Bond as well as stock markets rallied across Asia, with yields correcting sharply. The big swings in the markets of late, and especially Thursday’s wild ride, intensified an increasingly nervous tone on Wall Street which is still just off of record highs. The long end continued to lead the move in yields lower just as it paced the surge on Thursday. While the rally picked up some steam in late trading on index buying which erased most of Thursday’s rout, the move pales in comparison to the run up for the month. Indeed, it was the largest since the Trump victory in November 2016.

Headlines:

- RBA doubled its regular purchase volume at its bond-buying operation. – Australia’s 10-year rate dropped back. Opposition to higher rates in the market.

- New Zealand’s 10-year rate still declined 17 bp, JGB yields are down -0.8 bp and the US 10-year rate has dropped back -0.2% to 1.40%.

- China’s official manufacturing PMI came in below expectations and at 50.6 was at a 9-month low, but Japan’s reading lifted into expansion territory again and markets seem to have scaled back inflation worries somewhat, although clearly the sharp swings over the recent weeks remain worrying.

- JPN225 closed with a gain of 2.4%, the ASX was up 1.7% at the close and Hang Seng and CSI 300 are currently up 1.3% and 1.2% respectively. GER30 and UK100 are currently up 0.8%, while US futures are posting gains of 0.7-1.1%.

- Tech-heavy USA100 futures, that previously benefited from stay-home orders, outperforming again.

- The US approved a new single-shot vaccine by Johnson & Johnson, which is hoped will speed up the vaccination process while investors are in spending mood.

- British finance minister Rishi Sunak is set to announce an extra 1.65 billion pounds ($2.30 billion) to fund the country’s vaccination roll-out as part of his annual budget statement on Wednesday. He will not rush to fix the public finances as he readies a budget plan which will pile more borrowing on top of almost 300 billion pounds of COVID-19 spending and tax cuts.

- The US House of Representatives passed a $1.9 tln stimulus package.

- Largely weaker Dollar.

- Iran rejected a European Union offer to hold direct nuclear talks with the US in the coming days, risking renewed tension between Tehran and Western capitals.

Forex Market

EUR – below 1.2100, under its 20-day moving average.

GBP– supported at 1.3968.

JPY – at 106.50 after 6-month high.

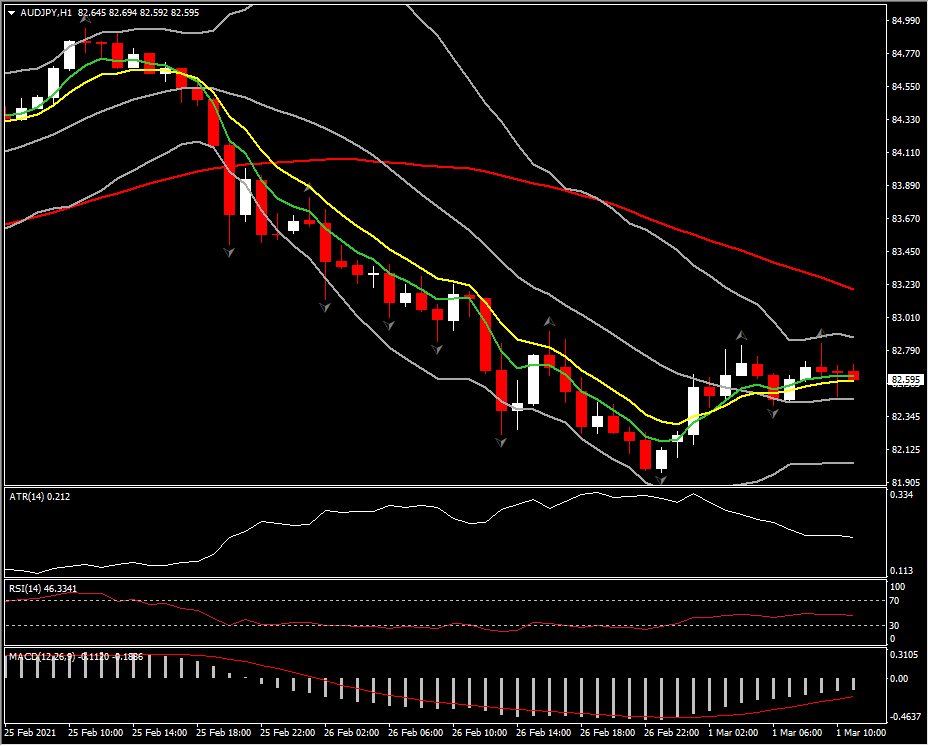

AUD – reversed nearly 70% of February’s gains – Currently between 20-and 50-DMA

CAD – jumped to 1.2700 from 1.2600 as risk aversion returned.

GOLD – recovers some of Friday’s losses but remains at mid-1700.

USOil – retests 63 again with a more than $1 appreciation after US stimulus news.

Today: Data releases today focus on final manufacturing PMI readings for the UK and the Eurozone as well as preliminary German inflation data for February. Eye are on the RBA as it is set to announce its policy tomorrow and markets will also be looking ahead to comments from Fed Chair Powell on Thursday and the OPEC+ meeting on output on the same day.

Biggest mover – AUDJPY (+0.69% as of 09:30 GMT)

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.