Bond bears took the FOMC’s message to heart and were big sellers on the day, driving yields sharply higher. Though the long end generally led the weakness, the entire curve was under pressure. Treasury yields dropped -1.7 bp overnight to now 1.69%, but JGB rates lifted 1.4 bp to 0.111%, after a mixed bag of BoJ decisions that included a widening of the band around the yield targets and a scrapping of the ETF buying schedule within an unchanged buying ceiling.

The FOMC’s optimistic view on the economy and the pledge to keep policy supportive for now rekindled reflation trades yesterday and the BoE also did little to push back against the trend higher in yields. ECB’s Lagarde meanwhile did her best to support peripheral markets with dovish comments in the PM, but it will also be the ECB’s stepped up purchase schedule that is helping to keep Eurozone spreads in as the recovery is still looking shaky.

Headlines:

- The BoJ’s purchases focus is set to shift away from the JPN225 to the wider Topix, which saw Topix rising 0.2%, while the JPN225 dropped 1.4%.

- Hang Seng and CSI 300 declined -2.0% and -2.7% respectively, as the start of top level talks between China and the US was anything but harmonious.

- There are fears that Australia would suffer the fallout from fresh US-China tensions; the ASX corrected -0.6%.

- GER30 and UK100 futures are down -0.8% and -1.0% respectively this morning, after a broad sell off across Asia.

- German PPI inflation jumped to 1.9% y/y from 0.9% y/y in the previous month. The headline rate was actually fractionally lower than expected.

- US: Blow-out Philly Fed report (the index jumped to the highest since 1973), and a disappointing jobless claims release.

- The high-level diplomatic meeting continues in Alaska between China and the US; China has outlined its hopes for an easing of tensions as a result of the meeting but also expressed low expectations.

Forex Market

JPY – dropped back to 108.70, amid a largely stronger Yen.

EUR – pulled back to 1.1901.

GBP – lifted to 1.3955 on dollar strength. The Pound continues to register as the strongest of the main currencies on the year so far, reflecting both a paring in the Brexit discount and UK’s world leading vaccination program (with nearly 40% of the population having now received at least one dose of a vaccine, only Israel and the UAE are ahead).

AUD – under pressure, at 0.7850 highs.

CAD – dropped to 1.2461.

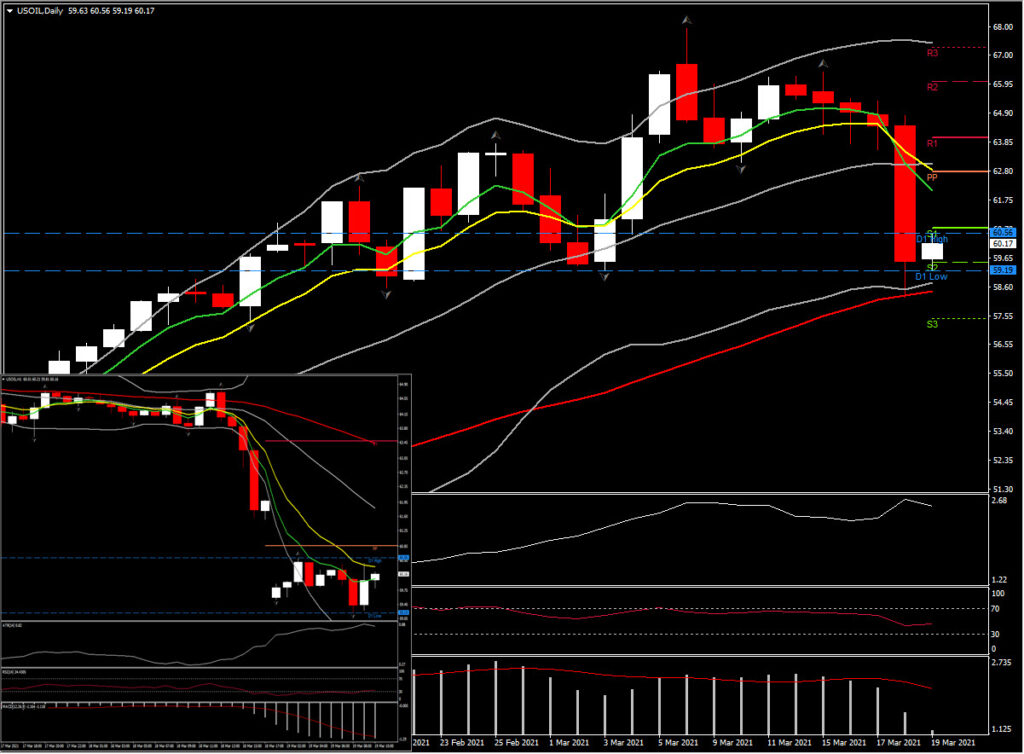

USOil – at $59.30 as oil prices are heading for the biggest weekly drop since September.

Gold – 3-day range, within the 1717-1755 area.

Today: There is little on the calendar in Europe and the US, which will leave markets to digest the impact of this week’s round of central bank decisions, while watching the difficult US-China meeting that didn’t get off to a harmonious start.

Biggest movers this week are USOIL and Palladium, with USOIL at $58.20 as oil prices are heading for the biggest weekly drop since September and Palladium at $2,755 on disruptions in supply along with expectations of more demand from the automobile sector.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.