The market cheered as Fed Chair Powell assured that there would not be a pre-emptive tightening. Yields pulled back from session highs initially, leaving modest gains on the longer dated issues and pulling short and medium term yields underwater. Fed Powell stressed that the Fed will clearly telegraph to the markets before it begins to taper QE purchases. Wall Street rallied.

For bonds the initial relief over the FOMC’s assurances on the rate outlook was short lived and Treasury yields started to move higher again, with bonds across Asia also under pressure as the optimistic economic outlook for the US economy revived reflation trades.

Headlines:

- The increasingly optimistic growth outlook for the US contrasts with concerns that the much slower vaccine rollout in the EU will delay the recovery in the Eurozone. GER30 is up 0.8%, versus a 0.4% rise in the UK100.

- Fresh reports that the Bank of Japan is considering widening the trading range around the 10-year target added to pressure on JGBs as the BoJ starts its 2-day meeting.

- Australian shares dragged down by technology and healthcare stocks.

- An economic contraction in the final quarter of 2020 sent New Zealand’s benchmark index to its biggest drop in two weeks. GDP at -1% q/q for Q4.

- The JPN225 was up 1.01% at the close and the Topix managed to clear the 2000 mark for the first time since 1991.

- Australia Feb. employment change +88.7K (vs expected +30K) & unemployment rate 5.8% (vs expected 6.3%).

- A high-level diplomatic meeting taking place today, in Alaska between China and the US; China has outlined its hopes for an easing of tensions as a result of the meeting but also expressed low expectations.

Forex Market

JPY – spiked to 109.29 ahead of EU open.

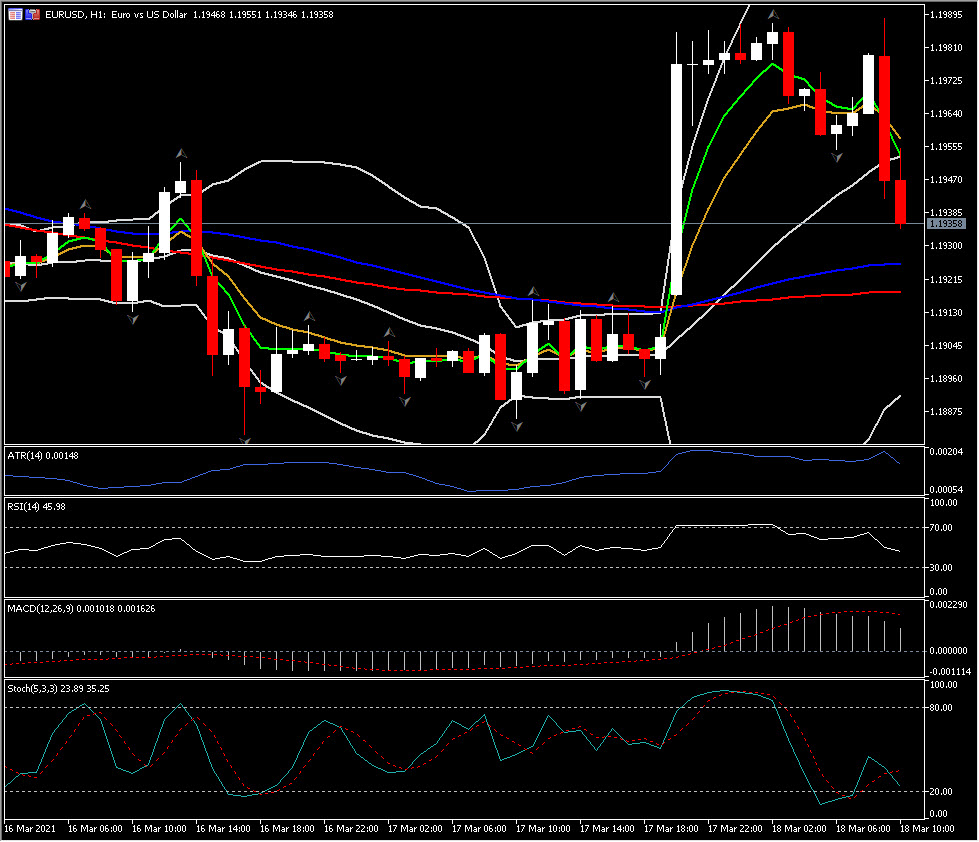

EUR – pulled back to 1.1948 from 1.1988 highs.

GBP – lifted to 1.3993 as the focus turns to the BoE, which is also expected to signal a strengthened growth outlook, while keeping policy settings stable.

AUD – steadied close to 20-day SMA.

CAD – dropped sharply as Powell removed lingering fears that the Fed would begin to remove accommodation before 2023, leaving the pair at 1.2365 from 1.2490 ahead of the announcement.

USOil –drops for 5th straight day after US inventories rise. The EIA inventory data showed a 2.4 mln bbl rise in crude stocks.

Gold – rose 0.35% to $1,755.47 per ounce by 01:19 GMT, as the Fed’s pledge to keep rates low and worries about inflation pushed up the precious metals. But currently lower on stronger Dollar.

Today: The focus turns to the BoE, which is also expected to signal a strengthened growth outlook, while keeping policy settings stable. The calendar also includes Eurozone trade numbers as well as comments from ECB President Lagarde.

BoE Preview: The bank is widely anticipated to leave policy unchanged by unanimous vote at the nine-member committee meeting, which will leave the repo rate at its historic low of 0.10% and the QE total at GBP 875 bln. Some focus will be on the statement and minutes, though these aren’t likely to be too interesting so soon after last month revising its quarterly forecasts. Nonetheless, it will be interesting to see the policymakers’ take on the transition afoot in markets — the spike in Gilt and global sovereign yields and the tumble and rotation in global stock markets. Most likely the guidance will be sanguine given the basis of improving global growth prospects, and the effective Covid vaccination program in the UK, juxtaposed to the level of spare capacity in the domestic economy.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.