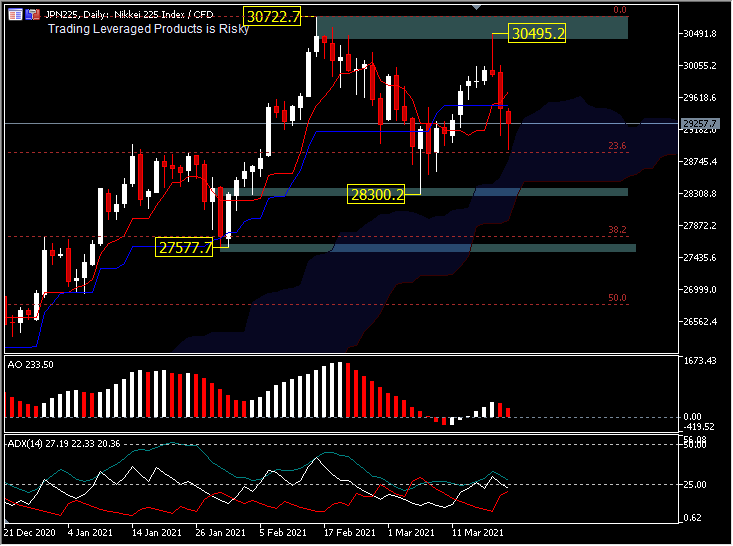

The Tokyo Stock Price Index, more commonly known as the Topix, together with the JPN225, is an important stock market index for the Tokyo Stock Exchange in Japan, which contains all shares of Japanese companies in the first section of the Tokyo Stock Exchange.

JPN225 trades sharply lower today, down -2.07% for 4 days in a row, as the sell-off continued after the BoJ decided to exclude Nikkei-related shares from its explicit target on ETF purchases. At the same time the Topix also traded down -1.09% yesterday. The Yen traded slightly higher, followed by the Dollar and Swiss Franc. However, yields differentials are likely to keep the Yen under pressure going forward, despite the BoJ last week widening the target band of its yield curve control mechanism.

JPN225 trades sharply lower today, down -2.07% for 4 days in a row, as the sell-off continued after the BoJ decided to exclude Nikkei-related shares from its explicit target on ETF purchases. At the same time the Topix also traded down -1.09% yesterday. The Yen traded slightly higher, followed by the Dollar and Swiss Franc. However, yields differentials are likely to keep the Yen under pressure going forward, despite the BoJ last week widening the target band of its yield curve control mechanism.

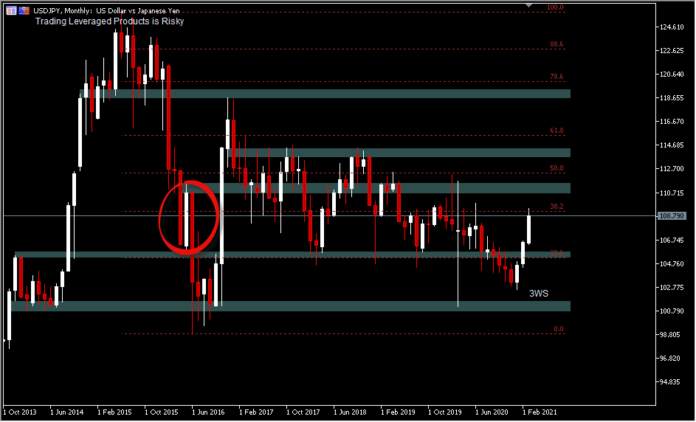

BoJ Governor Kuroda said last week that there was no need to change the yield curve control framework, and that it was vital to keep the yield curve low and stable. At the same time there will be a new facility to step in decisively if the yield strays outside the now wider band. At the same time, the ETF buying target was scrapped, while the overall ceiling was left in place. That gives the central bank more flexibility on the running purchase schedule and the bank said the maximum ETF buys will be about 1.2B yen per business day. As stated earlier, the bank shifted the focus of its stock buying program from the JPN225 to the broader Topix index. ETF purchases are also an important part of the yield curve control, which will guide YCC to avoid the impact of the stock price. Currently, central banks are not considering selling holdings of ETFs or stopping their buying at all. Governor Kuroda also stressed the need to maintain the inflation target of 2% which has become a global standard, as the inflation target also helps stabilize currencies among major economies.

