International Business Machines Corporation (IBM), the US digital technology company that manufactures and sells computer hardware and software, is scheduled to report first-quarter earnings this year today, Monday, April 19, 2021. The full-year Zacks Consensus Estimate for IBM calls for $11.15 per share in revenue and revenues of $74.35 billion. These results will represent a year-over-year change of +28.6% and +1%, respectively. Zacks provides a #3 (hold) rating for IBM at this time. The company’s first-quarter results are likely to reflect healthy improvements in the company’s hybrid cloud, mobile, analytics, cognitive technology and AI-related solutions.

In a previous report, Chairman and chief executive officer of IBM, Arvind Krishna, said IBM made progress in 2020 by developing a hybrid cloud platform as the basis for the digital transformation of IBM clients while facing the broader uncertainty of the macro environment, but focus on hybrid cloud and AI will survive and give confidence that revenue growth in 2021 will be achieved. IBM has also been working to increase the effectiveness of its quantum computing systems and blockchain offerings.

In the most recent quarterly report, GAAP EPS from continuing operations was $1.41 with Operating EPS (non-GAAP) of $2.07; EPS includes a pre-tax cost impact of more than $2.0 billion for structural measures in the fourth quarter. Revenues were $20.4 billion, down 6%. Total cloud revenue was $7.5 billion, up 10%.

Red Hat’s revenue was up 19%. GAAP’s gross profit margin was 51.7%, up 70 basis points; Operating gross profit margin (non-GAAP) was 52.5%, up 70 basis points and Debt decreased by $3.9 billion since the end of the third quarter.

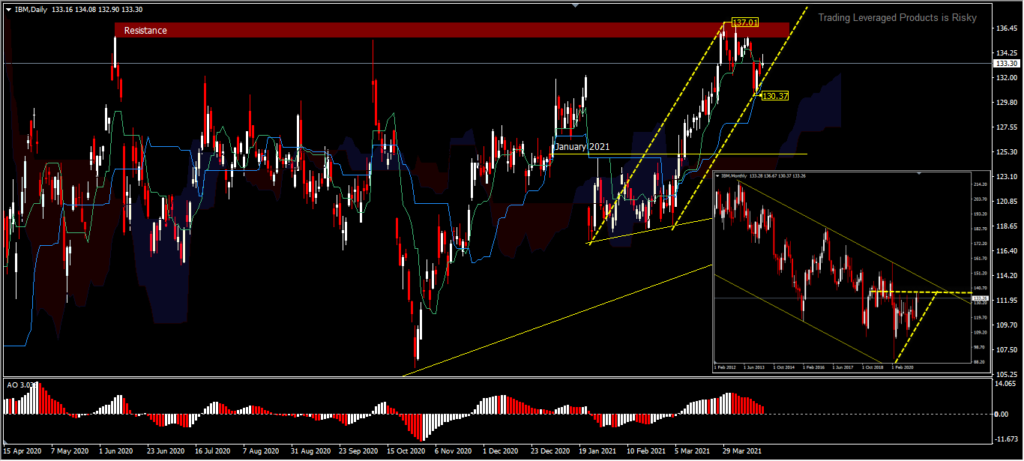

IBM, Daily

On an annual basis, IBM’s share price is still on a downward path 8 years after recording a peak price of 215.88 in 2013. This is of course exacerbated by the hit of the pandemic which sent IBM’s share prices to 90.48 to match the low prices of a decade ago by losing over 50% of the price. Although price recovery has occurred since the second quarter of 2020, the recovery of losses is still slow compared to its peers. At the beginning of 2021, prices also corrected again by 3.8% and the growth in February 2021 until today has not been able to reverse the decline in February-March 2020. The price position at the time of writing was at 133.30, still below the peak of 137.01 in March this year. Even though in the Daily chart display, it is still following the upward path, the price has lost its rally momentum in the past 3 weeks.

The surprise earnings report will likely bring prices stronger to test the 137.01 resistance and the less encouraging earnings reports will send prices to test 130.37 or the 127.87 support. However, the limited economic activity caused by the pandemic and a decline in global IT spending may have hampered business prospects in the first quarter for IBM.

Click here to access our Economic Calendar

Ady Phangestu

Market Analysts – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.