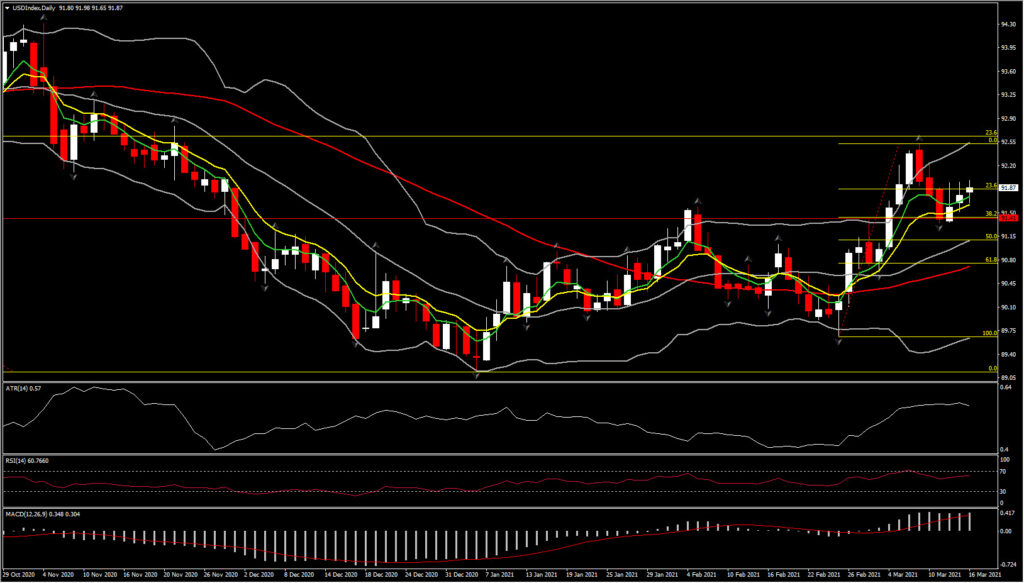

Currencies have been trading with stability amid a benign backdrop of buoyant stock markets and softer yields as markets anticipate policymakers to provide assurances this week, as Fed, BoJ and BoE will all have an opportunity to further address the run-up in yields. All three banks will maintain current commitments to extraordinary accommodation for quite some time longer as they express confidence that building inflation pressures can be kept under control amid building confidence in the recovery. The markets will look mainly to the Fed after the ECB announced last week it will step up the pace of asset purchases, sending a clear signal that the Bank will step in should reflation trades push yields up too high too quickly.

The FOMC, however, is highly unlikely to alter its QE buying to try to cap rates. Powell has indicated the Fed is worried about disorderly markets. The Fed is expected to sound more optimistic on the outlook, but still note downside risks. This is despite the $1.9 tln fiscal stimulus, which is being implemented on top of a better than anticipated economic rebound, though the Fed, looking beyond the upcoming burst of inflation caused by base effects on the year-on-year price comparison, will point to spare capacity in the labour market.

As for the Fed, while no changes to the policy stance are expected, there will be a lot of interest in the new economic projections, including the dot plot. It is universally expected that the Fed will keep the rate stance steady at 0% to 0.25% and is widely expected to maintain the $120 bln per month in asset purchases. The Fed Chair has largely shot down expectations for a shift, noting that the Fed is concerned with disorderly markets and not the increase in longer dated Treasury yields. The Fed’s ability to remain sidelined was boosted by the ECB’s surprise action after the Bank announced last week that it will “significantly” step up its asset purchases to help steady rate markets and cap the upside. Central banks have been jawboning to try to prevent a tightening of financial conditions, especially after the February 25 spike in the 10- and 30-year Treasury rates that sent global shockwaves. But now the ECB is actively engaged. With the ECB doing the heavy lifting, Powell could maintain his wait-and-see posture, even as the 10- and 30-year yields jumped last week to respective highs of 1.64% and 2.40%.

Be on alert for the Fed to give a more upbeat assessment on growth given current conditions which would normally pressure Treasury yields higher. However, the Fed will again emphasize the downside risks, stressing that there is still a long row to hoe before accommodation is removed. And of course policymakers will add that they will remain accommodative until their goals are met. On inflation, Powell will again acknowledge upside risks but stress they are temporary and largely due to base effects. That is the message sent by ECB’s Lagarde too. She also warned of a spike in prices and said she will “see through” any increase because the medium term outlook is subdued.

