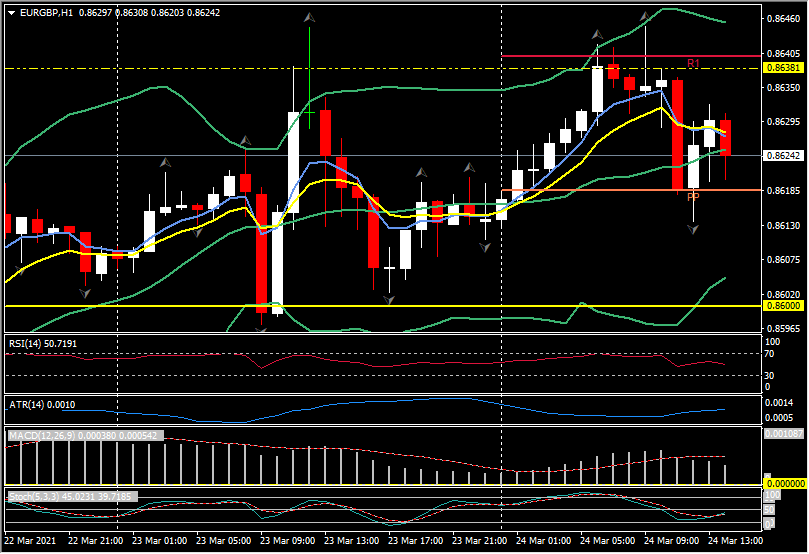

EURGBP, H1

Preliminary March UK PMI survey data came in much stronger than expected, with the headline composite reading rising to a seven-month high of 56.6, up from 49.6 in February. The median forecast had been for a much more modest improvement, to 50.6. The manufacturing PMI headline came in at a 40-month high at 57.9, improving from 55.1 in the month prior. The services PMI rose to a seven-month high at 56.8, advancing sharply from 49.5, with the sector expanding again after four consecutive months of contraction. This is the first month since last September that both the manufacturing and services sectors have seen a rise in new orders.

A rebound in sales into easing lockdown measures, which has come on the back of a so-far successful and rapid Covid vaccination program, has driven the improvement. Consumer confidence increased and the survey highlighted a surge in demand for residential property services. It is also notable that service sector activity overtook manufacturing sector activity for the first time in the pandemic era, and the survey also evidenced the release of pent-up demand, with businesses rebuilding capacity in response to rising consumer demand.

The data showed the first increase in staffing numbers in the private economy since February 2020, with the rate of job creation at the highest in almost two years. Optimism about the 12 months ahead rose for a third consecutive month, and stood at the highest level seen since the index began in July 2012. Input costs spiked by the most in over four years, which was accompanied by the highest rate of output charge inflation in over three years.

Earlier Eurozone Composite PMI was also back in expansion territory, with the overall reading lifting to an 8-month high of 52.5 from 48.8 in the previous month. The breakdown still reflects a two-speed recovery, with the manufacturing sector leading the way. The Manufacturing Output PMI as well as the general Manufacturing PMI were at record highs in March with readings of 63.0 and 57.9 respectively. The Services PMI remained in contraction territory at 48.8, but this was up from 45.7 in the previous month and indeed a 7-month high. Germany reported the first expansion of activity for six months, which ties in with the cautious re-opening of activity in March, although given that the government already signalled an extended “quiet period” over Easter as case numbers rise, the risk of a set-back is high. The manufacturing sector meanwhile is bursting at the seams, with the backlog of orders now rising again, particularly in Germany. The developments are also good news for the labour market, with Markit reporting that manufacturers saw headcounts rise at a rate not seen since August 2018 and that the services sector reported the largest rise in employment since the start of the pandemic.

Overall a very good report, that suggests the first quarter of the year was less weak than feared and that even in the services sector things are starting to look a bit better. In the very short term there may be a setback, but with the EU procurement scheme ensuring that vaccines are pretty evenly distributed across the EU/EEA area, even if national rollouts differ, the area remains set to bounce back in the second half of the year.

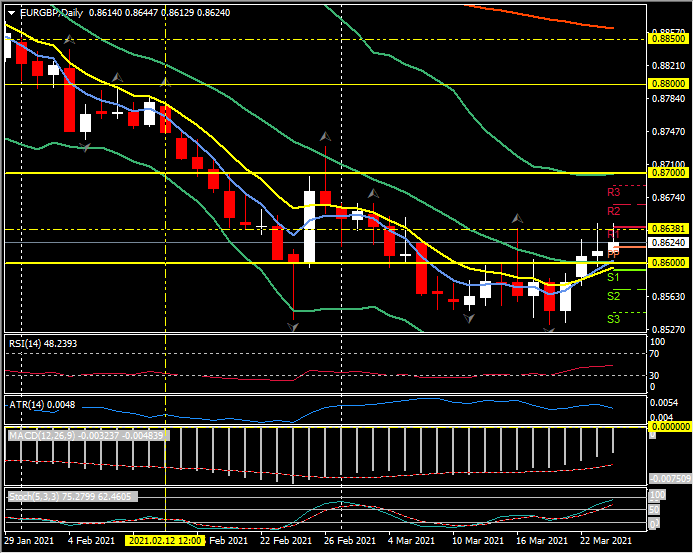

EURGBP spiked to 0.8645 earlier following the surprisingly weak UK CPI data, subsequently retraced to under today’s pivot point at 0.8617, before settling over 0.8620. The 20-day moving average at 0.8600 is the key support level in the higher timeframes, with immediate resistance at 0.8700 and the upper Bollinger Band.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.