Broadening and strengthening of the US recovery (the headline miss in the jobs report notwithstanding), expectations of better days ahead in the Eurozone, and faith that vaccines will win the day in pandemic hotspots provided another round of support for equity markets overall. Confidence is growing that the global economy is turning the corner to stronger growth, even as infections still surge in some regions. However traction gained this week regarding the concerns around inflation, drifting the stocks into a sell off. The Stock market sell off is intensifying currently as tech stocks in particular continue to be pressured by inflation fears and a -1.3% decline in the USA100 future suggests that the sell off is not over yet. The USA100 already lost -2.6% yesterday.

While fundamentals have taken a front seat to a lot of exogenous events, there will be plenty of data ahead to digest that will give an early view of 2021 activity. While attention in the markets has shifted to data and fundamentals, this week’s earnings reports will be in focus as well as the schedule of earnings is again very busy, with Alibaba, Commerzbank and Toyota due to report tomorrow, while there will be Walt Disney on Thursday as well.

Alibaba, billionaire Jack Ma’s ecommerce group, is one of the biggest companies reporting this week, with market capitalization of $609.6 billion. The company will present its earnings before the market open on Thursday, 13th May. Ahead of the report however there is a lot of scepticism and dark clouds around the company as it was recently fined $2.8 billion by the Chinese regulator for abusing its market position for years. Since the fine the company has been under intense scrutiny, stating that they do not expect any material impact from the antitrust crackdown in China that will push it to overhaul how it deals with merchants.

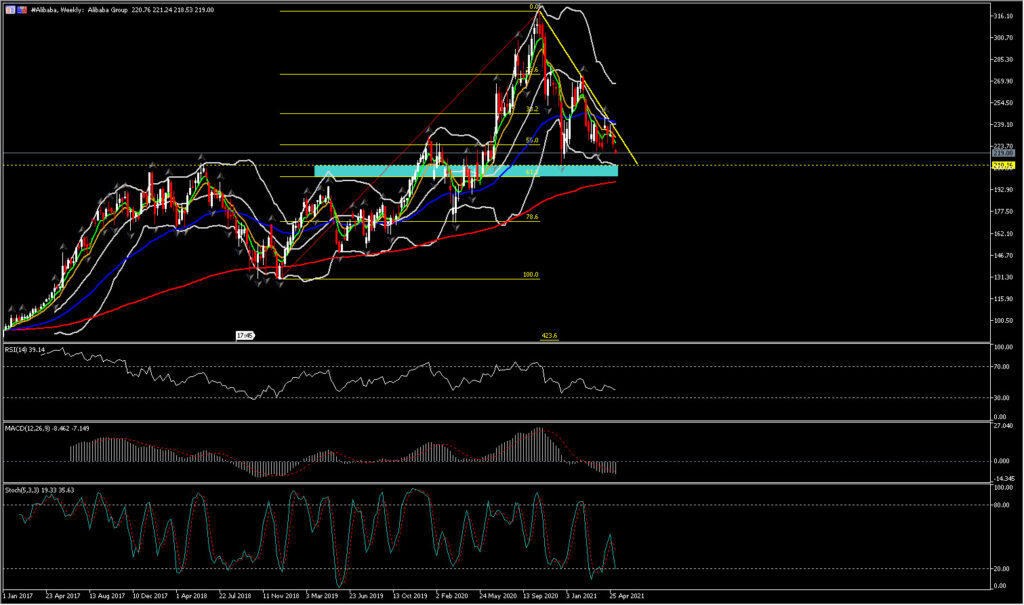

On top of the regulatory risks and whether they will affect Alibaba’s financial growth in the future, what keeps investors sceptical in the near term is the stock’s performance as its shares have remained close to the 1-year support, i.e. 210.15, which was seen as a key resistance area the past 4 years. That said, Alibaba’s stock hasn’t seen the same strong stock performance during the pandemic era as many of its e-commerce rivals, even though it leads 2/3 of the Chinese ecommerce market.

On the bright side, as reported by Zack’s Equity Research, Alibaba’s strong efforts to add value to consumers and sellers through the consumer segment, product enrichment and platform innovations are expected to have driven growth in its ecommerce business in the to-be-reported quarter by driving its customer momentum. Hence eyes will be on the figures on Thursday for the company’s fast-growing cloud computing division as well as any new business initiatives and the outlook for the full year’s financial figures, as the pandemic remains beneficial for all ecommerce giants and the world’s largest search engine due to the extended and repeated lockdowns worldwide.

According to Zacks Investment Research, the report for the fiscal Quarter ending March 2021 is expected to experience a near quarter rally of its Earnings Per Share (EPS) compared to last year, at $1.91, which reflects a rise of 46.9% from the same quarter last year. The company’s revenue is seen around $27.9 billion with the yearly change seen at approximately 17.9%.

Alibaba’s share price, as stated above, appears to have drifted since October 2020 to a $210.16 low, while it is currently retesting this strong floor once again as it forms a descending triangle. Both the 50- and 200-day EMA are trending lower as momentum is increasingly negative with RSI at 39 pointing lower and MACD lines extending southwards below zero. Against this backdrop, a disappointing earnings report could push the share price towards a breakdown of this key support.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.