The markets were rather quiet to start the week, especially relative to the big swings seen in much of this year. The advent of the FOMC meeting and the release of new quarterly forecasts limited action. Longer dated Treasuries managed modest gains, however, even as stocks were slightly higher much of the day. Yields still declined overnight, as investors hope for reassurance from the Fed on the policy outlook this week. Yields tumbled in Australia and New Zealand with local markets recovering yesterday’s sharp losses.

Bargain hunting and short covering helped push yields a little lower after last week’s market erosion saw 10- and 30-year rates extend the late February selloff and hit the highest levels in more than a year. The Fed is also expected to maintain its dovish posture. The Fed view, the stability in Treasuries, and the downtick in rates were supportive for Wall Street.

Headlines:

- The USA100 led the rally in stocks with a late charge to finish with a 1.05% gain above the 200-DMA and a 9-day high. Both the USA500 and the USA30 rose 0.65% and 0.53% respectively, to new all-time highs of 3,968 and 32,953.

- Optimism about the recovery helped to lift US markets to record highs with travel operators among those supported by re-opening expectations.

- There are lingering concerns of a further push back against internet companies in China and a reduction in stimulus as economic data suggests strong demand.

- In Europe Bonds remained supported by the dovish legacy of last week’s ECB stance while renewed concerns over the virus reappeared as more countries suspended the Astra-Zeneca vaccine.

- Italy went into tighter lockdowns, with rising pressure in France and Germany to tighten restrictions or delay re-openings ahead of what is usually a busy Easter holiday travel period.

- BoE Governor Bailey told the BBC that the recent rise in yields is “consistent” with “the change in the economic outlook,” which will be taken as an endorsement of the rising trend in long rates and refinancing costs.

- The Sydney Morning Herald and The Age were told in the first interview of a senior Biden official media that “We have made clear that the US is not prepared to improve relations in a bilateral and separate context at the same time that a close and dear ally is being subjected to a form of economic coercion.”

Forex Market

USDIndex – retests 92

JPY – as USD rallies again – USDJPY over 109.00

EUR – dropped against a largely stronger Dollar- currently at 1.1938 – but within 2-day range.

GBP – dips for a 3rd day – Currently at 1.3831

AUD – dipped below 20- and 50-DMA again, at 0.7725

CAD –turned to yesterday’s high at 1.2694

GOLD – advanced in Asia season due to a retreat in the Treasury yields, risk-off mood but currently retreats gains with a pullback to 1726 area

USOil – has dropped back to $64.79 per barrel – but still close to 13-month highs as the prospect of economic normalisation and curbs on supply pushed prices higher

Bitcoin – returns to 53.8K after record highs at 60.7K

Today: Today’s local data calendar focuses on German ZEW investor confidence, which is expected to reflect the improved sentiment in global equity markets. In the US, Retail Sales will dominate the attention. The sentiment remains tepid amid covid vaccine concerns and pre-FOMC meeting cautious trading.

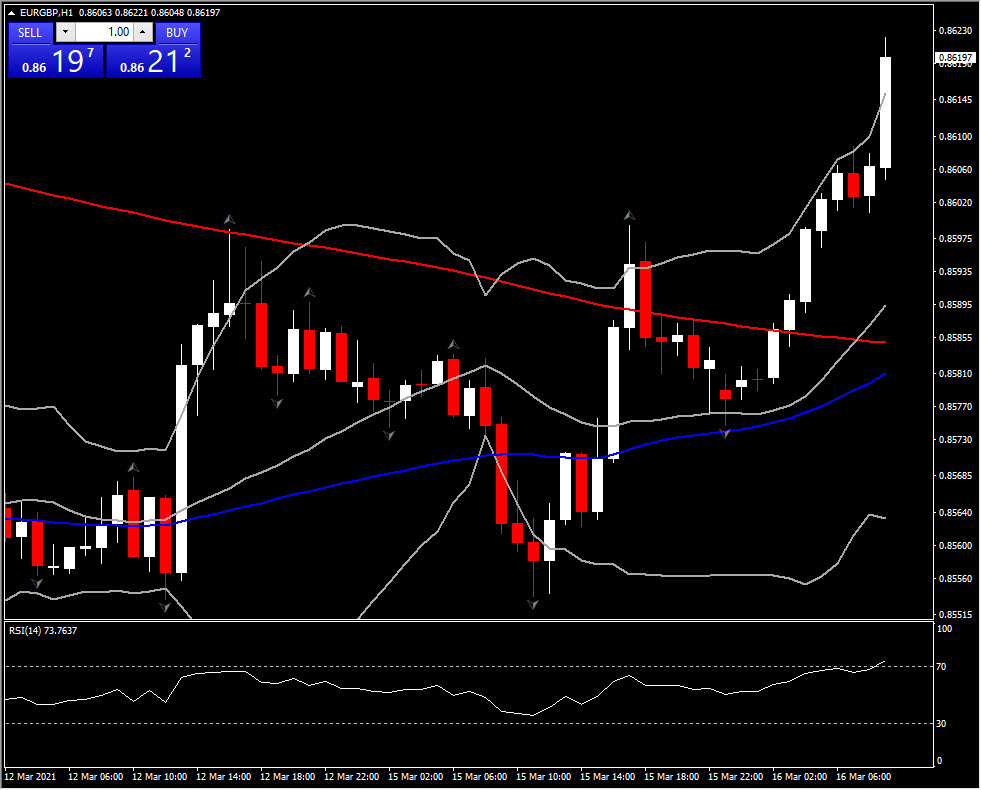

Biggest mover – EURGBP (+0.66% as of 07:30 GMT) – Retests the 20-DMA after posting a high at 0.8622. Overall remains in a downwards trajectory with long-term momentum still bearish. Intraday meanwhile rally extends above R2. H1 ATR is at 0.00074 and Daily ATR 0.00499.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.