Market News Today – Thursday was a day of correction for bonds and stocks. Treasury yields richened, recovering from Wednesday’s big selloff as the market took in its stride another hot inflation report, a rally on Wall Street, and a poor 30-year auction. Wall Street also corrected from oversold conditions with solid gains in major indexes as reflation trades helped lead the advance. The slip in the 10-year yield also supported stocks, and along with the drop in jobless claims, were the catalysts for dip buying.

As market sentiment started to improve Asia had also a positive session overnight, while in Europe, GER30 and UK100 futures are currently up 0.7% and 0.5% respectively, alongside broad gains in US futures. The USA30 and USA500 reclaimed the 34k and 4100 handles. Japanese government bond futures rose and yields on most cash bonds fell on Friday after a Bank of Japan debt-buying operation showed that investors have solid demand for long-term notes. For now then the correction in stocks seem to have run its course although we suspect that inflation jitters won’t go away forever.

In FX markets, the EURUSD lifted to 1.2106 and Cable was little changed at 1.4070. USDJPY is at 109.40. AUD and NZD steadied. USOIL is at $63 lows, extending losses on India Covid cases and as a key fuel pipeline in the United States resumed operations after being shut due to a cyber attack. Bitcoin slumped after Elon Musk’s tweet but also on news of a US probe into Binance, one of the world’s biggest cryptocurrency exchanges. It currently trades at the 48k area. Dogecoin, a relatively new coin promoted by Musk, jumped as much as 20% after he said he was involved in work to improve the token’s transaction efficiency. GOLD retests 3-month highs once again.

Today – The European data calendar today is very quiet, with only final inflation data for Spain of some note, however the US calendar includes Retail Sales and Michigan Index.

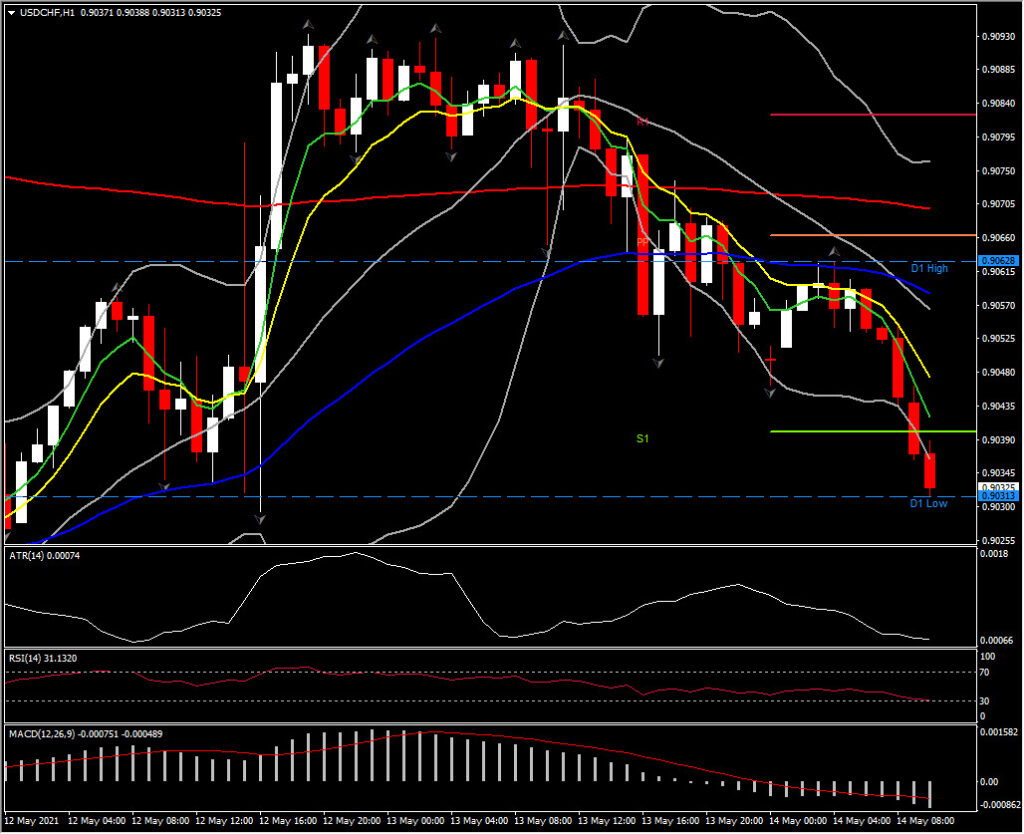

Biggest (FX) Mover @ (07:30 GMT) – USDCHF (+0.21%) drifted lower, breaking S1. Intraday the MAs aligned lower while RSI is at 32 but flattened and MACD is negatively configured, suggesting a negative outlook. ATR (H1) at 0.00074 & ATR (D) at 0.00556.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.