Trading was consolidative and quiet Tuesday as the markets took stock of recent activity. A lack of fresh catalysts also limited action. There was some late jostling in stocks after Texas announced it is opening up the state economy 100% and removing the mask mandate. The US Government suggested that vaccinations could be rolled out quicker than initially expected and the Fed’s Brainard indicated that volatility in bond markets could further delay the turnaround on asset purchases. Stock markets moved broadly higher, leaving the JPN225 and ASX up 0.5% and 0.8% respectively at the close, while the Hang Seng and CSI 300 are currently posting gains of 2.2% and 1.6% respectively. GER30 and UK100 futures are up 0.5% and 0.6% respectively and US futures are also broadly higher, with a 0.8% rise in the USA100 leading the way. Vaccine optimism and the push back from central bankers against the rise in yields has helped to stabilise sentiment and ease concern over cliff edge scenarios on growth.

Optimism on the outlook remains very supportive, especially with more vaccines on the way and another big stimulus injection on the horizon. Recent data are supporting that point of view with many revising up Q1 and 2021 growth projections. Treasuries have stabilized too which has helped calm jitters regarding the bearish impacts on stocks from rising rates, and worries inflation pressures will pick up and cause the FOMC to pullback accommodation sooner than expected.

Forex Market

EUR – close to its 20-day moving average at 1.2085.

GBP – ranging at 1.3850-1.4000.

JPY – at 106.86, retesting 107.00 for a 3rd day in a row.

AUD – reversed nearly 40% of last week’s dip.

CAD – down to 1.2616 from 1.2730.

GOLD – declines further below 50-day EMA, and 8-month Support.

USOil – edged up to $60.10 per barrel, amid growing conviction that the OPEC+ alliance is poised to agree an increase in output this week.

Today: Calendar includes final readings for Eurozone and UK services PMIs for February, which are expected to confirm levels in contraction territory as the sector remains depressed by virus measures. UK Chancellor Sunak will present his budget proposal today, with reports already out indicating that furlough measures will be extended until September, although the Chancellor also seems eager to find ways to finance crisis measures. Also on tap are the ISM Services for February for the US along with ADP employment data.

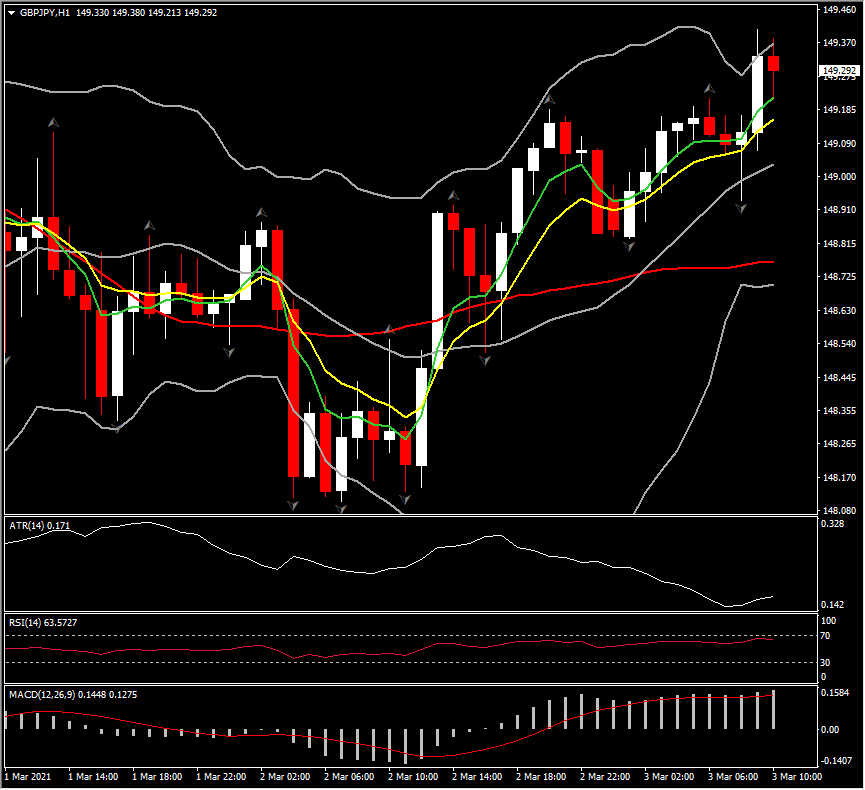

Biggest mover – GBPJPY (+0.37% as of 07:30 GMT)

Click here to access the our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.