The markets largely tracked global trends with gains in risk appetite weighing on bonds. More signs of rising price pressures also lifted yields. There weren’t any new drivers to provide strong direction. Investors continued to monitor the pandemic, with more waves of infections and new variants, along with more difficulties with vaccine rollouts, although optimism on the recovery remains. But weakness in tech and cannabis weighed through the US afternoon, with renewed worries over the virus and difficult vaccine rollouts for AstraZeneca and J&J in Europe and the US leaving a cautious tone.

Inflation is a major focal point as well, with data showing the spikes forewarned by the Fed. It’s the start of earnings season and it’s expected to be a blowout, as suggested by the JPMorgan and Goldman Sachs results. There were no new insights from Fed Chair Powell’s interview or in the Beige Book. The trade price data were stronger than expected but that was the risk.

Australia unemployment fell back to 5.6%, from 5.7% in the previous month. Employment jumped by 70.7K in March, more than double Bloomberg consensus expectations. German HICP inflation confirmed at 2.0% y/y, in line with the preliminary report, but the overall Eurozone number is clearly lower and the German rate alone won’t prompt a rethink at the ECB.

In FX markets, Coinbase’s IPO was successful, with the newly minted stock soaring over 50% from its opening debut of $250.00/share. EURUSD is little changed at 1.1974 moving sideways, Yen stuck at the 108.70-109.00 area while Cable dropped back to 1.3770. AUD and NZD sustain yesterday’s peaks. USOIL has romped up to near 1-month highs of $63.31, decisively breaking out of its near month long, well-worn trading band. Gold edged higher on weak USD, and currently is at R1 1745.50.

Today – Today’s expected round of final inflation data for Germany, France and Italy will likely also be bond negative. Investors await US weekly jobless claims and March retail sales data for further clarity on the recovery in the world’s largest economy.

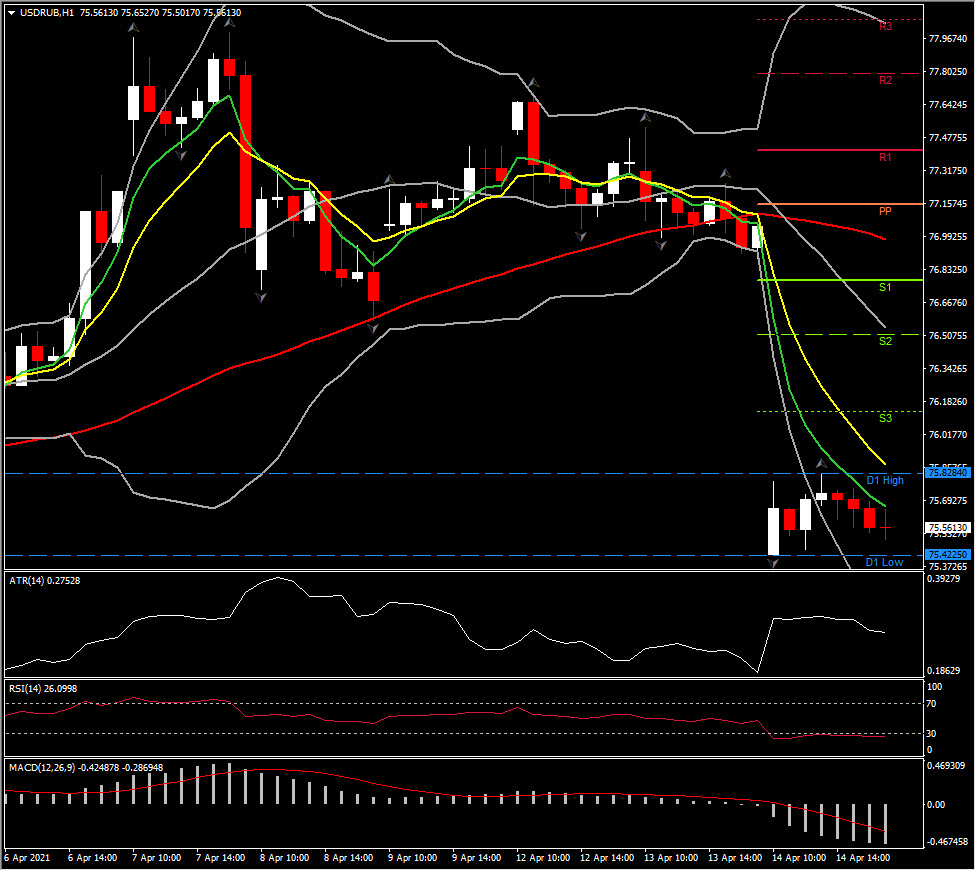

Biggest (FX) Mover – (USDRUB@ 07:30 GMT -1.84%) The Russian Rouble sank on reports the US will announce sanctions on Russia as soon as today for alleged election interference and malicious cyber activity. The asset drifted to 2-week lows, gapping down to 75.42 (below 20-DMA). ATR (H1) at 0.27528 and ATR (Daily) at 0.83564.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.