Wall Street will be looking for the positives from Chevron as it approaches its earnings report date scheduled for April 30, 2021, before the market opens. The company is expected to report EPS of $0.92, down 29.46% from the previous year’s quarter. The latest consensus estimate forecasts quarterly revenue of $30.9 billion, down 1.91% from a year ago period. This earnings report is for the fiscal quarter ending March 2021. According to analysts at Zacks Investment Research, the EPS forecast for Q121 is $0.92. The reported EPS for the same quarter last year was $1.29.

On an annual basis the Zacks consensus forecast shows an estimated revenue of $ 5.20 / share and a revenue of $ 127.4 billion. This total will mark a change of + 2700% and + 34.54% from the previous year, respectively. The Zacks Consensus Estimate EPS has moved 2.69% higher in the past month. CVX holds the # 1 Zacks Rating (Strong Buy) for now.

The strong correlation between Chevron and oil prices will tell a special story in this report. Over the past decade the price of oil per barrel has hovered below $ 100 during 2011-2021 with a peak price of $114.80 in May 2011 and a low point of $6.46 in April 2020, but averaged oil prices are playing back in the middle, above $60.00 per barrel, while over the same decade the CVX share price average fluctuated around $100 – $110 with a record high of $135.08 and a low of $51.57. Energy stocks including a consistent long-term profitable shareholder, Berkshire Hathaway Inc, owns 2.52% of Chevron. Strong balance sheet, consistent dividends and diversified company earnings become an important factor for shareholders.

Chevron Corporation is an American multinational energy company. A company with a long history, which began when a group of explorers and traders founded Pacific Coast Oil Co. on September 10, 1879 and is currently active in more than 180 countries. Chevron Corporation is one of the leading integrated oil and gas companies in the United States. Sustained higher oil and gas prices are likely to have a big advantage in this earnings report. But that was in the past, now the recovery has taken place with an abundance of liquidity from massive stimuli to prop up the economy.

In addition, Chevron decided to explore an alliance to develop hydrogen because it is considered an environmentally friendly transportation fuel option for green energy. When burned, hydrogen emits no greenhouse gases, which trigger global warming and destroy nature. In particular, it can be delivered by pipeline and is relatively easy to store compared to other renewables such as solar and wind.

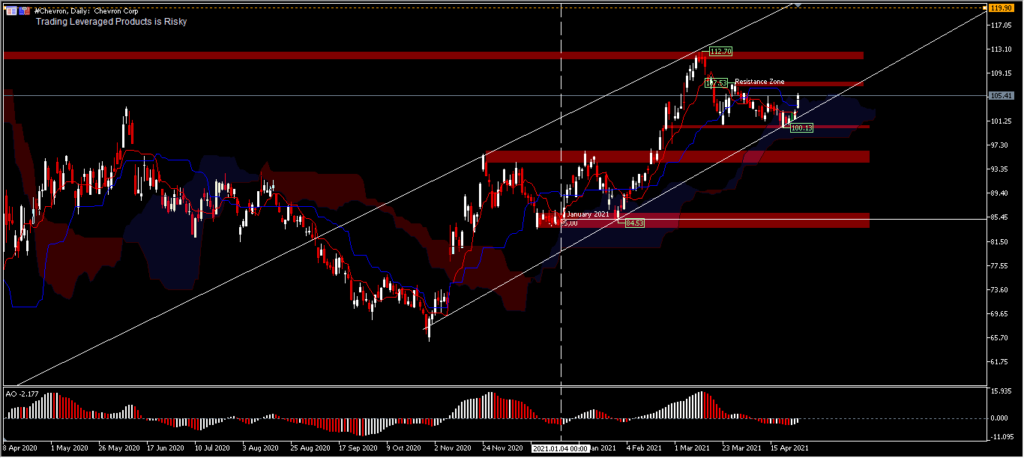

Chevron, D1.

The share price has been growing during Q121 by + 23.5% to date and posted a peak of $112.68 last March. Growth appears very moderate, amidst increasingly improving economic support and demand for energy needs. Even though it hasn’t fully recovered to match 2020 prices which topped $122.66, the recovery has already hit +/- 80%. And technical bias is likely to provide more favorable prospects up front. Prices appear to be trying to level the $107.53 minor resistance with the prospect of a rally to $112.70 . Price support is at $100.00 which is price psychology, a move below this price level will implicate a short-term correction for $96.30. However, the overall outlook is still bullish.

Ady Phangestu

Analyst – HF Indonesia

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.