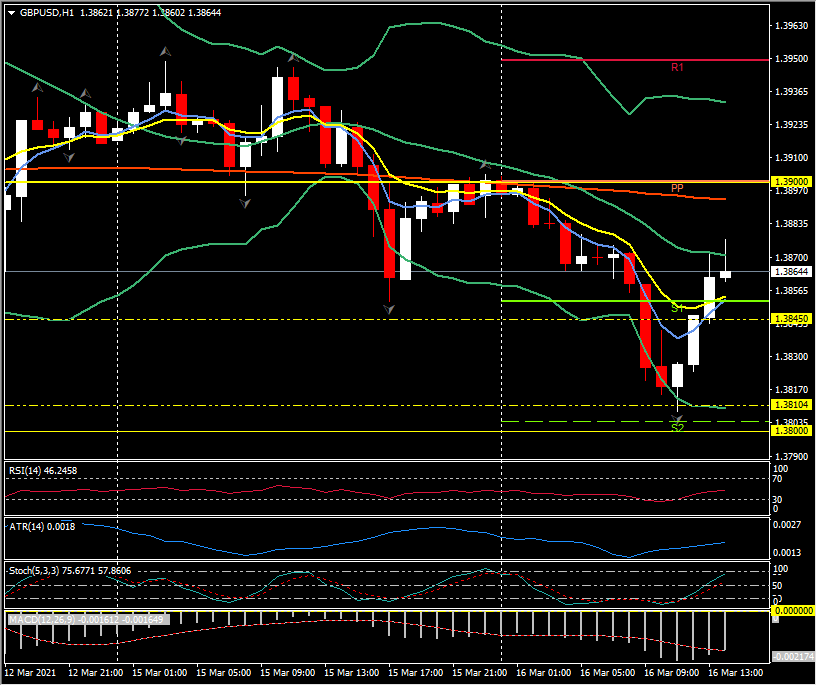

GBPUSD, H1

Currencies have mostly been trading with stability amid a benign backdrop of buoyant stock markets and softer yields as markets anticipate dovish guidance from the Fed and tomorrow’s conclusion of the FOMC meeting, which begins later today. This is despite the $1.9 tln fiscal stimulus which is being implemented on top of a better than anticipated economic rebound, though the Fed, looking beyond the upcoming burst of inflation caused by base effects on the year-on-year price comparison, will point to spare capacity in the labour market.