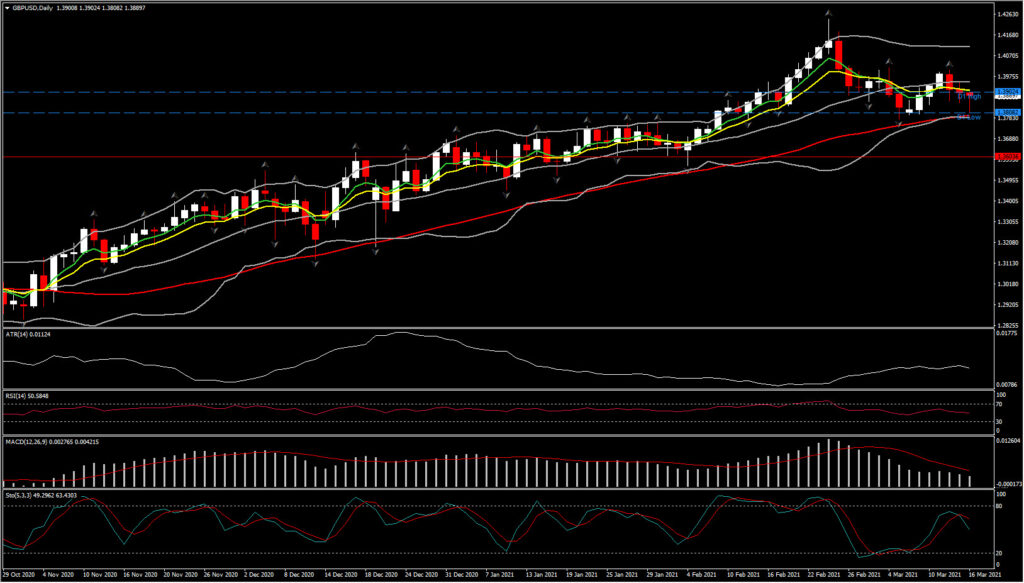

Next is BOE, with the March BoE Monetary Policy Committee meeting on Thursday. The ‘Old Lady’ is widely anticipated to leave policy unchanged by unanimous vote at the nine-member committee, which will leave the repo rate at its historic low of 0.10% and the QE total at GBP 875 bln. Some focus will be on the statement and minutes, though these aren’t likely to be too interesting so soon after revising its quarterly forecasts last month. Nonetheless, it will be interesting to see policymakers take on the transition afoot in markets — the spike in Gilt and global sovereign yields and the tumble and rotation in global stock markets. Most likely the guidance will be sanguine given the basis of improving global growth prospects and the effective Covid vaccination program in the UK, juxtaposed to the level of spare capacity in the domestic economy.

The Pound, which is registering as the strongest of the main currencies on the year so far, is likely to retain an upward bias. The UK stock market is relatively densely packed with cyclical stocks, at least compared to the main US indices, with the UK100 dominated by financials, oil and gas companies, and miners. Cyclical stocks are widely expected to outperform tech stocks during the recovery-from-pandemic trade, which is inspiring a “great rotation” in portfolios. Less than 2% of stocks in the UK100 are tech stocks, compared to nearly 28% in the USA500.

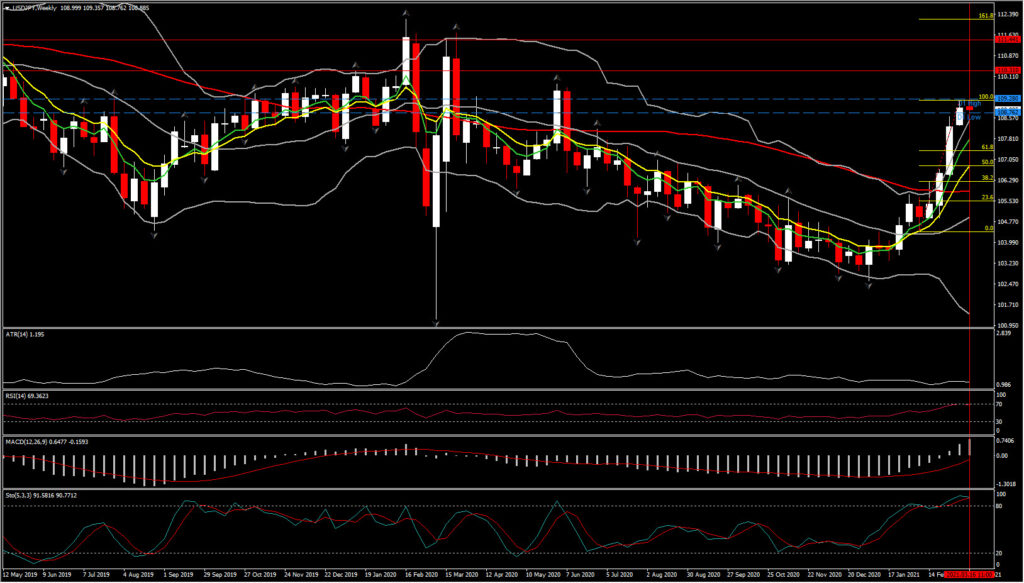

The very last spotlight of the week is the BoJ meeting (Thursday, Friday). No policy changes are expected, with the rate expected to be maintained at -0.1%. However, there could be some modest tweaks for a more flexible approach to the yield curve control policy after the recent policy review. That said, in the news today but also last week as well, BoJ Governor Kuroda said there was no need to change the yield curve control framework, and that it was vital to keep the yield curve low and stable. Hence the central bank is under pressure to expand the target rage in its yield curve control program, and may announce a phasing out of numerical targeting

Overall, the Yen is likely to remain on an overall weakening bias amid a backdrop of ascending global equity markets. USDJPY printed a fresh 9-month high at 109.36. Yen crosses remained underpinned, with EURJPY and CADJPY, for instance, posting fresh major trend highs on Monday. The rootedness of JGB yields has lately been seeing differentials tipped markedly out of the yen’s favour. The Yen is registering as the weakest of the main currencies on the year so far.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.