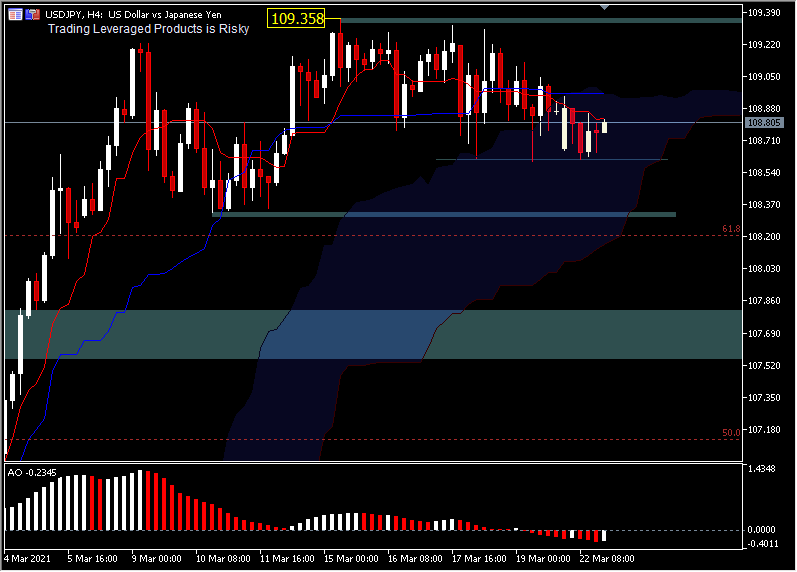

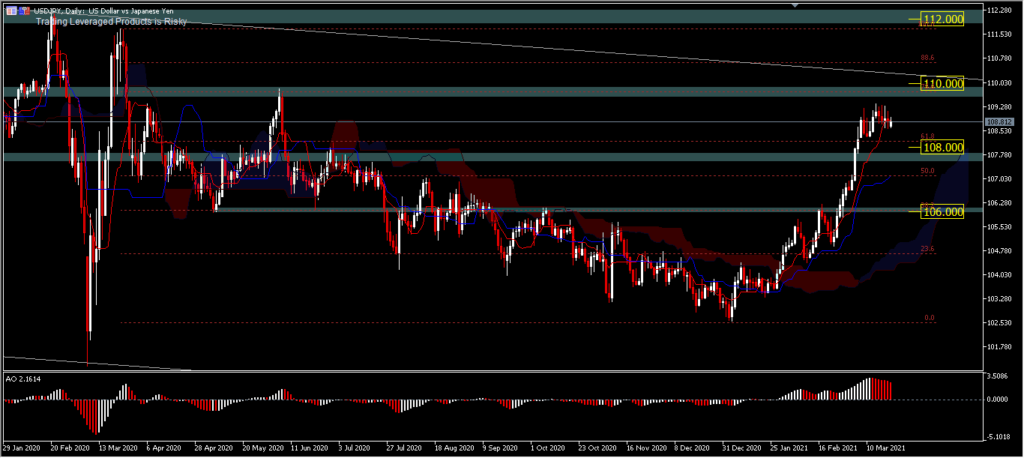

Meanwhile the USDJPY currency pair is still trading in a narrow range, below 109.00. The Resistance level is at 109.84, while the recent highs are still at 109.35, around 49 pips away. Technically, the price is still controlled by the buyers, after a number of hedge funds that have ramped up bearish bets on the Yen to the highest level in a year, due to the ongoing projected growth as well as the increase in global yields and vaccinations.

Meanwhile the USDJPY currency pair is still trading in a narrow range, below 109.00. The Resistance level is at 109.84, while the recent highs are still at 109.35, around 49 pips away. Technically, the price is still controlled by the buyers, after a number of hedge funds that have ramped up bearish bets on the Yen to the highest level in a year, due to the ongoing projected growth as well as the increase in global yields and vaccinations.

It’s the 3rd week that the asset is ranging below 109.35. Minor support is at last week’s low at 108.60, which in case of a break will target the weekly consolidation low of 108.33 as the low boundary. A break of this level will implicate a deeper correction. Technically, this shows that the price structure is overlapping, suggesting that the consolidation is likely to continue as long as the resistance holds, but on the positive side if the price moves above 109.35 then the rally that has started since the beginning of the year is likely to continue.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.