The RBA extended its quantitative easing program by an additional $76.2 billion at its February meeting. The RBA, like many central banks around the world, said that the economic recovery remains dependent on the progress of the coronavirus pandemic, and further fiscal and monetary support will be needed before the goals of inflation and unemployment are achieved.

The bank reiterated the same statement as before, that it does not expect to meet its inflation goal until 2024 at the earliest and that the board supports maintaining cash values until actual inflation is sustained in the 2% to 3% range.

The JPY225 closed 1.3% higher, after trimming some gains following an FT story that China is considering limiting rare earth mineral supplies to US defence contractors, which re-kindled concern over the future of US-China relations. The index held above the 30000 mark, however. The Hang Seng rallied 1.7% after coming back from the extended weekend and the AUS200 moved up 0.7%. China remains closed for the Lunar New Year holiday.

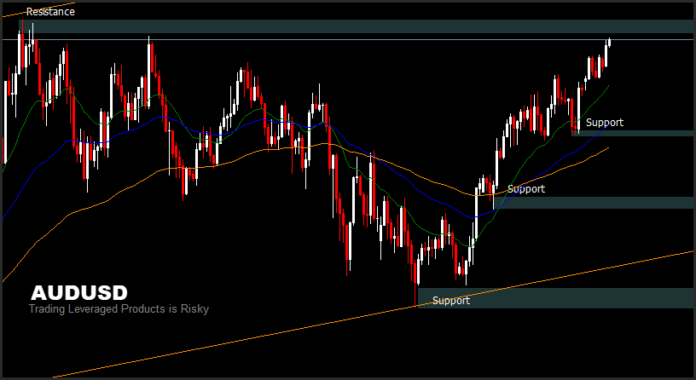

Meanwhile, AUDUSD rose 0.30%. AUDUSD’s rise from 0.7563 continues today and intraday bias remains on the upside to try to break resistance 0.7819. Further strengthening after breaking out of the resistance will target the price 0.8135, the peak formed in January 2018. On the downside, the 0.7717 minor support will be the obstacle to extending the correction from 0.7819. In case of a breakdown of these levels, correction bias will target lower levels below 0.7650 and 0.7582. Technically, it can be read from the ADX for the daily or 4 hour period that the momentum of the uptrend has not been completed and the price is still moving above the 20-day EMA 20 (green line).

Click here to access the HotForex Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.