Market News Today – USD slips – Core inflation missed (0.1%) and 10-yr auction was filled at 1.52%, better than expected. DOW closed at new ATH (+1.46%; 32,297) – Nasdaq flat – Stimulus bill passed – $1400 check to those on less than $75K and extra $300/week for unemployed. BOC – no change until “inflation objective is sustainably achieved”. Asia (China & SK rallied over 1.5%), Nikkei +0.6%. Huge Oil inventory build (13.8m vs 3.0m) shrugged off – tests $65 again.

The USDIndex has posted a six-day low at 91.68, extending the retreat from the 15-week high that was seen on Tuesday at 92.50. EURUSD concurrently lifted to a five-day high at 1.1947. Cable edged out a one-week high at 1.3954. The Australian and New Zealand Dollars saw the biggest magnitude of gains against the Greenback. AUDUSD hit a one-week peak at 0.7779. USDCAD pegged a two-day low at 1.2590.

A second principal theme in the currency market today has been yen underperformance. USDJPY, despite the broader softness in the Dollar, rose to an intraday peak at 108.81, extending a rebound from yesterday’s low at 108.33. EURJPY and AUDJPY posted two-week highs, while GBPJPY hit a fresh 35-month high and CADJPY came within 10 pips of the 28-month high that was seen earlier in the week. The Yen is registering as the weakest of the main currencies on the year so far. BoJ Governor Kuroda said last week that the yield curve needs to remain “stably low,” though said policy will be assessed at the upcoming March policy review. The rootedness of JGB yields, with the 10-year yield being pinned near to 0% under the yield curve control policy, has seen differentials versus other sovereign yields tip markedly out of the currency’s favour this year.

Today – ECB policy announcement, US JOLTS & Weekly claims, OPEC MOMR & US 30-year bonds.

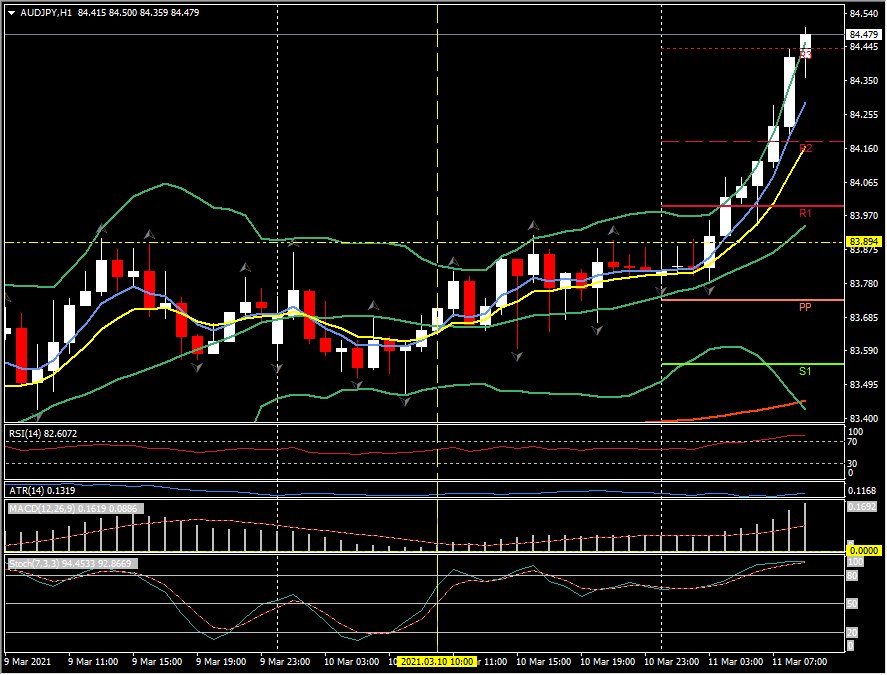

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (+0.71%) Big move from 83.50 lows yesterday, over 84.00 today and R3 at 84.45. Faster MAs aligned and higher, RSI 82.6 OB but still rising, MACD histogram & signal line aligned higher but looking stretched. Stochs 92 and OB from breaking 84.00 earlier. H1 ATR 0.1320, Daily ATR 0.9125.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.