Action remains mixed and subdued ahead of today’ s FOMC results.

The Treasury yield has lifted 1.2 bp to 1.63% as markets position for the FOMC announcement, which will take centre stage today. Markets are preparing for a less dovish tone against the background of a rapidly proceeding vaccination program and the prospect of a swift re-opening of the economy. In Europe the BoE is set to announce its policy decision tomorrow and while Governor Bailey is expected to offer some reassurance on policy, he seemed pretty sanguine on the trend higher in yields in comments from Monday. In the Eurozone meanwhile investors saw little evidence that the ECB has actually stepped up asset purchases in Monday’s data and seem to be testing the central bank’s resolve to keep spreads in.

Headlines:

- Slow progress of the vaccination program is adding pressure to the sentiment, as the temporary suspension of the AstraZeneca vaccine clearly isn’t helping. Officials may feel they have the need to act on even the slightest suspicion of problems, but the move could well backfire and play into the hands of the anti-vaccine movement, rather than offering reassurance that officials are keeping to very strict health guidelines.

- Australia (Queensland state) reports 4 severe reactions to AstraZeneca vaccination.

- Stock markets traded within a narrow range ahead of the FOMC. – GER30 and UK100 futures are currently down -0.06% and -0.04%, with US futures also marginally lower.

- A sharp narrowing in Japan’s trade surplus thanks to a slump in exports underpinned JGBs and saw the JPN225 close with a -0.2% loss.

- Reports of supply shortages from companies such as Samsung and Honda added to the cautious tone in stock markets.

- US Secretary of State Antony Blinken has released a report identifying 24 China and Hong Kong officials whose actions have reduced Hong Kong’s autonomy.

- Japan will raise tariffs on US beef imports for 30 days.

- Iran enriching uranium with new advanced machine type at underground plant – IAEA.

Forex Market

JPY – lifted to 109.20, unable to break 4-day resistance.

EUR – 4th day dropped currently at 1.1892.

GBP – steadied to 1.3877-1.3930 area.

AUD – steadied to low 0.77 area.

CAD & USOil –fell to a fresh three year low at 1.2437 even as WTI crude oil gyrated between $64 and $65 after pulling back from $66.38 yesterday.

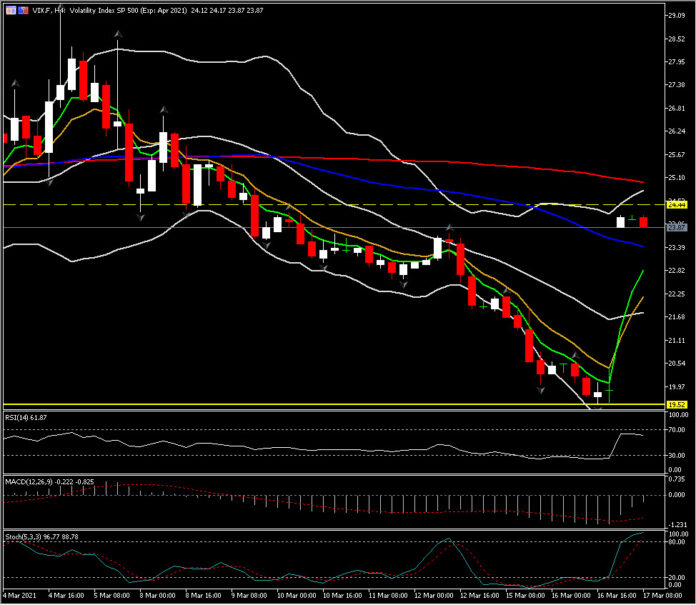

VIX – Appreciated by more than 20% in the open, just a breath below 20-day SMA.

Today: Today’s data calendar is pretty quiet, with only the final reading for Eurozone February inflation. The Fed concludes its meeting today and announces its decision and releases its quarterly forecasts at 18:00 GMT.

FOMC preview: The meeting will be followed by Fed Chair Powell’s press conference at 14:30 ET. The focus will be on the new views on the recovery and of course policy as reflected in the SEP and dot plot. The statement should show an improved outlook on the economy, but a still cautious stance on the labor market. Look for reiteration that inflation continues to run below target. In his press conference Chair Powell will acknowledge the run up in prices but will again say it’s expected to be a transitory blip. We suspect he will try to discourage worries that the run up in yields will initiate the start to tapering sooner than later. Remember the Fed has indicated it will begin trimming QE before it begins boosting rates. So it could be a difficult dance if the dots show more rate hikes in 2022 than the 1 from December as the markets would quickly price in Fed action for later this year.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.