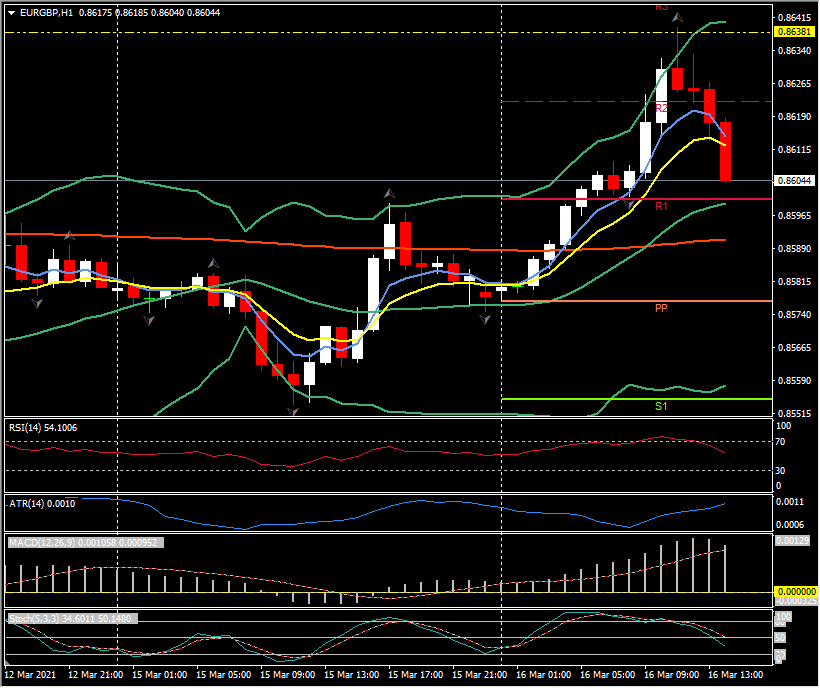

One side-theme of note today has been pound weakness, with Cable pushing nearly 0.5% lower in pegging a one-week low at 1.3807 and EURGBP rising by a similar magnitude in posting an eight-day high at 0.8636. This came after BoE Governor Bailey said that inflation will remain below the 2% target threshold even after the expected jump due to year-on-year base effects and economic reopening. Bailey also affirmed that the central bank will continue with its QE program for the remainder of 2021. The 10-year gilt yield nudged under 0.790% in the wake of his remarks.

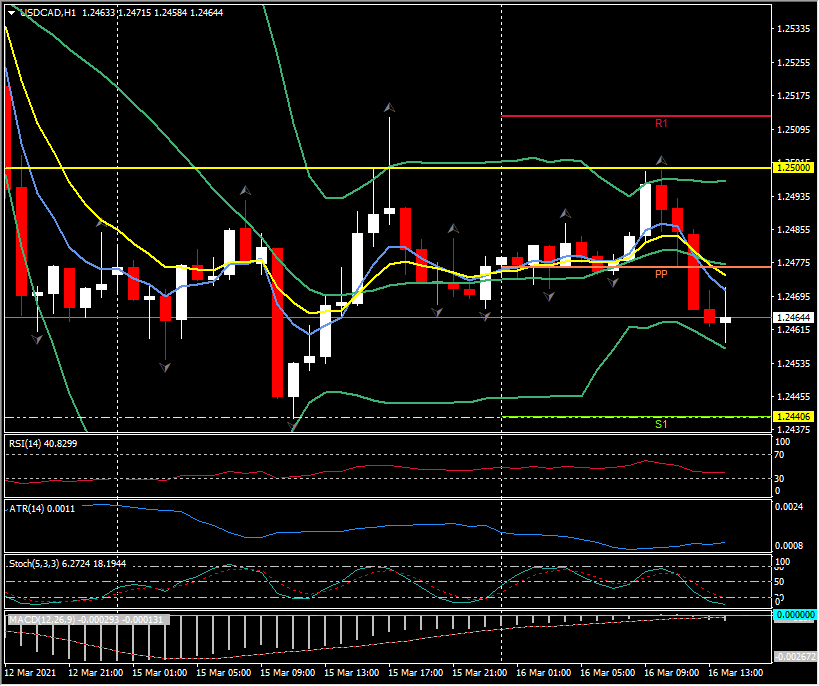

Elsewhere, both EURUSD and USDJPY traded in narrow ranges, respectively above and below their recent lows and highs. AUDUSD drifted lower, though remained above Monday’s low. USDCAD lifted, but remained below yesterday’s rebound high, which was seen after a 37-month low was clocked at 1.2441. The pair had been weighed on by Friday’s strong employment report out of Canada, which sparked a narrowing in the US over Canadian yield differential. A drop in oil prices subsequently countervailed this by weakening the Loonie.

In other news today, BoJ Governor Kuroda said there was no need to change the yield curve control framework, and that it was vital to keep the yield curve low and stable. The Japanese central bank reviews policy later this week, announcing on Friday. US President Biden said that he would not improve relations with China until Beijing ceases its economic coercion of Australia. A renewed rise in Covid cases is being seen in much of Europe, outside the UK, which is being driven, somewhat ironically, by the highly transmissible UK variant. Goldman Sachs are forecasting the 10-year T-note yield to rise to 2%, remarking that this will be digestible for equity markets, but first 1.75% needs to be breached; currently it’s exchanging hands below 1.60% at 1.593%.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.