Market News Today

Equities heavy & USD down again (Nasdaq –2.46%, TSLA -8.55% but DIS+4.4%) as Yields (+1.8% 10yr) & Commodities (inc. Oil +2% & Gold) gained. Commodity currencies close to 3-year highs. Another volatile session for BTC – 57k-49K. Facebook restores some Aussie news sites, Marathon & Occidental both missed expectations, HSBC announced a 34% fall in profits. Huawei launched a $2,800 foldable phone. US passed 500,000 Covid deaths (20% of global total) & England announced a slow exit from lockdowns. UK labour data was weak but better than expected (claims down & earnings up).

The Dollar remained on a softening path in what is now a fourth consecutive trading day of weakening, which has spanned over phases of both risk-on and risk-wary sentiment in global markets, alongside a continued ascent in Treasury yields.

Overall, as witnessed by gains in commodity prices over this period, which have been attributed by some market narratives today as helping revive stock market sentiment in Asia, the reflation trade remains in play. Copper prices, for instance, hit fresh 10-year highs today, and are up by nearly 20% on the year to day and by 62% from year-ago levels. Other base metals have seen a similar magnitude of advance.

There remains a conviction in markets that the reflation trade — the escape from pandemic recession and slow growth to the anticipated eventual return to societal and economic normalcy, fuelled by massive stimulus and a presumed unleashing of a pent up consumer ‘lockdown savings’ spending spree in developed economies — is inherently dollar bearish. The Dollar is richly valued by the measure of historic trade weighted levels, and many value/relative value investment opportunities in the inflation trade lie outside of the US economy. SocGen research, for instance, last week highlighted that the consensus expectation is for earnings to rise 30% in 2021 for companies in the MSCI World Index, and by 40% in emerging markets. That said, the Dollar (as measured by the USDIndex) remains above its early January lows. When it became clear that the Democrats would control the Senate following the early-January Georgia run-off elections, this put the brakes on what had been an unfolding dollar weakening trend — especially in light of the consequential passing of the gargantuan $1.9 tln stimulus bill, which has the potential to bring forward Fed tightening sooner than it would otherwise have been. But for now the Fed is likely to stick to its dovish guns, which is what we expect Fed chair Powell will do to today during his Congressional testimony of the central bank’s semi-annual Monetary Policy Report.

Today – EZ CPI (final), US Consumer Confidence, Fed Chair Powell’s semi-annual testimony to the Senate, BoC’s Macklem.

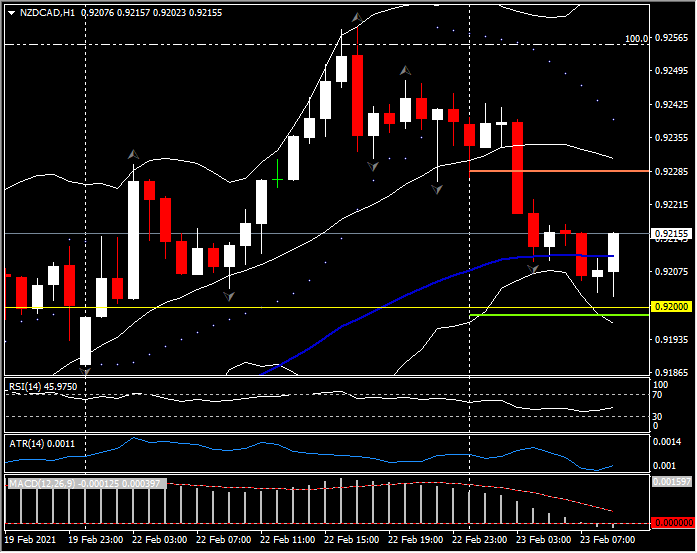

Biggest (FX) Mover @ (07:30 GMT) NZDCAD (-0.34%) Rejected 0.9250 yesterday, moved under PP, 20Hr & 50Hr MA earlier to test toward 0.9200. Recovered 50MA now. Faster MAs aligned and trending lower, RSI 45 and neutral, MACD histogram & signal line aligned lower, with a weak break of 0 line. Stochs. approaching OS. H1 ATR 0.0011, Daily ATR 0.0055.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.