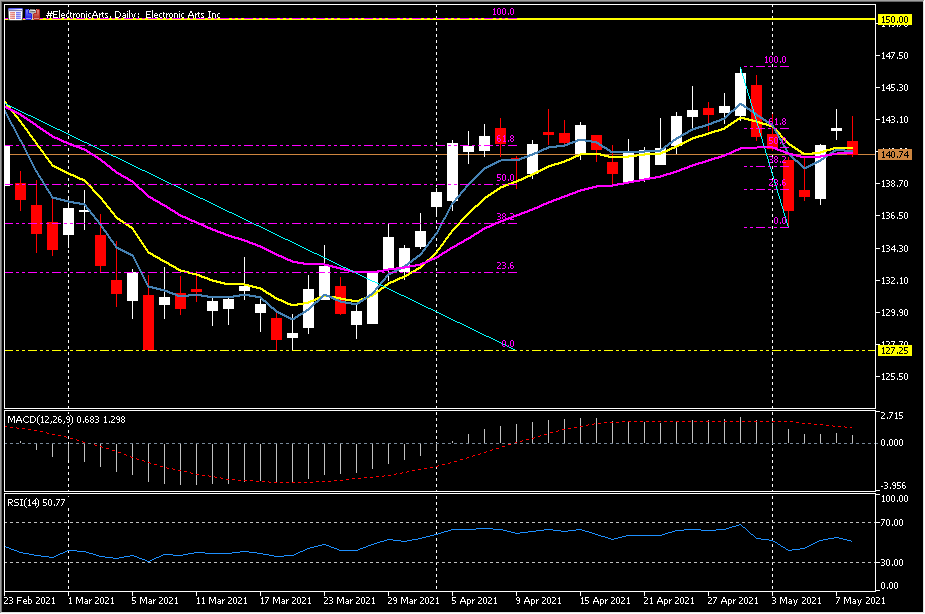

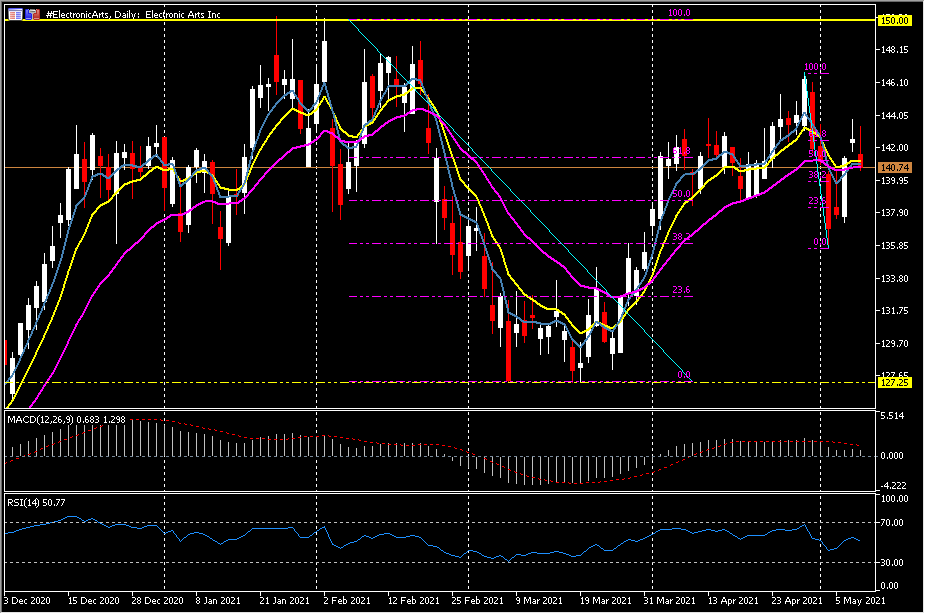

EA, Daily & Weekly

Electronic Arts (EA), the world’s largest video game publisher, home of the SIMS, FIFA and many, many more popular and critically-acclaimed titles, posts Q4 Earnings today, May 11th. Following a blowout year driven by lockdowns and stay at home situations due to the global pandemic, as the lockdowns ease and economies open up how will the numbers be affected? The recent rally in the stock from lows of $127.25 in mid-March to highs of $146.70 at the end of April has cooled to $140.75 yesterday (May 10) ahead of the earnings report and below a key support level.

Consensus for Q4 is for earnings per share to come in at $1.05, which represents a year-over-year decline of over 3% from the $1.08 per share seen in the same quarter a year ago. Revenues are expected to be $1.39 billion, however, there are some wide variations from the consensus view. Zacks research wrote “For the fourth quarter of fiscal 2021, EA expects GAAP revenues of $1.317 billion, cost of revenues to be $302 million, and operating expenses of $837 million. EA anticipates a loss per share of 7 cents for the fourth quarter. Net bookings are expected to be $1.375 billion, which indicates an increase of $75 million over the prior guidance. For fiscal 2021, EA expects revenues of $5.6 billion, cost of revenues to be $1.477 billion, and earnings per share of $2.54.”1 Alternatively, Earnings Whisper have a much better EPS at $1.19 on the consensus $1.39 billion revenue call and expect earnings to grow by an average of 19.1% per year for the next 3 years.²

It’s been a rollercoaster few years for EA investors and shareholders. Over the last five-years the company’s share price has accrued some 89% (but underperformed the overall market) but over the last twelve months the gain has been 22%, more in line with overall market performance. Over half a decade, EA managed to grow its earnings per share at 14% a year. That makes the EPS growth particularly close to the yearly share price growth of 14%. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.³

However, there are some warnings for future growth, as Simply Wall Street4 have pointed out; profit margins are expected to be significantly below last year’s blowout (52.6%) at 20.8% and there has been significant selling by institutions and other insiders in the last 3-months. Of the 33 analysts on Wall Street 22 have a Buy or Strong Buy recommendation with the remaining 11 placing a Hold on the stock. Average target prices sit at $161.00, with the low at $135.00 and the high at $177.00. Jefferies were the latest to publish a note on the company, (April 23) upgrading their position to Buy from Hold and lifting their target price to $165.00 from $145.00.

The EA share price has had a volatile few months; January and February highs at the psychological $150.00 were short lived and soon rejected, a decline in February and March found support above $125.00 at $127.25, then there was a rally in April but this stalled before month end (April 29) following the completion of the purchase of Glu Mobile. The deal was reached in February and under its terms, EA agreed to acquire Glu Mobile in an all-cash deal for $2.1 billion in enterprise value.♠

Technically, the 62.8 Fib level of the February to March decline and the 50.0 Fib level of the post Glu Mobile purchase decline (April 29 – May 4) both coincide around $141.35, making this a key pivot point moving forward. Initial resistance is Friday’s (May 7) inter-day high at $143.80, the April 29 high at $146.70 and then the psychological $150.00 round number. The all-time high for the stock was in July 2018 at $151.20. Support sits at $135.70 (the low for May), $132.55 (the 23.6 Fib level of the February-March decline) and then $127.25 (the March low).

¹https://uk.finance.yahoo.com/news/earnings-watch-next-week-marriott-071123228.html

²https://www.earningswhispers.com/stocks/ea

³https://finance.yahoo.com/news/had-bought-electronic-arts-nasdaq-091829095.html

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.