Market News Today – Investors position for key US inflation data later in the day. The start of the earnings season and reflation trades weighed on Wall Street yesterday and while there were pockets of strength in some markets overnight, GER30 and UK100 futures as well as US equity futures are little changed and mostly fractionally lower. The USA100 fell -0.36%, and the USA30 was off -0.16%, while the USA500 was off -0.02%. China’s official rates dropped after export growth missed expectations, even as they jumped 30.6%. Import growth meanwhile surged to 38.1%, which meant the trade surplus narrowed sharply. Stock markets traded mixed, across Asia.

In FX markets, the USD was supported as yields ticked up and EURUSD corrected to 1.189, GBPUSD was little changed at 1.3743, but the GBP managed to nudge higher against most other currencies after non-essential shops finally re-opened yesterday and pubs welcomed punters in outdoor settings. After weeks of a very strict lockdown in the UK, the vaccination program will now be put to the test as restrictions are gradually lifted. The AUD and NZD drifted lower on Tuesday as caution in global markets outweighed upbeat economic news and a solid sale of new Aussie government bonds. The Yen weakened, leaving USDJPY at 109.70. USOIL meanwhile is trading at USD 59.91 per barrel. Bitcoin traded higher at $61,274. Gold held up well against the USD.

Today – UK data at the start of the session showed monthly GDP improving 0.4%, slightly less than hoped, but with the January number revised higher, the 3-month trend was less negative than feared. Next we have the ZEW and US inflation, with the latter being the highlight of the day.

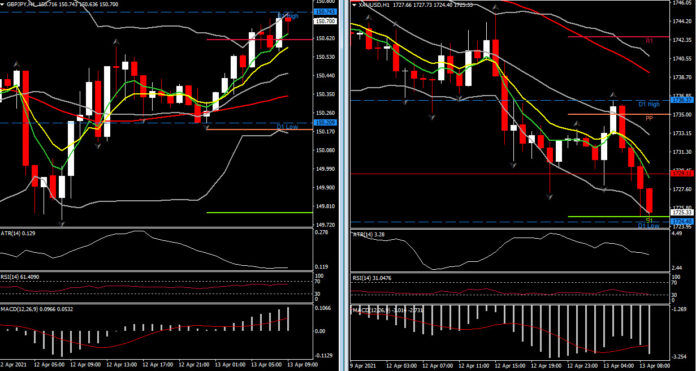

Biggest (FX) Mover – (GBPJPY at 07:30 GMT +0.32% & XAUUSD -0.44%) – Gold drifted to the 1724 area, breaking the 20-DMA and returning more than 38.2% of the latest up leg, while GBPJPY was boosted to Friday’s highs. Even though the overall outlook remains negative, intraday, fast MAs aligned higher, and MACD and RSI are pointing northwards above neutral zone. Next Resistance is at 151.00, while ATR (H1) is at 0.129.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.