Market News Today – The USD dips and then finds a bid. Stimulus Bill signed by Biden – targets July 4 as “normalcy”. Stocks closed higher (Nasdaq +2.5%), Weekly Claims close to November low (712k), 30-yr auction filled at 2.3%, again better than feared. ECB will quicken asset purchases but not increase them. Overnight Asian markets firmer; Nikkei +1.73%. German CPI inline and UK data dump biased to the upside.

Against this backdrop, the USDIndex reversed most of yesterday’s declines in posting a high at 91.81, up from the eight-day low at 91.36. EURUSD concurrently ebbed to a low at 1.1935, down from yesterday’s eight-day high at 1.1990. Cable dipped back to the mid 1.3900s after briefly lifting above 1.4000 for the first time since Thursday last week, despite UK yields rising by a similar magnitude to US yields.

USDJPY has been the biggest beneficiary of the firmer dollar, with the pair rising by over 0.6% today in posting a high at 109.17, which is 8 pips shy of the nine-month high that was seen earlier in the week. Yen crosses gained, with many hitting new major trend highs. EURJPY posted a 25-month high, while GBPJPY clawed out a new 25-month peak, and CADJPY a 28-month high, for instance. The rootedness of JGB yields has lately been seeing differentials has tipped marked out of the yen’s favour. The risk of further lurching spikes in Treasury yields are high with fiscal stimulus about to start being unleashed and as the US economy reopens. One argument is that the shear size of the stimulus, at 9% of GDP, dwarfs the output gap, which is near 3%. And note, the does not include the infrastructure bill that the Democrats are working on, which is likely to be vast — Goldman Sachs is anticipating it to be at least $2 tln, and potentially double that (over a 10-year period). Also, assuming Covid vaccinations allow reopening of hard-hit sectors, the prevailing deficiency on the supply-side of the economy should start to evaporate. Such as scenario would be bullish of the Dollar, although raising the possibility of eventual overheating.

Today – US PPI, Canadian jobs report, UoM Consumer Sentiment & Inflation expectations.

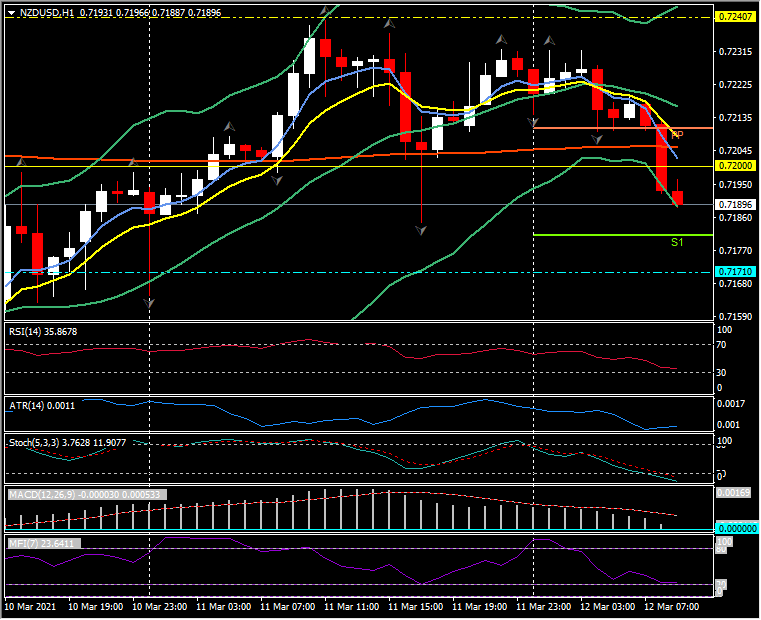

Biggest (FX) Mover @ (07:30 GMT) NZDUSD (+0.46%) Moved lower this morning from 0.7230 and then breached 200MA & PP at 0.7200. S1 at 0.7171. Faster MAs aligned lower, RSI 36.7 and falling, MACD histogram & signal line aligned lower, histogram testing 0 line. Stochs OS and still falling, MFI testing OS zone. H1 ATR 0.0011, Daily ATR 0.0090.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.