Over the past six months Bank of America stock has managed to rise by 34.2% compared to the overall industry’s reported gains of +39.9%, driven by the recent trend. The long-term interest rates could continue to support the bank’s outlook, in conjunction with Zacks’ estimations that the opening of new branches could improve digital offerings and efforts to manage costs and hence to help the profitability of the company; in turn, near-zero interest rates without any possibility of changes in the near future that could hurt the bank’s margins and interest income, driven by a strong balance sheet and liquidity position, are expected to help Bank of America’s finances. [1]

Specifically in more current operations, Bank of America shares managed to spike above the average target price of $33.57 for 12 months, changing hands at $34.27/share, so analysts might lower their valuation or readjust the target price to a higher level; however, this may depend on the fundamental business developments that may be responsible for driving the price of stocks that are rising, thus being the best time to increase the target price. [2]

In the meantime, Bank of America is patiently awaiting the approval of the stimulus plan of $1.9 trillion proposed by US President Joe Biden, as the company discovered that the last two spikes in the downloads of its trading app coincided with the reception of stimulus controls. Both spikes took place alongside extreme market moves and individual stock moves in April 2020 and January 2021, attracting investors. The BofA analysts, throughout the current year as people spend more time and money away from home, expect higher levels of retail activity compared to 2019 due to zero commissions. [3]

Similarly, Bank of America has opted for the strategy of deregistering foreign accounts regardless of whether they are personal or business, giving approximately 30 days for the pertinent movements to be made from the day the bank contacts the account holder to inform him of the cancellation of his account. That said, they also seek higher probability of avoiding money laundering, trying to avoid financial and legal risk. [4]

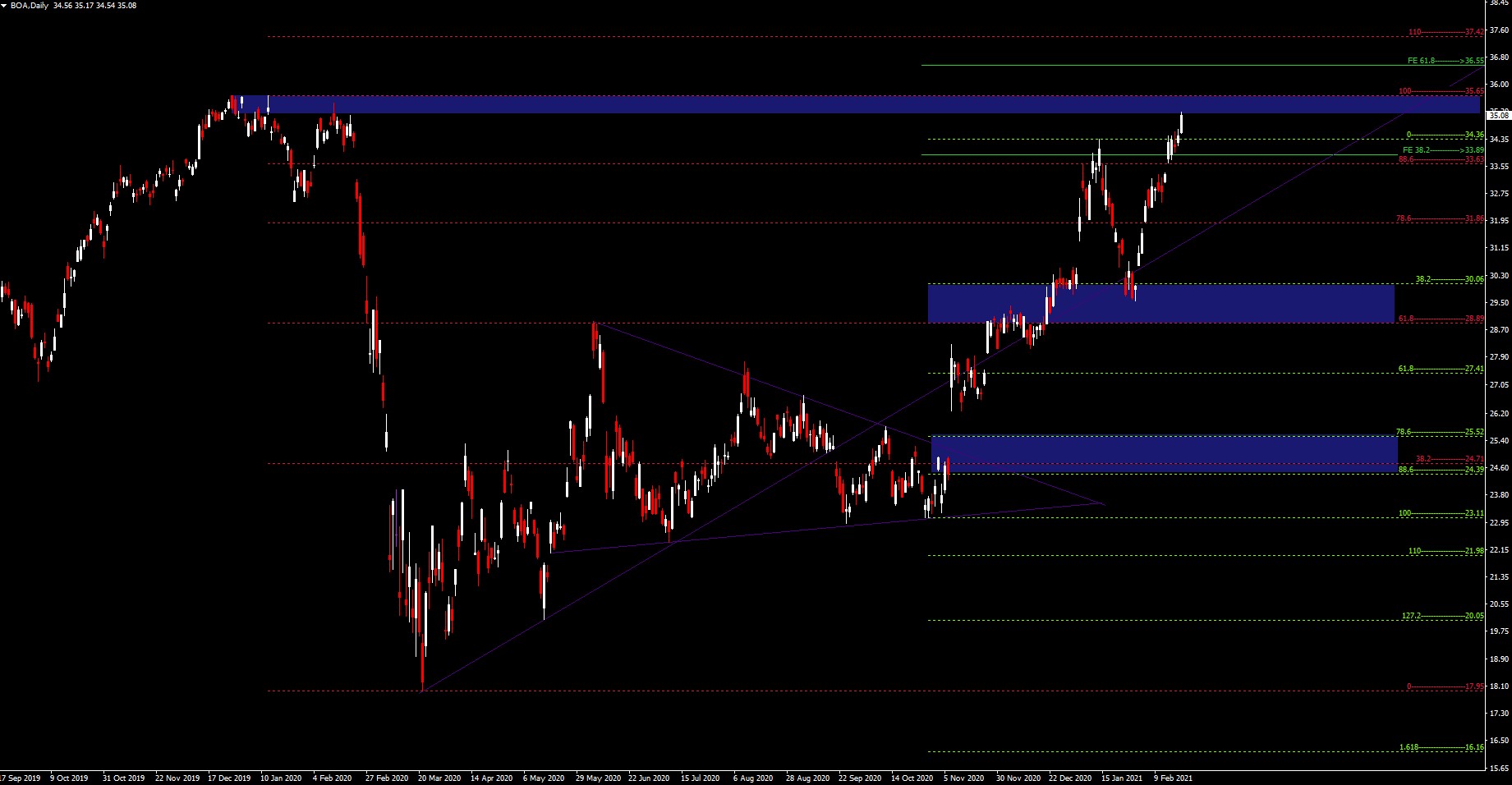

BOA maintains a bullish outlook after breaking the 2021 high that was at $34.36 and is now at a psychological level with a current price of $35.08, approaching the 2019-2020 highs at $35.65. The breakout of the ascending triangle with an upward gap on November 9, 2020 set a rapid pace in the current upward trend that has recovered almost 100% of the fall of 2020. In this rally the price has broken key levels between the psychological level of $30 to the 61.8% Fib. retracement level, corresponding to its fall at 28.89.

If the price sustains an upwards movement and manages to break the $35.65 level, then the next Resistance area sits at 61.8 FE at $36.55, and the next on the psychological level of $40. Meanwhile the 127.2% Fib. level is at $40.46, with the 100 FE at $40.86 leaving a range for longer time resistance levels.

If the price falls and tests the current uptrend or tries to make a stronger pullback to past levels, Supports could be seen at the Fib. levels that coincide with the bullish channel at $33.63-$34.36. If the asset falls below the latter, the 38.2% and 61.8% Fib. retracement levels would provide a strong support range for the asset at $28.89-$30.06. Nevertheless a break of the $30 level to the downside could see further weakness and potential retest of $27.41 or the gap at the $24.39-$25.52 range.

https://www.nasdaq.com/articles/top-stock-reports-for-visa-bank-of-america-salesforce-2021-02-17

https://www.nasdaq.com/articles/top-stock-reports-for-visa-bank-of-america-salesforce-2021-02-17- https://www.nasdaq.com/articles/bank-of-america-reaches-analyst-target-price-2021-02-17

- https://markets.businessinsider.com/news/stocks/stock-market-outlook-stimulus-retail-investing-robinhood-reddit-direct-checks-2021-2-1030088683

- https://www.sandiegored.com/es/noticias/199561/Bank-of-America-anuncia-a-sus-clientes-extranjeros-que-cerraran-sus-cuentas

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.