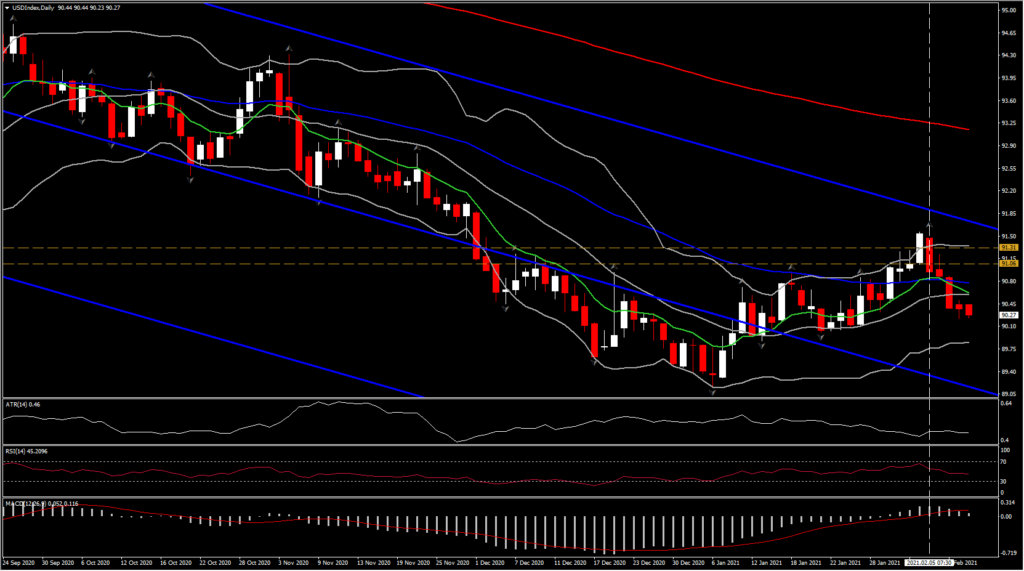

The USDIndex is diving below the 50-day SMA around 90.20, printing another red session for the fifth day in a row. The USDJPY is trying to gain some ground, holding above the 104.50 support level.

Ahead, we anticipate that the US Dollar will continue to weaken, assuming that the reflation trade sustains on the back of the sharp drop in new positive Covid tests, which is being seen globally, along with vaccination optimism, and overall good corporate earnings reports, plus stimulus measures and the prospect for a pent-up consumer spending spree in developed economies. Note, too, that the January CPI report out of the US, yesterday, was cooler than expected while Fed Chair Powell said that policymakers still aren’t even thinking about removing accommodation.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.