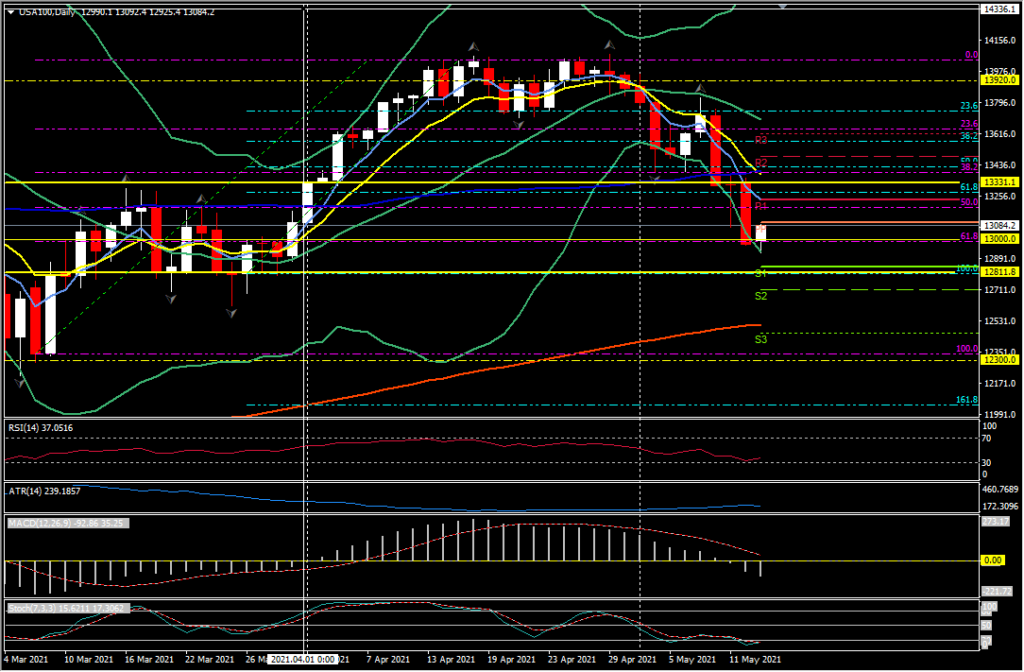

USA100, Daily

The tech giants led global equity markets higher, and as the inflation and risk sensitive growth stocks started to cool, they lead the markets lower. Initially, it was as investors rotated from technology growth stocks that had benefitted the most from the pandemic lockdowns and work from home regimes, into cyclical stocks like the oversold Energies, Financials and Utilities. However, yesterday’s huge -2.67% decline in the USA100 erased all of the hard fought (successive all-time) gains from April, breached the key 61.8 Fibonacci level and closed below the psychological 13,000 level. So where to next?

Next key support to the downside is the 12,800 level which provided support during March, and below this is the 200-day MA at 12,500, the March low at 12,300 and then the 161.8 Fib extension down to 12,050. A 10% fall from all-time highs at 14,040 would be 12,636 and a bear market signal would be triggered following a 20% fall to 11,232, and a new 7-month low. The USA100 has been below the 20-day moving average for all 9 trading days in May and currently sits at 13,700, before that level is the confluence of the 50-day moving average and 9-day EMA at 13,300 and today’s pivot point at 13,100. The RSI is trending lower at 33 and testing the OS zone, the MACD histogram broke below the 0 line on Tuesday (for the first time since April 1) and the Signal line is trending lower towards the 0 line. The Stochastics have been testing the oversold zone all month with little sign of an uplift.

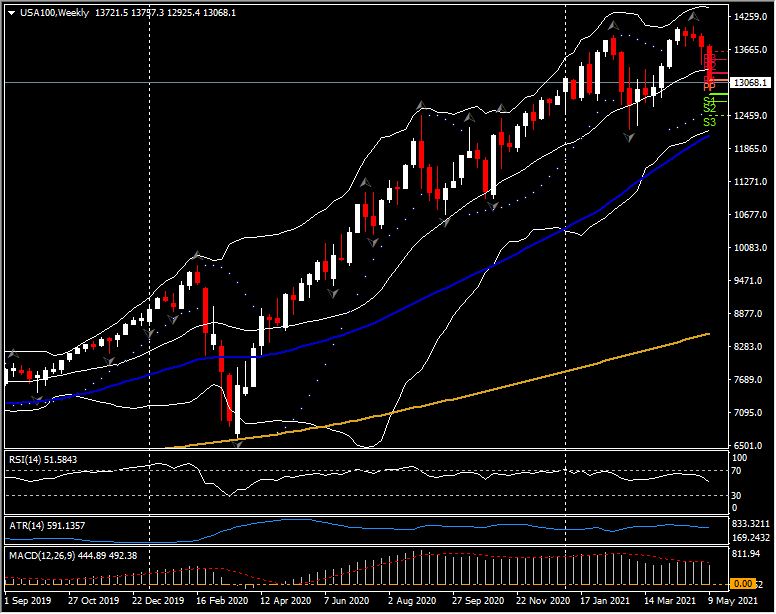

In the higher time frame, the Weekly chart is currently significantly under the 20-period moving average (13,300) for the first time since April 2020 (56 weeks) at 8,580.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.