Market News Today – US Equities closed flat, USD (2-week lows) and 10-yr yields cool further. JPY sees new financial year bid, EUR, GBP also flat – CAD & AUD crosses weaker. USOil remains under $60.00, Gold holds at $1735. EU unemployment rose unsurprisingly & US JOLTS (job moves and openings) are at 2 yr highs. EU-US disparity continues. Overnight – Asian markets touch 3-week highs – Nikkei also closed flat – Samsung Q1 profits up 45%. European FUTs also flat. India reported record 115,000 virus cases, AZ pause testing vaccine on children and EU talk of 60% of popn. offered vaccine by June.

Week Ahead – RBA (6th) UK, EU & US PMIs & FOMC Minutes (7th), ECB Minutes, Weekly Claims & Powell speech (8th), CAD Jobs & US PPI (9th).

The Dollar has posted fresh lows, which put the USDIndex at a 15-day low at 92.23. The forex market appears to have been somewhat wrong-footed by a pronounced decline in Treasury yields. Inflation worries have been fading a bit, at least for now, as Fed policymakers continue to stress they do not see any problem with price pressures for the foreseeable future. The Fed has also assured it will not hike rates pre-emptively, needing to see real evidence that their goals are being met before acting. At the same time there has been a sputtering phase in US stock markets after the bellwether US indices scaled to record highs on Monday, which has induced a safe haven bid for Treasuries. Investors are digesting prospects for higher corporate taxes linked to President Biden’s $2 bln infrastructure plan, which analysts at GS reckon would trim 9% of earnings per share for companies listed in the S&P 500. The 10-year Treasury yield has pressed below 1.640%, down by around 8 bp from yesterday’s high.

This backdrop has fostered a reversal of recent themes in the currency market, aside from the correction in the Dollar, with the Yen and Euro, currencies that have lately been found in the underperforming lane more often than not, having rebounded notably over the last couple of days. EURUSD has pegged a 15-day high at 1.1883, setting up the pair for what might be its second down week out of the last seven. USDJPY has dropped to a nine-day low at 109.58, setting up what could be the pair’s second down week out of the last six.

The biggest movers out of the main currencies we monitor have been EURCAD and CADJPY. The Canadian Dollar, which has been amongst the strongest currencies on the year so far, being a principal winner in the reflation trade due to its correlation with oil prices, had been looking due for a correction, with the oil price rally having lost traction in recent weeks. This has lifted USDCAD to eight-day highs above 1.2600, despite the prevailing broader weakness in the Greenback. The Pound has also found itself in the underperforming lane, with EURGBP, most notably, having rebounded quite sharply after the cross printed a 14-month low on Monday. Despite the prevailing losses, the UK currency still remains one of the strongest performing currencies when measured from the start of the year.

Today – EZ, UK & US final services & composite PMIs, ECB asset purchases & bi-monthly PEPP summary, DoEs, FOMC minutes, Fed’s Evans, Kaplan, Barkin.

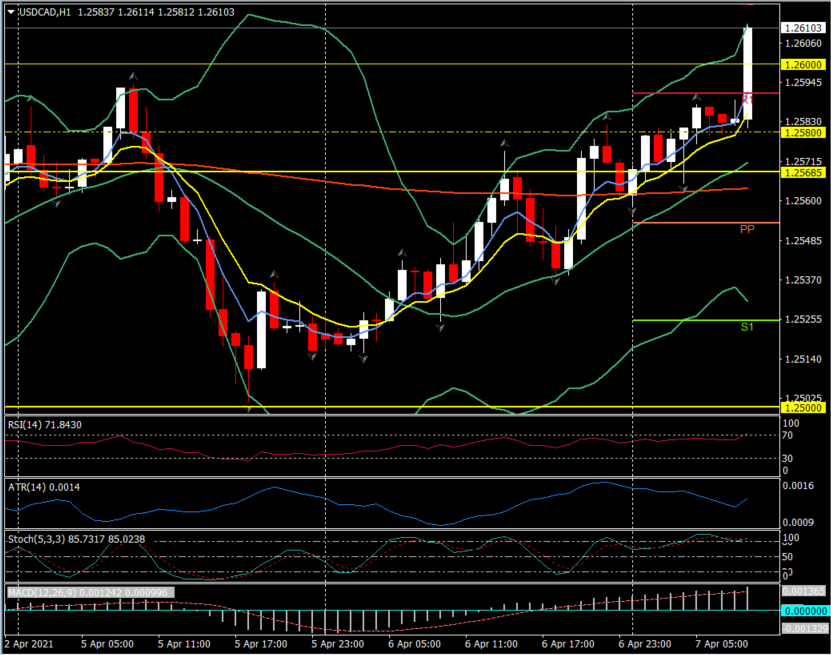

Biggest (FX) Mover @ (07:30 GMT) USDCAD (+0.36%) rallied from test of 1.2500 on Monday to close at 1.2580 yesterday and breach 1.2600 and R2 now. R3 1.2635. MAs remain aligned higher, RSI 71 and in OB zone but still rising, MACD histogram & signal line aligned higher and over 0 line from midday yesterday. Stochs in OB zone but also still rising. H1 ATR 0.0014, Daily ATR 0.0070.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.